Middle East and Africa Usage Based Insurance Market Region Insights | Industry Trends, Growth and Size By Forecast 2025 - 2032

Key Drivers Impacting Executive Summary Middle East and Africa Usage Based Insurance Market Size and Share

Key Drivers Impacting Executive Summary Middle East and Africa Usage Based Insurance Market Size and Share

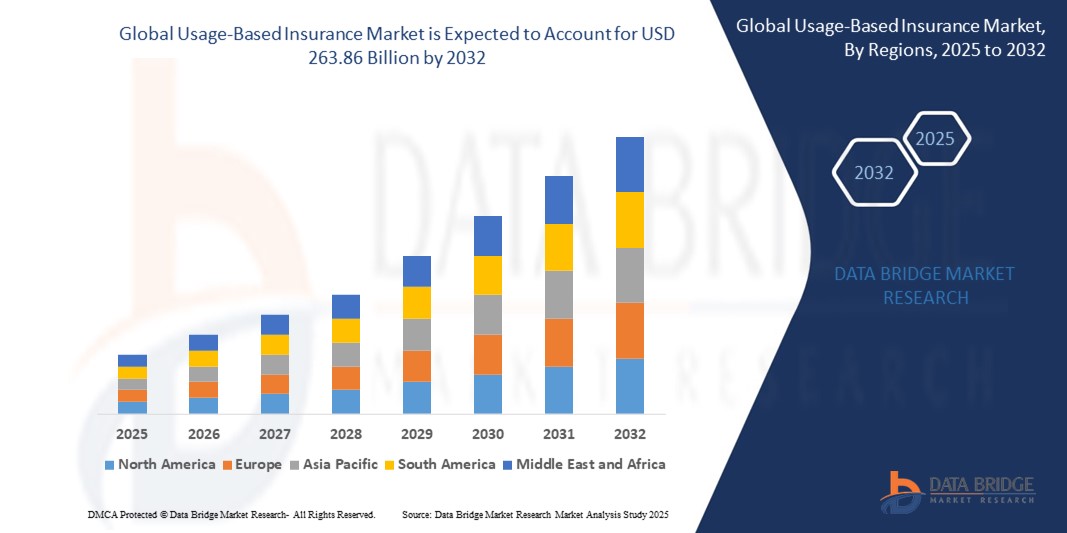

The Middle East and Africa Usage-Based Insurance Market size was valued at USD 2.12 billion in 2024 and is expected to reach USD 6.01 billion by 2032, at a CAGR of 13.90% during the forecast period

Analysis and discussion of important industry trends, market size, market share estimates are also covered in this global Middle East and Africa Usage Based Insurance Market report. The usefulness of SWOT analysis and Porter's Five Forces analysis in generating market research report makes it preferable by the businesses and hence also used while preparing this Middle East and Africa Usage Based Insurance Market report. Middle East and Africa Usage Based Insurance Market report consists of market analysis by regions, especially North America, China, Europe, Southeast Asia, Japan, and India, focusing top manufacturers in global market, with production, price, revenue, and market share for each manufacturer. Being the most suitable example of the key market attributes, this Middle East and Africa Usage Based Insurance Market report has been prepared by keeping in mind every market related aspect.

Middle East and Africa Usage Based Insurance Market report provides statistics on the current state of the industry and thereby acts as a valuable source of guidance and direction for companies and investors interested in this market. Each of the topics is researched and analysed in depth for generating comprehensive Middle East and Africa Usage Based Insurance Market research report. This Middle East and Africa Usage Based Insurance Market report examines the market with respect to general market conditions, market status, market improvement, key developments, cost and profit of the specified market regions, position and comparative pricing between major players. Middle East and Africa Usage Based Insurance Market report is an absolute background analysis of the Middle East and Africa Usage Based Insurance Market industry which includes an assessment of the parental market.

Understand market developments, risks, and growth potential in our Middle East and Africa Usage Based Insurance Market study. Get the full report:

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-usage-based-insurance-market

Middle East and Africa Usage Based Insurance Industry Trends

**Segments**

- **By Package Type**: Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD).

- **By Vehicle Type**: Passenger Vehicle, Commercial Vehicle.

- **By Device Offering**: OBD-II, Smartphone, Hybrid.

- **By Electric & Hybrid Vehicle**.

The Middle East and Africa Usage Based Insurance Market is segmented based on package type, vehicle type, device offering, and electric & hybrid vehicle. The PAYD segment is expected to witness significant growth due to the increasing adoption of this type of insurance package that allows customers to pay premiums based on their actual usage of the vehicle. The commercial vehicle segment is also projected to grow steadily as businesses look for ways to manage their fleet more efficiently. OBD-II devices are the most commonly used in UBI policies, providing accurate data on driving behavior for insurance companies to assess risk.

**Market Players**

- Allianz Group

- AXA

- InsurePal Limited

- MAPFRE

- Vodafone Automotive

- Sierra Wireless

- TOMTOM TELEMATICS BV

- Liberty Mutual Insurance

- MetaSystems

- Metromile

- PING AN INSURANCE (GROUP) COMPANY OF CHINA, LTD.

- ZUBIE

Several key players are operating in the Middle East and Africa Usage Based Insurance Market, offering a range of products and services to cater to the growing demand for personalized insurance solutions. Companies such as Allianz Group and AXA are dominating the market with their innovative offerings and strong market presence. InsurePal Limited and MAPFRE are also emerging as significant players in the UBI market, leveraging technology to provide value-added services to their customers. Vodafone Automotive and Sierra Wireless are leading providers of telematics solutions, enabling insurance companies to collect data efficiently and accurately for usage-based pricing.

The Middle East and Africa Usage Based Insurance Market is poised for robust growth driven by evolving consumer preferences towards personalized insurance packages. The PAYD segment is forecasted to experience substantial traction as customers increasingly look for flexible payment options based on their actual vehicle usage. This shift in behavior is attributed to the desire for fairer pricing models and the ability to control insurance costs. Additionally, the commercial vehicle segment is anticipated to witness steady growth due to businesses adopting UBI solutions to better manage their fleets and optimize operational efficiency.

In terms of device offering, OBD-II technology remains the preferred choice for UBI policies as it provides insurers with accurate and real-time data on driving behaviors and patterns. This data is crucial for insurance companies to effectively assess risks and offer tailored insurance packages to customers. Smartphone-based and hybrid device offerings are also gaining traction in the market, providing alternative solutions for data collection and analysis in UBI programs.

The segmentation based on electric and hybrid vehicles presents a unique opportunity for insurers to tap into the growing market of eco-friendly vehicles. With the rise in environmental consciousness and government incentives for electric vehicles, the UBI market is likely to see an uptick in offerings tailored specifically for this segment. Insurers can leverage data from electric and hybrid vehicles to incentivize safe driving practices and promote sustainability, aligning with the global trend towards green initiatives.

Key players in the Middle East and Africa Usage Based Insurance Market such as Allianz Group, AXA, and InsurePal Limited are at the forefront of innovation, offering cutting-edge solutions to meet the evolving needs of customers. These market leaders are leveraging technology and data analytics to deliver value-added services, enhance customer experience, and drive business growth. Collaboration with technology providers like Vodafone Automotive and Sierra Wireless enables insurers to harness the power of telematics and IoT devices for efficient data collection and analysis, ultimately leading to more accurate risk assessment and pricing models.

As the market continues to expand and evolve, players in the UBI space must focus on customer-centric solutions, strategic partnerships, and technological advancements to stay competitive and capitalize on the burgeoning demand for usage-based insurance products in the Middle East and Africa region.The Middle East and Africa Usage Based Insurance Market is a rapidly growing sector driven by the increasing demand for personalized insurance solutions and evolving consumer preferences. The segmentation based on package type, vehicle type, device offering, and electric & hybrid vehicles reflects a diverse market landscape with opportunities for insurers to cater to specific customer needs. The PAYD segment is particularly promising, offering customers the flexibility to pay premiums based on their actual vehicle usage, aligning with the trend towards fairer pricing models and cost control. Additionally, the commercial vehicle segment presents steady growth prospects as businesses seek more efficient fleet management solutions through UBI offerings.

In terms of device offering, OBD-II technology remains a popular choice for UBI policies due to its ability to provide insurers with accurate and real-time data on driving behaviors. This data is essential for risk assessment and tailoring insurance packages to individual customers. The emergence of smartphone-based and hybrid device offerings also indicates the market's adaptability to alternative data collection and analysis solutions in UBI programs, further expanding the market's reach and applicability.

The segmentation around electric and hybrid vehicles signifies a unique opportunity for insurers to tap into the growing market of eco-friendly vehicles. With the increasing focus on sustainability and governmental incentives for electric vehicles, the UBI market is poised to offer specialized packages for this segment, leveraging data to promote safe driving practices and environmental initiatives. Insurers can leverage the data from electric and hybrid vehicles to incentivize eco-conscious behavior among customers and align with the global shift towards green initiatives.

Key players in the Middle East and Africa Usage-Based Insurance Market such as Allianz Group, AXA, and InsurePal Limited are leading the way in innovation, providing advanced solutions to meet the changing needs of customers. Their focus on technology and data analytics allows for value-added services, improved customer experiences, and business growth. Collaborations with technology providers like Vodafone Automotive and Sierra Wireless enable insurers to harness telematics and IoT devices effectively for data collection and analysis, leading to more accurate risk assessment and pricing models.

As the market landscape continues to evolve, it is imperative for players in the UBI space to prioritize customer-centric solutions, forge strategic partnerships, and drive technological advancements to remain competitive and capitalize on the growing demand for usage-based insurance products in the Middle East and Africa region. By staying ahead of market trends and adopting agile business practices, insurers can position themselves for success in a dynamic and expanding market environment.

Break down the firm’s market footprint

https://www.databridgemarketresearch.com/reports/middle-east-and-africa-usage-based-insurance-market/companies

Middle East and Africa Usage Based Insurance Market Reporting Toolkit: Custom Question Bunches

- What is the total valuation of the Middle East and Africa Usage Based Insurance industry this year?

- What will be the future growth outlook of the Middle East and Africa Usage Based Insurance Market?

- What are the foundational segments discussed in the Middle East and Africa Usage Based Insurance Market report?

- Who are the dominant players in Middle East and Africa Usage Based Insurance Market each region?

- What countries are highlighted in terms of revenue growth for Middle East and Africa Usage Based Insurance Market?

- What company profiles are included in the Middle East and Africa Usage Based Insurance Market report?

Browse More Reports:

Global Webcams Market

Global Welded Spiral Heat Exchangers Market

Global Wilson’s Disease Market

Global Wind Turbine Tower Market

Global Women Fleece & Pullovers Market

Global Wood-based Cellulose Packaging Market

Global Zollinger-Ellison Syndrome Treatment Market

Global Backscatter X-Ray Devices Market

Global Door And Window Automation Market

Global Hydrogen Truck Market

Global Needle-Free Peptide Delivery Market

Global Propineb Market

Global Universal Quick Disconnect Coupling Market

Global Agricultural Pneumatic Integrated Equipment Market

Global Antioxidant Vitamin Market

Europe Molecular Diagnostics Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com