What Factors Are Accelerating the Middle East and Africa Trade Surveillance Market?

Detailed Analysis of Executive Summary Middle East and Africa Trade Surveillance Market Size and Share

CAGR Value

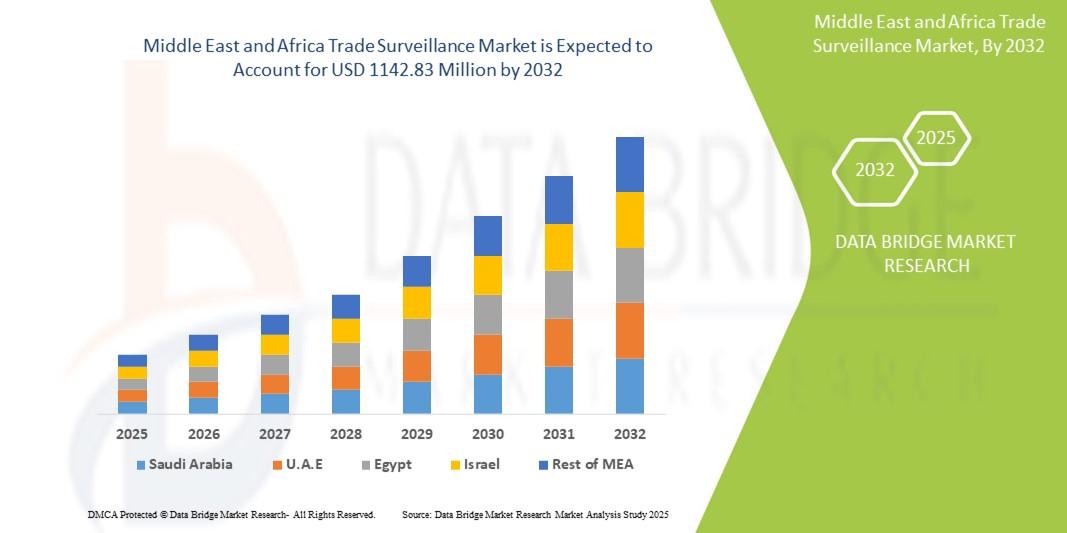

The Middle East and Africa Trade Surveillance market size was valued at USD 358.36 Million in 2024 and is expected to reach USD 1142.83 Million by 2032, at a CAGR of 15.6% during the forecast period

This Middle East and Africa Trade Surveillance Market report serves you with the bigger picture of the marketplace as it studies market and the industry by considering several aspects. This market report gives an absolute background analysis of the industry along with an assessment of the parental market. To achieve sustainable growth in the market, businesses must be well-versed with the specific and most relevant product and market information in the Middle East and Africa Trade Surveillance Market The resources used for collecting the data and information that is included in this report are very trustworthy and range from journals, company websites, and white papers etc.

Being professional and comprehensive, this Middle East and Africa Trade Surveillance Market report focuses on primary and secondary drivers, market share, leading segments, possible sales volume, and geographical analysis. This market report also analyzes the market status, market share, current trends, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, and distributors. The Middle East and Africa Trade Surveillance Market report clearly explains what market definition, classifications, applications, engagements and market trends are for the Middle East and Africa Trade Surveillance Market industry. This market report provides explanation about the detailed market analysis with inputs from industry experts. The Middle East and Africa Trade Surveillance Market report presents data on patterns and improvements, and target business sectors and materials, limits and advancements.

Take a deep dive into the current and future state of the Middle East and Africa Trade Surveillance Market. Access the report:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-trade-surveillance-market

Middle East and Africa Trade Surveillance Market Data Summary

Segments

- Component: The Middle East and Africa trade surveillance market can be segmented based on components into solutions and services. Solutions include risk and compliance management, surveillance and analytics, case management, and others. Services include professional services and managed services.

- Deployment Mode: This market can also be segmented based on deployment mode into cloud and on-premises. The cloud deployment mode is expected to witness significant growth due to benefits such as scalability, flexibility, and cost-effectiveness.

- Organization Size: The Middle East and Africa trade surveillance market can further be segmented based on organization size into small and medium-sized enterprises (SMEs) and large enterprises. SMEs are increasingly adopting trade surveillance solutions to comply with regulations and ensure efficient trading practices.

- End-User: The end-user segment includes brokerage firms, asset management firms, investment banks, hedge funds, and others. The rising focus on regulatory compliance and increasing instances of market abuse are driving the adoption of trade surveillance solutions in these sectors.

Market Players

- Nasdaq, Inc.: Nasdaq offers trade surveillance solutions that help organizations detect and prevent market abuse. Their solutions leverage advanced analytics and automation to enhance surveillance capabilities.

- IPC Systems, Inc.: IPC Systems provides trade surveillance solutions designed to monitor trading activities and detect suspicious behavior. Their solutions offer real-time monitoring and alerting capabilities to ensure regulatory compliance.

- Cinnober Financial Technology AB: Cinnober offers trade surveillance solutions that enable organizations to effectively monitor trading activities across multiple asset classes. Their solutions help in detecting market manipulation and insider trading.

- Tata Consultancy Services Limited: TCS provides trade surveillance solutions that incorporate artificial intelligence and machine learning algorithms to analyze trading patterns and identify potential risks. Their solutions help organizations in mitigating compliance risks effectively.

- OneMarketData: OneMarketData offers trade surveillance solutions that provide real-time monitoring and analysis of trading activities. Their solutions help in identifying anomalies and potential market abuse to ensure a fair and transparent trading environment.

The Middle East and Africa trade surveillance market is witnessing significant growth driven by regulatory requirements, increasing instances of market abuse, and the adoption of advanced technologies. To gain more insights and in-depth analysis, refer to The Middle East and Africa trade surveillance market is poised for substantial growth as organizations across various sectors prioritize regulatory compliance and the prevention of market abuse. With the segmentation of the market into components, deployment modes, organization sizes, and end-users, it is evident that there is a diverse range of opportunities for trade surveillance solutions and services providers. In terms of components, the market offers solutions such as risk and compliance management, surveillance and analytics, case management, along with services like professional services and managed services. This indicates a comprehensive approach towards ensuring effective trade surveillance practices within organizations.

The deployment mode segmentation into cloud and on-premises solutions showcases the increasing adoption of cloud-based deployments due to advantages such as scalability, flexibility, and cost-effectiveness. This trend is likely to drive significant growth in the cloud segment as more organizations seek efficient and easily scalable trade surveillance solutions. Furthermore, the organization size segmentation highlights the growing interest among SMEs in implementing trade surveillance solutions to adhere to regulations and enhance trading efficiency, presenting a lucrative market for providers catering to this segment.

In terms of end-users, brokerage firms, asset management firms, investment banks, and hedge funds are increasingly investing in trade surveillance solutions to address regulatory compliance requirements and combat market abuse. The focus on regulatory compliance and the need to detect suspicious activities in real-time are key drivers fuelling the adoption of trade surveillance solutions across these sectors. Market players such as Nasdaq, IPC Systems, Cinnober Financial Technology, Tata Consultancy Services, and OneMarketData are at the forefront of providing innovative trade surveillance solutions that leverage advanced technologies like artificial intelligence, machine learning, and real-time monitoring to enhance surveillance capabilities and mitigate compliance risks effectively.

The Middle East and Africa trade surveillance market is expected to witness sustained growth as organizations continue to prioritize regulatory compliance and invest in advanced technologies to safeguard against market abuse. The increasing awareness about the benefits of trade surveillance solutions, coupled with the rising instances of market manipulation, are driving the demand for comprehensive surveillance tools across various industry verticals. As the market evolves, providers that can offer customizable, scalable, and technologically advanced solutions are likely to experience significant traction as organizations seek to bolster their surveillance capabilities and ensure fair and transparent trading practices.The Middle East and Africa trade surveillance market is experiencing robust growth driven by the increasing emphasis on regulatory compliance and the need to combat market abuse within the region. As organizations across various sectors prioritize adherence to regulations and seek to enhance their surveillance capabilities, the demand for trade surveillance solutions and services is expected to escalate. With a focus on components, deployment modes, organization sizes, and end-users, the market presents a diverse landscape of opportunities for providers in the trade surveillance space.

In terms of components, the market offers a range of solutions such as risk and compliance management, surveillance and analytics, and case management, catering to the specific needs of organizations looking to enhance their surveillance practices. Additionally, the availability of services like professional services and managed services further facilitates the implementation and management of trade surveillance solutions, contributing to the overall market growth.

The segmentation based on deployment mode highlights the increasing adoption of cloud-based solutions, driven by factors like scalability, flexibility, and cost-effectiveness. Cloud deployments are gaining traction as organizations seek more agile and easily scalable surveillance capabilities to meet their evolving needs. This shift towards cloud deployment is expected to shape the market landscape significantly, with providers offering cloud-based solutions poised to capitalize on this growing demand.

Furthermore, the segmentation based on organization size underscores the growing interest among small and medium-sized enterprises (SMEs) in deploying trade surveillance solutions to ensure compliance with regulations and improve trading efficiency. This presents a lucrative opportunity for solution providers to cater to the specific requirements of SMEs in the region and help them navigate the complexities of trade surveillance effectively.

In terms of end-users, brokerage firms, asset management firms, investment banks, and hedge funds are actively investing in trade surveillance solutions to address regulatory requirements and detect suspicious activities in real-time. The increasing focus on regulatory compliance and the need to mitigate compliance risks are key drivers propelling the adoption of trade surveillance solutions across these sectors, creating a conducive environment for market growth.

In conclusion, the Middle East and Africa trade surveillance market is poised for substantial expansion as organizations prioritize regulatory compliance and leverage advanced technologies to enhance their surveillance capabilities. Providers offering innovative, customizable, and technologically advanced solutions are likely to thrive in this evolving market landscape, as organizations seek to bolster their surveillance practices and uphold fair and transparent trading standards. As the market continues to evolve, collaborations between solution providers and industry stakeholders, along with a keen focus on technology-driven surveillance solutions, will be key in driving the market forward and ensuring effective surveillance practices across the region.

Investigate the company’s industry share in depth

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-trade-surveillance-market/companies

Middle East and Africa Trade Surveillance Market Overview: Strategic Questions for Analysis

- What is the size of the global Middle East and Africa Trade Surveillance Market industry this year?

- What rate of growth is forecasted for the next decade for Middle East and Africa Trade Surveillance Market?

- What are the key divisions of the Middle East and Africa Trade Surveillance Market?

- Which organizations have the strongest presence in Middle East and Africa Trade Surveillance Market?

- Which markets are the focus of the geographic analysis for Middle East and Africa Trade Surveillance Market ?

- What companies are featured in the competitive landscape for Middle East and Africa Trade Surveillance Market?

Browse More Reports:

Global Self Cleaning Filters Market

Global Shale Gas Market

Global Specialty Feed Additives Market

Global Tank Level Monitoring System Market

Global Tracheostomy Products Market

Global Uninterruptible Power Supply (UPS) Datacenter Power Market

Global Vaccine Contract Manufacturing Market

Global Wood Plastic Composite Market

Global 3D Semiconductor Packaging Market

Global Achlorhydria Treatment Market

Global Acromicric Dysplasia Treatment Market

Global Aircraft Ailerons Market

Global Aircraft Fairings Market

Global Aircraft Lightning Protection Market

Global Antiemetics Market

Global Aquafeed Testing Market

Global Arterial Blood Collection Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"