Pea Flakes Market investment landscape exploring funding trends accelerating technological and capacity advancements

This article examines how the global investment landscape surrounding the Pea Flakes Market is evolving, highlighting funding sources, technological upgrades, capacity expansion initiatives, and financial strategies shaping long-term competitiveness.

The Pea Flakes Market has entered a transformative phase, driven by rising demand from pet food producers, livestock nutrition manufacturers, and emerging applications in customized feed solutions. As adoption accelerates, the investment landscape supporting this market has become increasingly dynamic. Companies, investors, and policymakers are intensifying their focus on technological improvements, sustainability initiatives, and global production capacity expansion. Collectively, these investments are reshaping the direction and competitive structure of the industry, making capital allocation a strategic priority for businesses aiming to secure long-term growth.A significant portion of investments within the market is concentrated on processing technology enhancements. Traditional flaking systems often limit production efficiency and nutrient preservation, prompting manufacturers to seek advanced mechanical and thermal processing solutions. Investors now prioritize companies adopting energy-efficient flakers, high-precision milling tools, and upgraded drying systems that protect protein integrity. Such advancements not only improve final product quality but also reduce operational costs, making them highly attractive for large-scale producers. Funding trends show that firms offering integrated processing lines receive higher financial backing due to their ability to ensure consistent quality and scalability.

Another area experiencing rapid funding growth is automation. Investors recognize that automation directly improves throughput, minimizes contamination risks, and ensures greater batch consistency—all crucial for feed-grade ingredients. Automated quality monitoring, robotic packaging, and AI-driven process optimization are increasingly funded as part of modernization programs. These technologies enable companies to produce higher volumes with fewer errors, helping them remain competitive in a market where reliability is a critical purchase driver. Automated systems also support faster product diversification, allowing manufacturers to offer various flake sizes or formulations tailored for specific animal categories.

Sustainability-focused investments are another defining trend. As environmental concerns continue to shape purchasing behaviors, investors prioritize companies adopting green technologies. Water-efficient processing, renewable energy integration, and waste-heat recovery systems are among the top investment targets. Firms that commit to low-carbon production models attract greater institutional support, especially from sustainability-centered funds. This financial momentum encourages producers to implement eco-friendly agricultural partnerships, regenerative soil management practices, and transparent supply chain reporting—all of which enhance competitiveness in global markets that increasingly demand responsible sourcing.

Capacity expansion is another major focal point in the investment landscape. Demand for pea flakes is rising across regions including Europe, North America, and Asia–Pacific, with pet food manufacturers in particular driving sustained interest. To meet these needs, companies are constructing new facilities, upgrading older plants, and establishing regional hubs to reduce shipping times. Funding for expansion often comes through private equity investments, government-backed agricultural development programs, and joint ventures with feed manufacturers. Investors view capacity growth as a reliable opportunity due to the stable demand patterns in animal nutrition markets. Increased capacity also allows firms to secure long-term supply contracts with major buyers, strengthening revenue predictability.

Innovation in product diversification is receiving strong financial support as well. Companies are developing high-protein pea flakes, organic-certified variants, and blends enriched with micronutrients for specialized feed applications. Investors appreciate that product innovation allows companies to enter premium categories with higher margins. Enhanced nutritional products, especially those meeting the needs of aging pets, performance animals, or aquaculture species, are gaining traction and attracting targeted funding. Innovations in cold-pressing processes and low-temperature drying are also appealing to investors seeking differentiated product offerings.

Digitalization is emerging as a powerful investment theme. Blockchain-based traceability systems, cloud-driven inventory management, and digital supplier integration platforms are being funded to improve transparency and operational efficiency. These technologies allow companies to track ingredients from farm to factory, reinforcing authenticity and boosting customer confidence. Investors increasingly favor digitally mature companies due to their ability to respond quickly to disruptions, manage inventory efficiently, and maintain high compliance standards.

Government incentives also play an important role in shaping the investment landscape. Many countries support pea cultivation and processing due to peas’ contribution to soil health and low water requirements. Subsidies, tax reductions, and grants encourage manufacturers to adopt advanced technologies and expand domestic production. These incentives reduce financial risk for investors and accelerate market growth by strengthening local supply chains.

Mergers and acquisitions are becoming a core strategy within the investment ecosystem. Larger feed manufacturers and ingredient suppliers increasingly acquire smaller pea flake producers to secure stable supply and integrate production capabilities. Investors often support these acquisitions because they create vertically integrated businesses with stronger competitive positioning. Consolidation also reduces fragmentation, enabling larger firms to invest more aggressively in research, sustainability, and advanced infrastructure.

International expansion is another area attracting funding. Companies with ambitions to enter high-growth markets such as Southeast Asia, Latin America, and Eastern Europe receive backing for distribution partnerships, regulatory compliance initiatives, and localized marketing campaigns. Investors see strong potential in these regions due to expanding livestock populations, growing aquaculture production, and rising pet food expenditure.

Looking forward, the investment landscape for the Pea Flakes Market is expected to remain active as companies continue modernizing production systems, enhancing product portfolios, and expanding global presence. Investors will favor businesses demonstrating technological maturity, strong sustainability commitments, and robust distribution capabilities. With rising demand and continuous innovation, capital inflow will remain a decisive factor in shaping the competitive future of the pea flakes industry.

Categorii

Citeste mai mult

JBO Vietnam: Trusted Online Betting with Top-Quality Entertainment A Safe and Reliable Betting Platform JBO has been a safe and reputable online betting provider in Vietnam for many years. Players trust the platform because it prioritizes security and fairness. Every game and betting option is carefully managed to ensure a secure experience for users. Advanced technology protects personal and...

Seasonal maintenance plays a critical role in extending the life of a stove and minimizing the chances of costly breakdowns. Whether operating a traditional wood stove, pellet stove, or furnace-style heating system, consistent inspections ensure safe burning, efficient performance, and lower repair risks. Technicians and service providers highlight that preventive checks save both money and...

Building a business that lasts requires more than short-term success or quick profits. Long-term sustainability depends on vision, values, and strategic decision-making. Businesses that endure over time focus on people, purpose, and continuous improvement while adapting to change. Establishing a Strong Vision and Purpose: A lasting business begins with a clear vision and purpose. Vision defines...

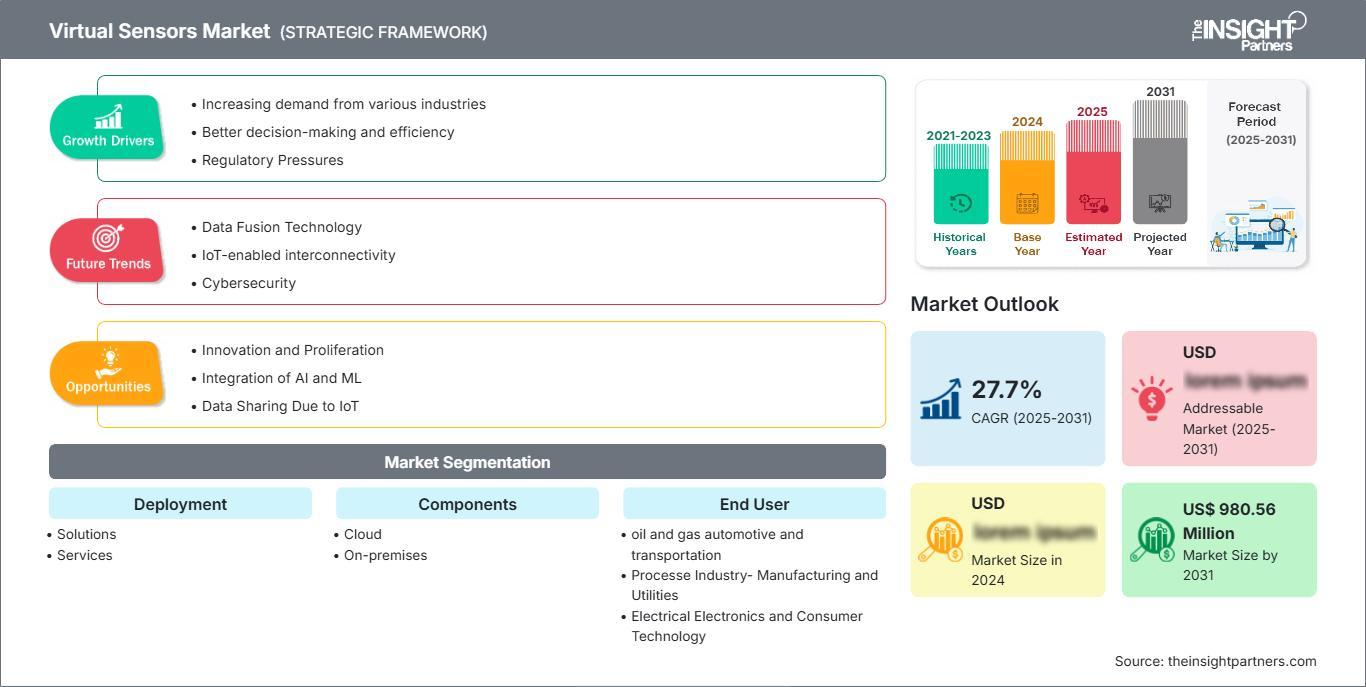

United States of America– 19 Dec 2025- Virtual sensors are revolutionizing industries by leveraging software algorithms to estimate measurements without physical hardware, driving efficiency in data-driven operations. This market-oriented report explores key dynamics, growth drivers, and strategic opportunities shaping the sector's trajectory. The Virtual Sensors...

Pink Palm Puff is a clothing brand known for fresh daily wear. The brand focuses on shirts, hoodies, and other needed items. Many people choose this brand for daily use and light outings. The brand gives close care to fabric choice and sizing. Each item aims to match daily life needs. The brand keeps its range clear and easy to pick from. Pink Palm Puff also keeps prices in a fair range for...