Silt Curtain Market Trends and outlook 2026-2035

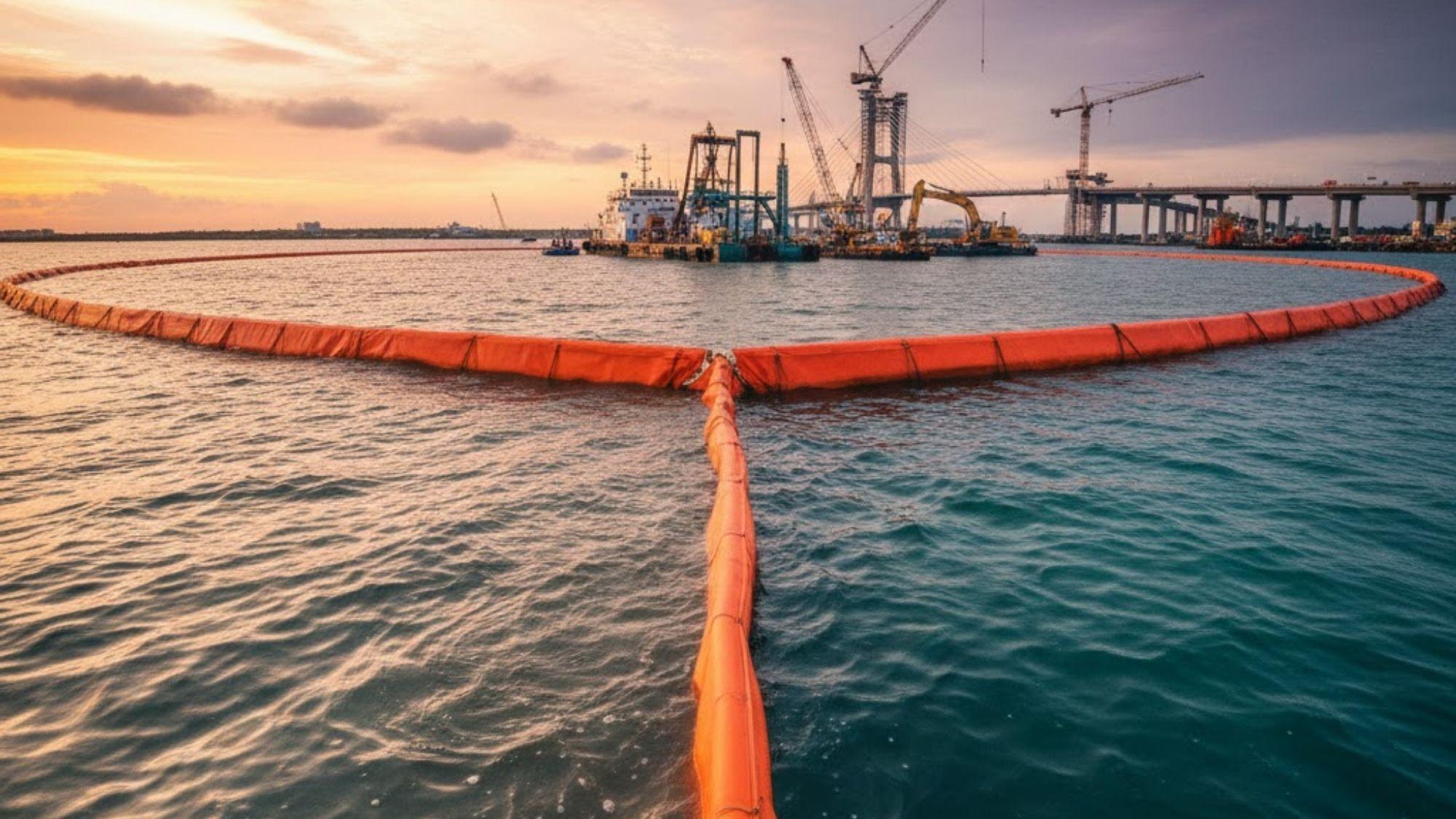

The silt curtain market trends reflect steady expansion driven by increasing infrastructure construction activities, tightening environmental regulations governing water body protection, and growing awareness of sediment pollution control across coastal and inland waterway projects globally. This sector reached around USD 7.89 Billion in 2025 and is projected to grow at a CAGR of 4.00% between 2026 and 2035 to reach nearly USD 11.68 Billion by 2035. Moreover, the global silt curtain industry benefits from expanding marine construction projects, rising dredging activities, and stringent regulatory frameworks requiring turbidity control measures throughout port development, bridge construction, and coastal erosion management programs.

Growing environmental consciousness and construction sector expansion create substantial opportunities for manufacturers. Additionally, climate change driven coastal protection investments and increasing urbanization near waterways drive market development across Type I, Type II, and Type III product categories.

Get a Free Sample Report with Table of Contents:

Product Type Based Market Segmentation

Type II silt curtains dominate consumption as they address moderate current velocity environments common in harbors, estuaries, and inland water construction projects requiring intermediate sediment containment performance. These curtains balance durability, flow through resistance, and installation practicality making them versatile solutions across diverse project conditions. Furthermore, Type II variants offer cost effective performance for the majority of standard dredging and waterway construction applications encountered globally.

Type I curtains serve calm water applications including lakes, ponds, and sheltered coastal areas where minimal current velocities allow lighter weight barrier systems providing adequate sediment containment. Meanwhile, Type III heavy duty curtains address high energy environments including open ocean construction zones, fast flowing rivers, and exposed coastal locations requiring maximum structural integrity. Therefore, the three tier product classification enables project engineers matching specific current conditions and sediment loads with appropriately rated containment solutions.

Application Segments and End Use Distribution

Construction applications dominate silt curtain demand as waterfront development, bridge pier installation, pipeline crossing, and port expansion projects require mandatory turbidity barrier deployment meeting environmental permit conditions. Marine and coastal contractors specify silt curtains protecting sensitive aquatic habitats including seagrass beds, coral reefs, and spawning grounds from construction related sediment plumes. Furthermore, dredging operations supporting navigation channel maintenance and port deepening generate recurring silt curtain demand from government infrastructure programs.

Erosion control applications demonstrate steady growth as shoreline stabilization projects, coastal restoration initiatives, and stormwater management systems utilize silt curtains containing sediment runoff from disturbed land areas. Additionally, mining operations near water bodies and offshore energy installations including wind farm foundations require turbidity control during installation phases. Meanwhile, environmental remediation projects addressing contaminated sediment removal mandate silt curtain deployment protecting surrounding water quality.

Regional Market Dynamics

Asia Pacific leads consumption driven by massive infrastructure investment across China, India, Southeast Asian nations, and Australia where port expansions, coastal development, and river management projects create substantial silt curtain demand. The region benefits from active offshore energy development and extensive aquaculture protection requirements. However, North America maintains significant market presence through coastal infrastructure maintenance programs and strict Clean Water Act compliance requirements governing construction near water bodies.

Europe demonstrates consistent demand through stringent environmental legislation including the Water Framework Directive and active coastal protection initiatives addressing climate change driven erosion challenges. Meanwhile, Middle East demonstrates growing potential through ambitious coastal development and offshore construction projects. Additionally, Latin America and Africa show expanding demand through port modernization and coastal infrastructure investment programs.

Key Growth Drivers and Market Evolution

Several factors propel market expansion through the forecast period. Global infrastructure investment acceleration particularly in coastal resilience, port capacity expansion, and underwater pipeline networks drives construction activity requiring turbidity protection. Moreover, climate change adaptation programs including coastal flood defense construction and beach nourishment projects create consistent silt curtain deployment demand.

Regulatory enforcement intensity increases as environmental agencies implement stricter turbidity monitoring and compliance requirements for water body adjacent construction. Therefore, contractors face mandatory silt curtain specifications as standard permit conditions on qualifying projects. Additionally, offshore renewable energy expansion through wind farm installation drives specialized heavy duty silt curtain demand.

Innovation in geotextile materials improves silt curtain durability, UV resistance, and reusability reducing lifecycle costs. Meanwhile, modular anchor systems and quick deployment designs improve installation efficiency reducing project program time.

Market Challenges and Strategic Considerations

Despite positive indicators, certain challenges influence market dynamics. Installation complexity in high current environments requires specialized marine contractors limiting deployment speed and increasing project costs. However, improved anchor system designs and installation equipment progressively address deployment challenges.

Silt curtain effectiveness limitations in extreme weather conditions create performance gaps requiring supplementary sediment control measures. Additionally, disposal and recycling of used geotextile material creates environmental management responsibilities for contractors. Meanwhile, price competition from low quality imported products pressures established manufacturers requiring differentiation through performance certification and technical service.

Competitive Landscape

The market features several prominent players contributing to industry development.

Nilex Inc. maintains strong positioning through its comprehensive geosynthetic product portfolio and environmental containment expertise, delivering silt curtain solutions for diverse construction and erosion control applications with focus on technical performance and regulatory compliance support.

Geofabrics Australasia Pty Limited leverages its geotextile manufacturing expertise and Asia Pacific market presence, providing engineered silt curtain systems for marine and civil construction applications with emphasis on durability and environmental performance.

Agastya Invention Pvt. Ltd. focuses on cost competitive silt curtain manufacturing and growing infrastructure market penetration, delivering sediment containment solutions for construction and erosion control applications across South Asian markets.

Murlac Limited emphasizes specialized marine environmental protection products and technical consultation services, delivering silt curtain systems for sensitive aquatic environment protection with focus on project specific engineering support.