Orchestrating the Edge: Competitive Dynamics and DERMS Market Share in 2026

As of February 2026, the global energy landscape is no longer defined by massive, centralized power plants, but by millions of interconnected energy nodes. From residential rooftop solar panels and community battery banks to the rapidly growing network of electric vehicle (EV) charging stations, the "prosumer" era has arrived in full force. Managing this decentralized chaos requires a sophisticated digital nervous system, which has led to a significant surge in DERMS Market Share for leading technology providers. Distributed Energy Resource Management Systems (DERMS) have moved from the experimental pilot phase into the core infrastructure of modern utilities. In 2026, the market is characterized by a high degree of consolidation among established industrial giants, a fierce battle for software dominance, and a rapid geographical shift toward the Asia-Pacific region.

The Regional Power Balance: North America and Beyond

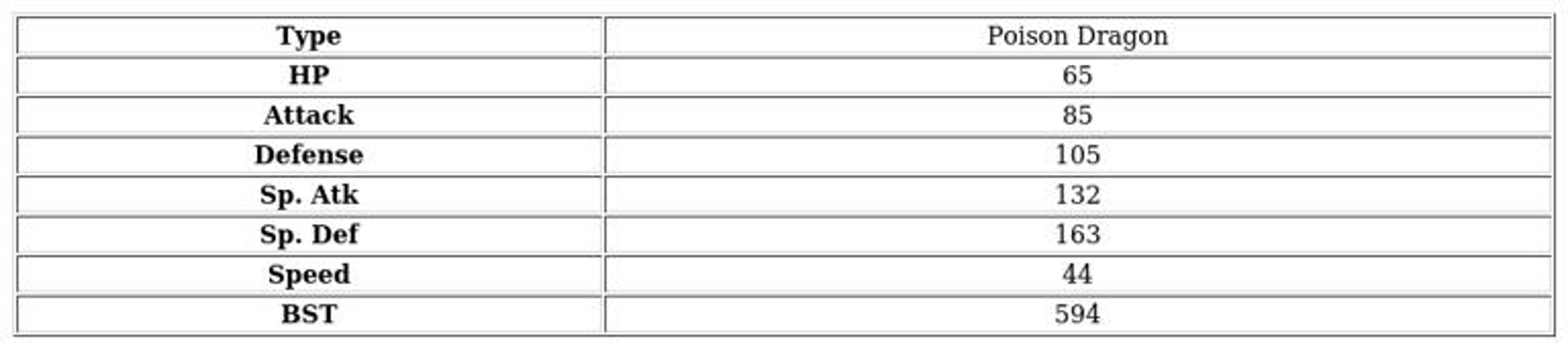

In early 2026, North America continues to hold the largest portion of the global market share, accounting for roughly forty percent of total revenue. This leadership is driven by early and aggressive smart grid adoption in states like California and New York, where high renewable energy mandates have made digital orchestration a regulatory necessity. Utilities in the United States and Canada are investing heavily in grid resilience to combat extreme weather events, using DERMS to manage bidirectional power flows and prevent transformer overloads.

However, the 2026 landscape is witnessing a massive surge from the Asia-Pacific region. Led by China’s unprecedented deployment of distributed solar and India’s rapid grid modernization, this region is currently the fastest-growing segment. Australia, with its exceptionally high penetration of residential solar, has also become a global testbed for DERMS, forcing local utilities to adopt these systems at a pace that rivals North American leaders.

Software vs. Hardware: Where the Revenue Resides

The segmentation of the 2026 market shows a clear winner: software. Approximately fifty-eight percent of the revenue share in the industry is now generated by software platforms. While hardware components like smart meters and sensors are essential for data collection, the real value lies in the algorithms that perform real-time analytics, forecasting, and optimization.

Cloud-based architectures have become the preferred deployment model in 2026, offering utilities scalability and lower upfront costs. These platforms allow for the creation of Virtual Power Plants (VPPs), where thousands of small-scale assets are aggregated to act as a single, dispatchable resource. By using AI-driven forecasting, these software suites can anticipate demand spikes and adjust the discharge of home batteries or the charging speed of EVs, effectively balancing the grid without the need for carbon-heavy backup generators.

Competitive Landscape: The Industrial Giants and Disruptive Startups

The competitive arena in 2026 is dominated by a few global technology leaders who have spent the last several years acquiring smaller, specialized startups to bolster their portfolios. Firms like Siemens, Schneider Electric, ABB, and GE Vernova hold the lion’s share of the market. These companies have successfully integrated DERMS into their broader Advanced Distribution Management Systems (ADMS), offering utilities a "single pane of glass" to manage both legacy assets and new distributed resources.

Siemens and Schneider Electric, in particular, have maintained their leading positions by focusing on "open-architecture" solutions. These platforms are designed to be "vendor-neutral," allowing them to communicate with a wide variety of solar inverters and EV chargers from different manufacturers. This interoperability is a key selling point in 2026, as utilities seek to avoid "vendor lock-in" while managing an increasingly diverse ecosystem of consumer devices.

Application Dominance: Solar and the EV Surge

When analyzing market share by application, Solar PV remains the dominant force, accounting for more than half of the total revenue in 2026. The sheer volume of rooftop solar installations globally has necessitated the use of DERMS to manage voltage fluctuations and "duck curve" issues. However, the fastest-growing application segment this year is EV charging and Vehicle-to-Grid (V2G) integration.

As electric vehicle adoption hits record highs, the collective battery capacity of parked cars represents the world’s largest potential storage resource. In 2026, DERMS platforms are being deployed to coordinate these mobile batteries, allowing them to feed energy back into the grid during peak hours. This symbiotic relationship between the automotive and energy sectors is reshaping the industry, with charging network operators now holding a growing piece of the market share as they transition into energy service providers.

Conclusion

The DERMS market share in 2026 reflects an energy world in the midst of a digital revolution. By merging heavy engineering with artificial intelligence and cloud computing, the industry has provided the tools necessary to make a decentralized grid not only possible but profitable and resilient. As we move further into the decade, the focus will likely shift toward "edge intelligence," where decentralized assets become even more autonomous. For utilities and service providers, the 2026 market is no longer about testing the waters—it is about scaling the digital infrastructure that will power the next century.

Frequently Asked Questions

Which region currently leads the global DERMS market share? As of 2026, North America is the leading region, holding approximately 40% of the market share. This is attributed to mature smart grid infrastructure, supportive regulatory frameworks, and significant investments in grid modernization in the United States and Canada.

What is the most valuable part of a DERMS deployment in 2026? The software segment is the most valuable, accounting for roughly 58% of the revenue share. This is because the sophisticated AI and machine learning algorithms used for real-time forecasting, grid optimization, and managing Virtual Power Plants provide the core intelligence that makes the system functional.

Which application is driving the most growth within the DERMS industry? Solar PV remains the largest application segment due to the widespread adoption of rooftop solar. However, EV charging and Vehicle-to-Grid (V2G) integration is the fastest-growing application in 2026, as utilities seek to use the collective battery power of electric vehicles to balance the grid.

More Trending Reports on Energy & Power by Market Research Future

Automatic Transfer Switch Market Growth

Autonomous Energy Systems Market Growth

Ancillary Services for Battery Energy Storage Systems Market Growth