QuickBooks Journal Entry Explained: Tips, Uses & Best Practices

Accounting is the backbone of any business, and QuickBooks Journal Entry is a powerful tool to keep your financial records accurate and organized. Whether you are an experienced accountant or a small business owner, understanding how to make a journal entry in QuickBooks Online is essential. In this guide, we will explore general journal entry QuickBooks, its uses, best practices, and how to create entries efficiently.

What Is a Journal Entry in QuickBooks?

A journal entry in QuickBooks records all business transactions in your accounting system. It is the foundation of your financial reporting, helping track debits, credits, and overall financial health. Unlike invoices or bills, journal entries are used for more complex accounting transactions, including adjusting entries, accruals, and corrections.

Key Points:

-

Records financial transactions systematically.

-

Ensures debits equal credits.

-

Forms the basis for reports like the balance sheet and profit & loss statements.

Why Are Journal Entries Important?

Understanding how to create a journal entry in QuickBooks Online helps you:

-

Maintain accurate financial records.

-

Track transactions that don’t involve invoices or payments.

-

Ensure compliance with accounting standards.

-

Correct errors from previous entries.

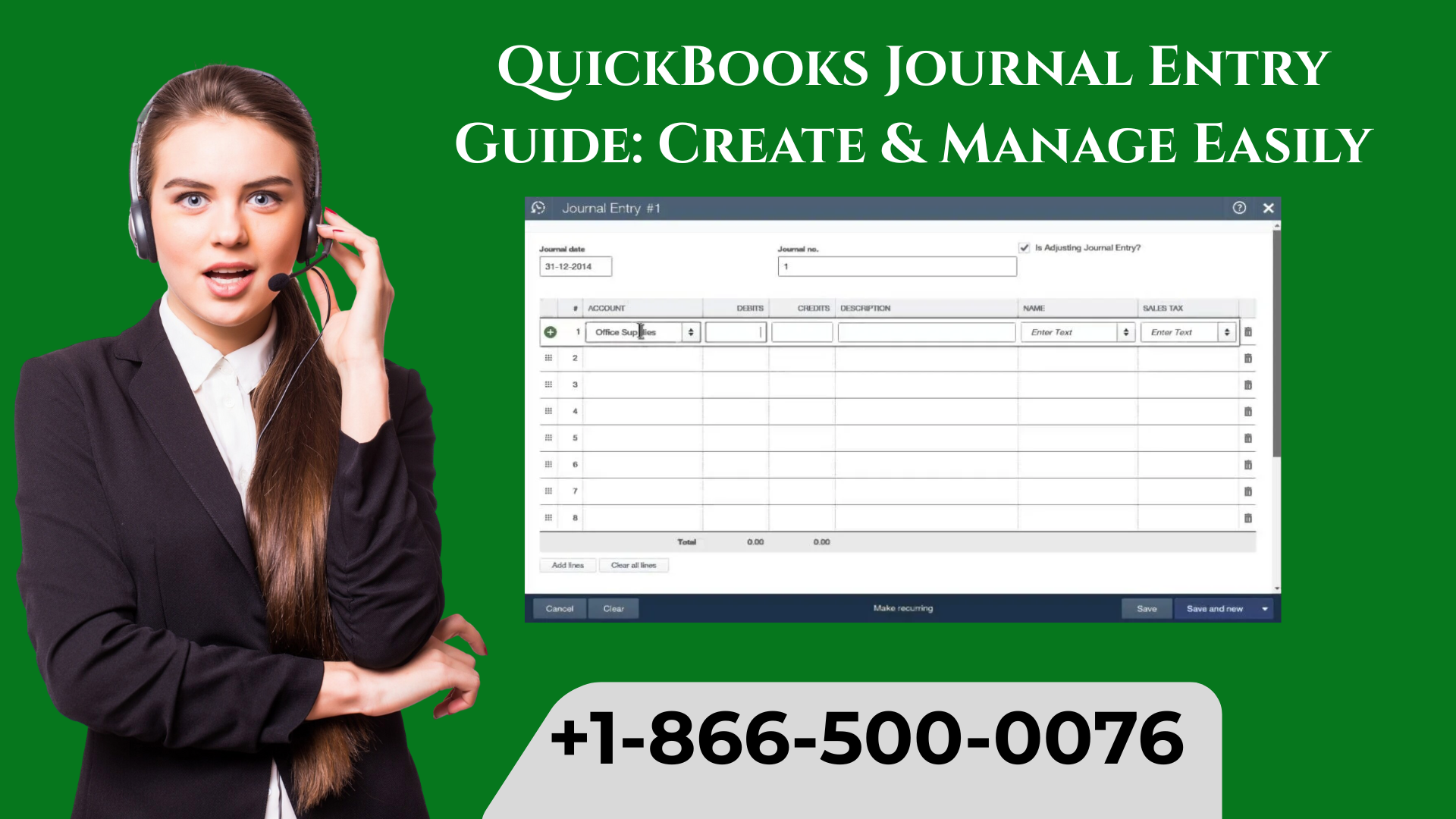

How to Make a Journal Entry in QuickBooks Online

Creating a journal entry in QuickBooks Online is simple if you follow these steps:

-

Log in to QuickBooks Online

-

Navigate to the + New button.

-

Select Journal Entry under the Other category.

-

Fill out the following details:

-

Date of transaction

-

Accounts affected (Debit and Credit)

-

Amount for each entry

-

Optional: Description for clarity

-

-

Review your entry to ensure debits equal credits.

-

Click Save and Close or Save and New for multiple entries.

Pro Tip: Always double-check accounts before posting to avoid misclassification.

Common Uses of Journal Entries in QuickBooks

General Journal Entry QuickBooks is used in various scenarios, such as:

-

Adjusting entries at month-end or year-end

-

Correcting errors from previous entries

-

Recording depreciation, amortization, or accruals

-

Transferring balances between accounts

UL/OL Style Example:

-

Adjustment Entries: Fix errors or align accounts with actuals.

-

Accruals: Record revenue or expenses before actual cash movement.

-

Depreciation: Track asset value reduction systematically.

-

Intercompany Transfers: Move funds or balances accurately.

Best Practices for QuickBooks Journal Entries

Implementing best practices ensures that your QuickBooks journal entries remain error-free and compliant:

-

Always verify accounts: Ensure the correct debit and credit accounts are selected.

-

Include clear descriptions: Helps during audits or reviews.

-

Check balances: Debits and credits must always match.

-

Regularly review entries: Avoid errors that can affect reports.

-

Use recurring entries: For regular transactions like rent or utilities.

Tips for Efficient Journal Entry Management

-

Use templates: QuickBooks allows you to save commonly used entries.

-

Automate repetitive entries: Recurring journal entries save time.

-

Maintain a log: Keep track of all entries for quick reference.

-

Cross-check with reports: Compare journal entries with your ledger and reports.

Mistakes to Avoid in QuickBooks Journal Entries

-

Posting to wrong accounts

-

Forgetting to balance debits and credits

-

Not providing descriptions for complex entries

-

Ignoring recurring entries for regular transactions

-

Skipping review before posting

Avoiding these mistakes ensures accurate accounting and prevents costly errors during audits.

Advanced Tips for QuickBooks Journal Entries

-

Use Classes and Locations: Track financial data by department or location.

-

Attach supporting documents: Helps during audits.

-

Regular reconciliations: Ensure journal entries match bank and credit card statements.

-

Train your team: Make sure anyone handling entries knows proper procedures.

Conclusion

Mastering QuickBooks Journal Entry simplifies accounting and ensures accurate financial reporting. By learning how to make a journal entry in QuickBooks Online and following best practices, you can avoid errors, save time, and gain better control of your finances. For businesses using QuickBooks, understanding general journal entry QuickBooks and efficient management is essential.

If you are experiencing issues like Windows Firewall Is Blocking QuickBooks, professional support can help you resolve these errors quickly and get back to smooth accounting operations.

FAQs

Q1: What is a journal entry in QuickBooks?

A: A journal entry records debits and credits for transactions not handled by invoices or bills, forming the foundation of your financial records.

Q2: How do I make a journal entry in QuickBooks Online?

A: Go to + New → Journal Entry, fill in date, accounts, amounts, description, then save.

Q3: Can I create recurring journal entries in QuickBooks?

A: Yes, recurring entries can be set for regular transactions to save time and maintain consistency.

Q4: What are common mistakes in journal entries?

A: Common mistakes include posting to wrong accounts, unbalanced entries, and skipping descriptions or reviews.

Q5: Why should I use journal entries instead of invoices?

A: Journal entries are ideal for complex transactions like adjustments, accruals, or transfers that invoices or bills cannot handle.