Subsurface Strategy: Drilling Service Market Share and Market Research Future Insights

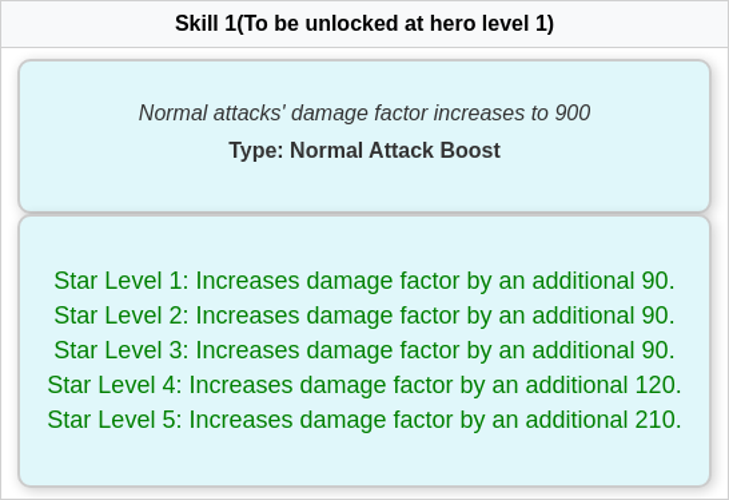

As we navigate the complexities of 2026, the global energy landscape is being redefined by a high-tech race to secure resources. The Drilling Service Market Share has become a primary metric for understanding which regions and technologies are leading the charge in the post-transition era. While traditional hydrocarbon extraction remains a dominant force, the emergence of geothermal energy and critical mineral mining has diversified the competitive landscape. As Per Market Research Future, the global market is witnessing a steady expansion, with a projected valuation reaching USD 240.63 billion by 2035, driven by a compound annual growth rate (CAGR) of 4.11%. This growth is not evenly distributed; it is increasingly concentrated among firms that can provide integrated, digital-first solutions that reduce the environmental footprint and operational costs of complex wells.

Regional Dominance and the Offshore Surge

In 2026, regional dynamics are playing a crucial role in determining the distribution of market participants. North America continues to hold the largest slice of the pie, primarily due to the ongoing maturity and technological refinement of the shale industry in the Permian Basin. However, the fastest-growing segment is in the Asia-Pacific region, where countries like China and India are aggressively expanding their domestic exploration budgets to fuel burgeoning industrial sectors. As Per Market Research Future, the offshore segment is also capturing a larger portion of the total market share. As onshore reserves face depletion, the "Golden Triangle"—comprising the Gulf of Mexico, Brazil, and West Africa—is seeing record-high investment in ultra-deepwater drilling services, which command higher premiums due to the technical expertise required.

Key Drivers and the "Digital Driller" Trend

Several transformative trends are currently influencing the Drilling Service Market Share:

-

Automation and AI Integration: Rigs are becoming "smart" hubs. Leading players are gaining share by offering AI-driven predictive maintenance that eliminates costly non-productive time (NPT).

-

Energy Security Mandates: Geopolitical shifts have forced many nations to prioritize domestic production, leading to a resurgence in "wildcat" drilling and exploratory services in frontier regions.

-

Geothermal Crossover: Service providers originally focused on oil and gas are successfully capturing share in the renewable sector by repurposing deep-drilling technology for heat extraction.

As Per Market Research Future, the competitive landscape is also being reshaped by mergers and acquisitions. Larger service giants are acquiring specialized firms that excel in directional drilling and logging-while-drilling (LWD) technologies, aiming to provide a "one-stop-shop" service model that appeals to major national oil companies (NOCs).

Operating in the Drilling Service Market Share arena in 2026 is an exercise in extreme engineering and data science. The industry has moved past the era of "brute force" drilling. Today, success is measured by the "Net Foot Drilled" per day and the carbon intensity of the operation. This has led to the rise of hybrid-electric rigs and the use of biodegradable drilling fluids, which are no longer just optional "green" add-ons but are now required for regulatory compliance in major markets. As Per Market Research Future, those who can align their service offerings with stringent ESG (Environmental, Social, and Governance) standards are rapidly gaining a competitive edge over legacy providers.

Furthermore, the integration of "Digital Twins" has changed the way project owners interact with service providers. Before a single bit touches the ground, a virtual model of the well is created to simulate pressure zones and geological hazards. This level of preparation has significantly reduced the frequency of "lost-in-hole" incidents, which previously cost the industry billions annually. As we move through 2026, the market share is increasingly flowing toward companies that act as "technology partners" rather than mere equipment contractors. By providing real-time data visualization and remote operation capabilities, these leaders are allowing human experts to manage multiple rigs from centralized hubs thousands of miles away, drastically improving safety and operational scale.

Frequently Asked Questions (FAQ)

1. Which service type currently holds the highest Drilling Service Market Share? As of 2026, directional drilling holds the largest value-based share of the market. This technology allows operators to reach multiple targets from a single surface location, which is essential for both unconventional shale plays and high-cost offshore platforms where minimizing the surface footprint is critical.

2. How is the mining industry affecting the market share of drilling services? The mining industry is the fastest-growing end-user segment. The global demand for lithium, copper, and cobalt—minerals essential for electric vehicle batteries—has triggered a massive wave of mineral exploration drilling. This has allowed service providers specialized in hard-rock and core drilling to capture a larger portion of the global share.

3. What role does the Middle East play in the global market share distribution? The Middle East remains a vital pillar of the global market. Countries like Saudi Arabia and the UAE are investing heavily in "unconventional" gas reserves and expanding their offshore capacity. As Per Market Research Future, the region's focus on maintaining global production leadership ensures that high-tier drilling services will continue to see robust demand in this territory.

More Trending Reports on Energy & Power by Market Research Future

US Gas Insulated Transformer Market