Vinyl Acetate Market competitive landscape showcasing top companies and emerging industry players

The Vinyl Acetate Market competitive landscape showcasing top companies and emerging industry players provides insights into market positioning, strategies, and innovations. Vinyl acetate, a key monomer for polyvinyl acetate (PVA), ethylene vinyl acetate (EVA), and polyvinyl alcohol (PVOH), serves adhesives, coatings, packaging, construction, automotive, and specialty applications. Understanding competitive dynamics enables manufacturers, investors, and stakeholders to make informed strategic decisions, identify opportunities, and maintain global competitiveness.

Leading Companies Overview

Leading companies dominate the vinyl acetate market through production capacity, technological advancements, and regional presence. Industry leaders invest in research and development, capacity expansion, and sustainable production practices. High-performance derivatives, innovation, and strategic partnerships enable top companies to maintain market share, enhance industrial application adoption, and meet global demand in adhesives, coatings, packaging, and specialty sectors.

Emerging Industry Players

Emerging players contribute to market innovation and regional competitiveness. New entrants focus on niche applications, cost-effective solutions, and advanced derivative development. Startups and regional manufacturers leverage technological innovation, sustainable practices, and strategic collaborations to expand market presence. Emerging players are crucial in diversifying industrial applications, capturing new opportunities, and increasing overall vinyl acetate market growth globally.

Strategic Collaborations and Partnerships

Collaborations, joint ventures, and strategic partnerships drive competitive advantage. Leading and emerging companies combine expertise, technology, and production capabilities to develop high-performance derivatives and expand industrial applications. Partnerships enable efficient supply chain management, regional market penetration, and access to emerging applications, enhancing competitiveness in the vinyl acetate market across adhesives, coatings, packaging, and specialty industries.

Technological Innovation and R&D

Technological innovation and research and development are key competitive differentiators. Advanced polymerization techniques, automation, smart manufacturing, and process optimization improve derivative quality, production efficiency, and operational scalability. R&D enables development of tailored PVA, EVA, and PVOH derivatives for emerging industrial applications. Companies prioritizing innovation maintain market leadership and strengthen competitiveness in global and regional markets.

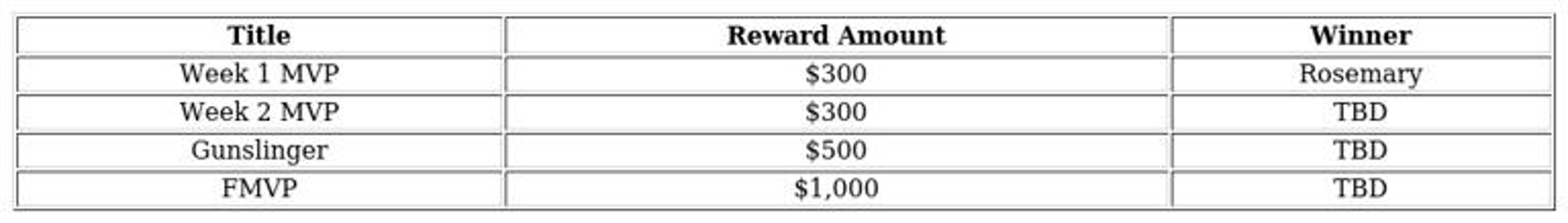

Market Share Distribution

Market share is influenced by production capacity, product quality, technological adoption, and regional presence. Leading manufacturers capture significant share through high-capacity plants, diversified derivatives, and strong distribution networks. Emerging players occupy niche segments with specialized applications and cost-efficient production. Monitoring market share trends helps stakeholders identify competitive strengths, potential collaborations, and market expansion opportunities globally.

Asia-Pacific Competitive Landscape

Asia-Pacific dominates vinyl acetate production and consumption. China, India, Japan, and South Korea lead in adhesives, coatings, packaging, and construction applications. Regional companies expand production, adopt advanced technology, and invest in derivative innovation. High industrial demand and infrastructure development drive growth. Competitive dynamics in Asia-Pacific encourage innovation, efficiency, and regional market expansion for both leading and emerging players.

North America Competitive Landscape

In North America, top manufacturers focus on high-performance derivatives and sustainable production. The United States, Canada, and Mexico prioritize adhesives, coatings, packaging, and specialty applications. Technological innovation, energy-efficient processes, and regulatory compliance define competitive advantage. Emerging players develop specialized derivatives and niche solutions to penetrate industrial segments. Strategic production and innovation maintain competitiveness in North American markets.

Europe Competitive Landscape

Europe emphasizes sustainable production, compliance, and innovation. Germany, France, Italy, and the United Kingdom lead in low-VOC adhesives, recyclable packaging, and energy-efficient coatings. Competitive advantage is based on derivative quality, technological adoption, and strategic collaborations. Manufacturers integrating sustainable practices and advanced production processes maintain market leadership and capture emerging applications across construction, automotive, and specialty industries.

Supply Chain and Operational Efficiency

Efficient supply chains and operational management are critical for competitive positioning. Reliable sourcing of acetic acid, ethylene, and catalysts ensures consistent production. Regional distribution networks and inventory management reduce operational risks. Companies optimizing supply chains can meet industrial demand, improve delivery timelines, and enhance competitiveness in adhesives, coatings, packaging, construction, automotive, and specialty markets globally.

Sustainability as a Competitive Advantage

Sustainability drives market competitiveness. Low-emission production, recyclable derivatives, and eco-friendly processes align with regulatory and consumer expectations. Leading and emerging companies adopting sustainable practices enhance brand reputation, market acceptance, and operational reliability. Integrating sustainability supports long-term growth, market share expansion, and strengthens industrial adoption across vinyl acetate applications globally.

Future Outlook

The vinyl acetate market competitive landscape will continue evolving with technological innovation, industrial demand, and emerging applications. Asia-Pacific will remain the largest hub, North America will focus on high-performance derivatives, and Europe will emphasize sustainability and regulatory compliance. Strategic collaborations, R&D investments, and sustainable production will define competitive advantage, enabling companies to capture growth opportunities and expand market share worldwide.

Conclusion

The vinyl acetate market competitive landscape showcasing top companies and emerging industry players underscores the importance of innovation, strategic planning, and sustainability. PVA, EVA, and PVOH derivatives are critical in adhesives, coatings, packaging, construction, automotive, and specialty applications. Companies leveraging technology, operational efficiency, and collaborations can strengthen competitiveness, capture emerging opportunities, and achieve global market leadership in the vinyl acetate industry.