Secure Access Services Edge Market Dynamics, Segmentation & Strategic Outlook | 2035

For a new company, entering the formidable Secure Access Services Edge (SASE) market is an exceptionally challenging endeavor, as the landscape is dominated by a handful of well-funded, large-scale platform providers. A pragmatic analysis of effective Secure Access Services Edge Market Entry Strategies reveals that a direct attempt to build a full, comprehensive SASE platform to compete head-on with Palo Alto Networks or Zscaler is not a viable path for a startup. The capital investment required to build a global network of Points of Presence (PoPs) and to develop a full suite of security and networking software is monumental. Therefore, the most successful entry strategies for newcomers are almost always built on a foundation of extreme focus and specialization, targeting a specific technological niche within the broader SASE framework. The market's rapid evolution and complexity ensure that such niches are constantly emerging. The Secure Access Services Edge Market size is projected to grow USD 42.86 Billion by 2035, exhibiting a CAGR of 22.1% during the forecast period 2025-2035. This expansion creates opportunities for innovative startups to succeed by being a critical "ingredient" in the SASE ecosystem, rather than trying to be the whole meal.

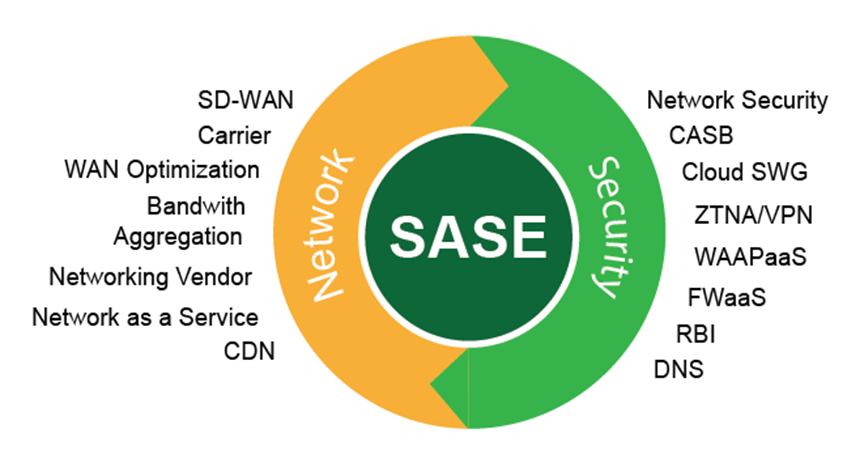

One of the most potent entry strategies is to focus on a single, best-of-breed component of the Security Service Edge (SSE) stack and to do it better than anyone else. Instead of a full SASE platform, a startup could focus exclusively on developing a superior Cloud Access Security Broker (CASB) with advanced data loss prevention (DLP) capabilities for SaaS applications. Or it could build a next-generation Zero Trust Network Access (ZTNA) solution with a unique micro-segmentation technology. The strategy here is not to compete with the major SASE platforms, but to partner with them and sell to them and their customers. By creating a product that is demonstrably better at one specific function than the native module of a major SASE platform, the startup can become a valuable "add-on" for customers with advanced needs. This "best-of-breed point solution" strategy allows the new entrant to focus its limited R&D resources on a single problem and to build a business by becoming an essential part of a multi-vendor SASE architecture, with the ultimate goal often being a strategic acquisition by one of the major platform players.

Another powerful entry strategy is to build a technology or service that enables the SASE ecosystem itself. This is a classic "picks and shovels" play. A new company could develop a software platform for Digital Experience Monitoring (DEM) that is specifically designed to give enterprises visibility into the performance of their SASE deployment. This tool would help a company diagnose whether a user's slow application performance is due to their local Wi-Fi, their internet provider, or the SASE vendor's network, a major pain point for IT teams. By providing this critical visibility layer, the startup can sell its product to any company that is adopting SASE, regardless of which SASE vendor they use. Another "enabling" strategy is to focus on a specific service offering. A new entrant could create a boutique consulting firm that specializes exclusively in helping enterprises plan, procure, and migrate to a SASE architecture, acting as a vendor-neutral expert advisor. This service-led model is less capital-intensive than building a product and can build a strong reputation based on expertise. In all these cases, the key to a successful entry is to be a deep specialist, solving a hard problem that is a crucial piece of the larger S-A-S-E puzzle.

Top Trending Reports -

Germany Iot Public Safety Market