UBI Market Forecast: Connected Vehicles & Data-Driven Pricing

Polaris Market Research has published a brand-new report titled Usage Based Insurance Market Share, Size, Trends, Industry Analysis Report, By Policy Type (Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), and Manage-How-You-Drive (MHYD)); By Technology; By Region; Segment Forecast, 2024- 2032 that includes extensive information and analysis of the industry dynamics. The opportunities and challenges in the report's dynamical trends might be useful for the worldwide Usage Based Insurance Market. The study provides an outline of the market's foundation and organizational structure and forecasts an increase in market share. The study offers a comprehensive analysis of the Usage Based Insurance market size, present revenue, regular deliverables, share, and profit projections. The study report includes a sizable database on future market forecasting based on an examination of previous data.

Brief About the Report

The market's supply-side and demand-side Usage Based Insurance market trends are evaluated in the study. The study provides important details on applications and statistics, which are compiled in the report to provide a market prediction. Additionally, it offers thorough explanations of SWOT and PESTLE analyses depending on changes in the region and industry. It sheds light on risks, obstacles, and uncertainties, as well as present and future possibilities and challenges in the market.

Global Usage Based Insurance Market size and share is currently valued at USD 34.26 billion in 2024 and is anticipated to generate an estimated revenue of USD 154.89 billion by 2032, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 20.8% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 - 2032

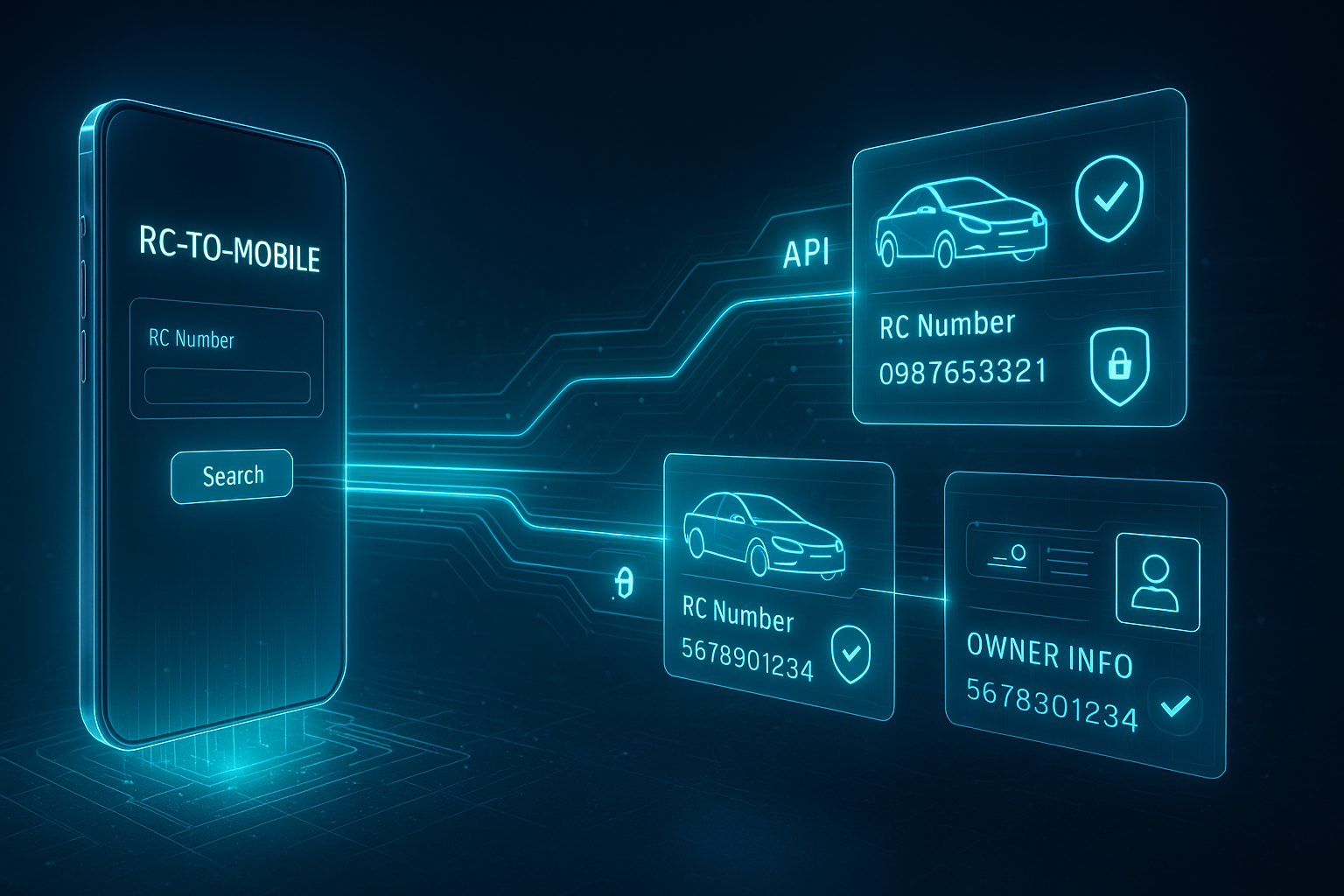

Usage Based Insurance (UBI) is a telematics-driven insurance model where premiums are adjusted based on actual driving behavior—mileage, speed, braking patterns, time of day, and route risk—collected via telematics devices, smartphone apps, or connected vehicle data. Market trends include wider adoption of pay-how-you-drive and pay-as-you-drive products, integration of AI for behavior scoring, and partnerships between insurers, OEMs, and telematics providers to access richer in-vehicle data. Consumers reward transparency and potential savings, while insurers gain improved risk segmentation and claims reduction through proactive risk alerts. Forecasts indicate sustained growth as regulatory environments evolve to permit data-sharing, as privacy solutions mature (anonymization and consent frameworks), and as EVs and connected fleets expand the data sources. The scope extends beyond personal auto into commercial fleet policies, usage analytics services, driver coaching, and dynamic pricing platforms. Key opportunities include micro-insurance for short-term rental or mobility services, embedded insurance via OEM partnerships, and aftermarket telematics for older vehicles. Challenges include regulatory differences across regions, customer privacy concerns, and ensuring models avoid discrimination. Overall, UBI promises more personalized pricing, improved road safety incentives, and cost efficiencies for insurers and safer outcomes for drivers.

Key Aspects Covered in The Report

- Market size and growth rate during the forecast period.

- Key vendors operating in the market with their company profiles

- Opportunities and threats faced by the existing vendors in the market.

- Trending factors influencing the market in the geographical regions.

- In-depth understanding of market drivers, constraints, and major micro markets.

- The critical data of each segment is highlighted at an extensive level.

Usage Based Insurance Market Segmentation Analysis

The study offers a thorough analysis of the numerous market segments, including application type, product component, service types, and several geographic locations. The report's segment analysis section contains thoroughly researched expert-verified industry data. Strategic recommendations are given in terms of key business segments based on market estimations.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐓𝐡𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐂𝐨𝐦𝐩𝐫𝐞𝐡𝐞𝐧𝐬𝐢𝐯𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐇𝐞𝐫𝐞:

https://www.polarismarketresearch.com/industry-analysis/usage-based-insurance-market

Leading Players Analysis

The research report's chapter is entirely devoted to the competition environment. The Usage Based Insurance market key players are examined, analyzing information on their evaluation and development in addition to a quick review of the company. Understanding the techniques employed by businesses and the steps they have recently taken to combat intense rivalry allows one to examine the competitive landscape. It covers each player's company profiles comprising sales, revenue, share, recent developments, SWOT analysis, capacity, production, revenue, gross margin, growth rate, and strategies employed by the major market players.

Different potentials in the domestic and regional markets are revealed by regional analysis of the sector. Each regional industry associated with this market is carefully examined to determine its potential for growth in the present and the future. Moreover, information on recent mergers and acquisitions that have taken place in the market is the subject of the research. This section provides important financial information about mergers and acquisitions that have recently shaped the Usage Based Insurance industry.

Top Players:

- Aioi Nissay Dowa Insurance UK Ltd (UK)

- Allianz (Germany)

- Allstate Insurance Company (U.S.)

- Bridgestone Mobility Solutions B.V. (Netherlands)

- Liberty Mutual Insurance (U.S.)

- MAPFRE (Spain)

- Progressive Casualty Insurance Company (U.S.)

- State Farm Mutual Automobile Insurance Company (U.S.)

- UNIPOLSAI ASSICURAZIONI S.P.A. (Italy)

- Verisk Analytics, Inc. (U.S.)

- Verizon (U.S.)

Regions Covered in This Report Are

- North America (United States, Canada, and Mexico)

- Europe (Germany, France, United Kingdom, Russia, Italy, and the Rest of Europe)

- Asia-Pacific (China, Japan, Korea, India, Southeast Asia, and Australia)

- South America (Brazil, Argentina, Colombia, and the rest of South America)

- The Middle East and Africa (Saudi Arabia, United Arab Emirates, Egypt, South Africa, and the Rest of the Middle East and Africa)

Report Summary

The analysis focuses on the regional forecast by type and application and the Usage Based Insurance market sales and revenue prediction. The research report features data about the target market, such as pricing trends, customer requirements, and competitor analysis. The market growth has been examined using analytical approaches like PESTLE analysis, Porter's Five Forces analysis, feasibility studies, player-specific SWOT analyses, and ROI analyses.

Objectives of the Report

- To carefully analyze and forecast the size of the market by value and volume.

- To evaluate the market shares of major segments of the market

- To explain the development of the industry in different parts of the world.

- To analyze and study micro-markets in terms of their contributions to the market, their prospects, and individual growth trends.

- To offer precise and valuable details about factors affecting the Usage Based Insurance market forecasts

- To provide a meticulous assessment of crucial business strategies used by leading companies.

More Trending Latest Reports By Polaris Market Research: