Rising Demand for Minimally Invasive Surgeries and Robotic Integration to Propel Global Trocars Market Growth at 6.3% CAGR Through 2031

The global trocars market is poised for steady expansion over the next decade, driven by the rapid adoption of minimally invasive surgical (MIS) procedures and continuous technological innovations in medical devices. Valued at US$ 664.1 Mn in 2022, the market is projected to grow at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2031, reaching approximately US$ 1.1 Bn by the end of 2031. The rising preference for precision-based surgical interventions, lower recovery times, and enhanced patient safety continues to redefine the growth trajectory of the industry.

Analyst Viewpoint

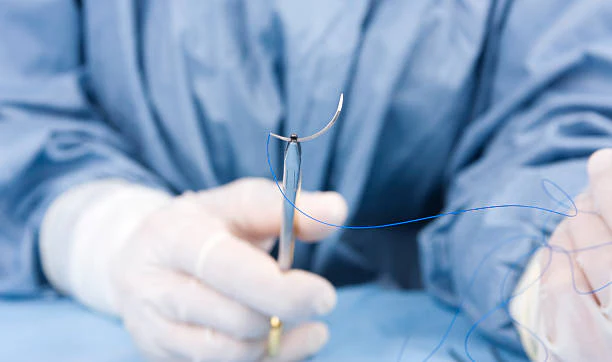

The surge in demand for minimally invasive surgeries is the primary driver shaping the trocars industry landscape. Trocars serve as critical access devices in laparoscopic and other minimally invasive procedures, enabling the insertion of cameras and specialized surgical instruments into the body through small incisions. This significantly enhances visualization, surgical precision, and procedural efficiency.

The benefits associated with MIS—such as reduced infection risk, minimal tissue trauma, lower scarring, and faster patient recovery—are encouraging healthcare providers and surgeons to adopt trocar-based surgical techniques. Furthermore, continuous innovations in trocar systems, including disposable and reposable variants with surgeon-friendly tip designs, are optimizing surgical outcomes and patient comfort.

Leading market participants are increasingly investing in robotic-assisted surgical systems and the development of trocars designed for single-incision laparoscopy. These advancements are aligned with the global trend toward minimally traumatic procedures that prioritize both clinical efficiency and patient satisfaction.

Trocars Market Overview

A trocar is a precision medical device used to create small punctures in body cavities during minimally invasive procedures. It typically consists of an obturator, cannula, and seal, allowing surgeons to introduce cameras, scissors, graspers, and other instruments into the abdominal or thoracic cavity.

Trocars are extensively utilized in:

- Laparoscopic surgeries

- Gynecological procedures

- Urological surgeries

- Pediatric interventions

- General surgical applications

Key advantages of trocars include improved procedural precision, reduced injury risk, and enhanced patient comfort. Recent market trends indicate increasing investments in advanced cannula systems and trocar catheters, especially to address the growing demand for fluid drainage and diagnostic applications.

Manufacturers are also exploring veterinary applications, expanding the scope of trocar technology beyond human healthcare.

Key Market Drivers

1. Rise in Demand for Minimally Invasive Surgeries

The global healthcare ecosystem is witnessing a substantial shift toward minimally invasive techniques. Smaller incisions, shorter hospital stays, and quicker return to normal activities are compelling both patients and surgeons to prefer MIS over traditional open surgeries.

According to published medical data, nearly 15 million laparoscopic procedures are performed worldwide annually, with the United States accounting for approximately 4.8 million procedures each year. This significant volume underscores the critical role trocars play in modern surgical practices.

The ability of trocars to provide stable entry points for high-definition cameras and precision instruments enhances dexterity and visualization, enabling surgeons to perform complex operations with greater accuracy.

2. Technological Advancements in Medical Devices

Ongoing innovations in medical technology are streamlining surgical procedures and improving safety standards. Trocar manufacturers are focusing on:

- Bladeless and optical trocar designs

- Disposable systems to reduce cross-contamination

- Enhanced sealing mechanisms

- Improved ergonomics and insertion techniques

Advancements in trocar needle sets and insertion technologies also facilitate passive fluid drainage, opening new opportunities in diagnostic and therapeutic interventions.

Leading medical device companies invest heavily in research and development. Industry reports indicate that major firms allocate nearly 15% of their revenue to R&D, with total annual innovation spending surpassing US$ 23.4 Bn in 2022. This substantial investment continues to fuel product differentiation and performance enhancement.

Regional Outlook

North America – Market Leader

North America accounted for the largest share of the trocars market in 2022. The region’s dominance can be attributed to:

- Advanced healthcare infrastructure

- High healthcare spending

- Strong presence of leading medical device companies

- Increased adoption of robotic-assisted surgeries

In the United States alone, around 1.8 million minimally invasive cosmetic surgeries are performed annually, representing nearly 17% of all cosmetic procedures. The widespread integration of advanced surgical technologies further reinforces the region’s leadership.

Asia Pacific – Emerging Growth Hub

The Asia Pacific market is projected to expand at a steady pace during the forecast period. Growth factors include:

- Expanding healthcare infrastructure

- Rising diagnostic rates

- Growing geriatric population

- Increasing awareness about minimally invasive procedures

Countries such as China, India, and Japan are investing significantly in healthcare modernization, creating lucrative opportunities for trocar manufacturers.

Market Segmentation Analysis

By Product

- Disposable Trocars

- Reusable Trocars

- Reposable Trocars

- Accessories

Disposable trocars are gaining traction due to infection control measures and enhanced convenience in high-volume surgical settings.

By Tip Type

- Bladeless Trocars

- Optical Trocars

- Blunt Trocars

- Bladed Trocars

Bladeless and optical trocars are witnessing increased adoption due to reduced tissue trauma and improved visualization.

By Application

- General Surgery

- Gynecological Surgery

- Laparoscopy

- Urological Surgery

- Pediatric Surgery

- Others

Laparoscopy remains the dominant application segment owing to its widespread use in abdominal and pelvic procedures.

By End-user

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

Hospitals continue to hold the largest market share, supported by high patient volumes and advanced surgical capabilities.

Competitive Landscape

The global trocars market is characterized by intense competition and strategic innovation. Prominent players are focusing on expanding their product portfolios, improving surgical entry technologies, and strengthening geographic presence through mergers and collaborations.

Key companies operating in the market include:

- Johnson & Johnson MedTech

- B. Braun SE

- Teleflex Incorporated

- CooperSurgical Inc.

- CONMED Corporation

- Applied Medical Resources Corporation

- LaproSurge

- Purple Surgical

- Unimax Medical Systems Inc.

These companies are profiled based on parameters such as product portfolio, financial performance, strategic initiatives, and regional presence.

Recent Developments

In December 2023, Xpan, a Canada-based surgical instrument company, received approval from the U.S. Food and Drug Administration (FDA) for its universal trocar system. The newly approved system is designed to minimize tissue damage and enhance laparoscopic access, reflecting the broader industry focus on safety and precision.

Market Outlook Through 2031

The trocars market is positioned for sustained growth, driven by demographic shifts, rising chronic disease prevalence, and increasing surgical volumes worldwide. The integration of robotics, development of single-incision laparoscopic tools, and continuous innovation in entry systems are expected to redefine surgical standards.

With expanding healthcare infrastructure in emerging economies and strong R&D investments by leading manufacturers, the market is set to witness robust expansion over the forecast period.

By 2031, the industry is anticipated to surpass US$ 1.1 Bn, supported by steady technological advancements and the global transition toward minimally invasive surgical solutions. As healthcare systems prioritize efficiency, safety, and patient-centric care, trocars will remain indispensable components in the evolution of modern surgery.