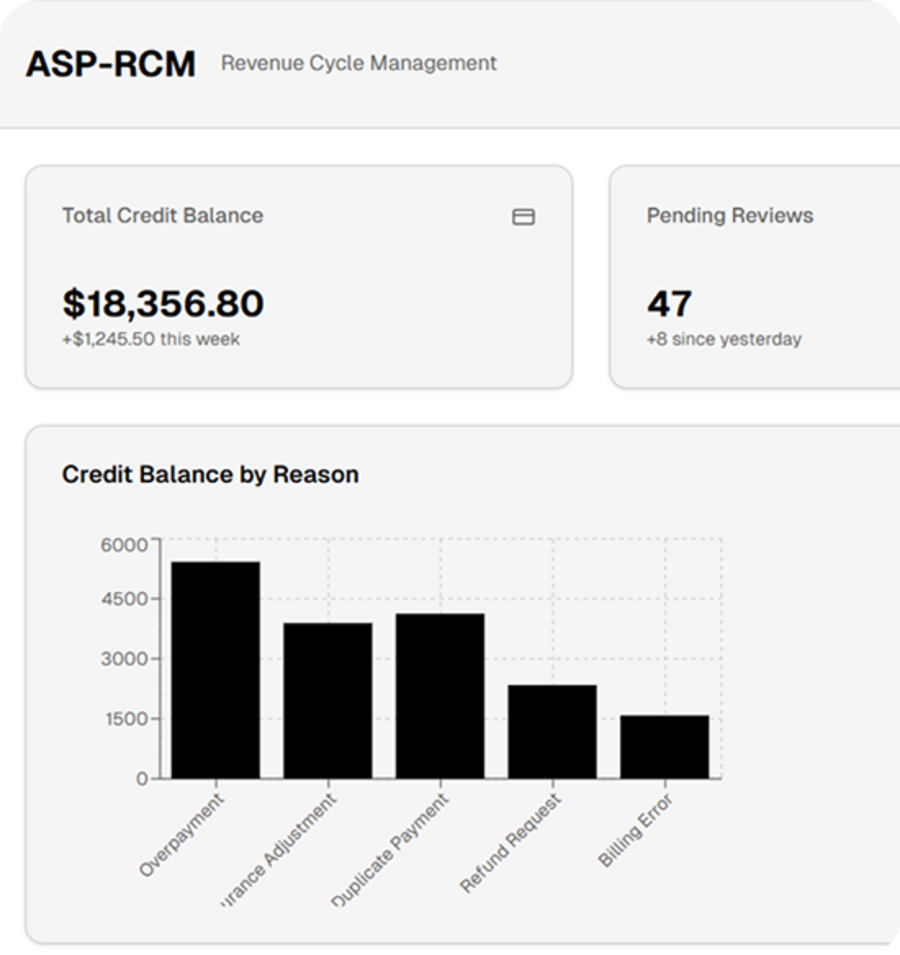

credit balance process in medical billing

Understanding the Credit Balance Process in Medical Billing

In medical billing, a credit balance occurs when a healthcare account shows an excess payment — meaning the payer, whether a patient or insurance company, has paid more than what is owed. Proper handling of credit balances is critical, as mismanagement can lead to compliance issues, financial losses, and patient dissatisfaction.

1. Identifying Credit Balances

Credit balances can arise from multiple situations:

Duplicate payments: A patient or insurer accidentally pays the same bill twice.

Overpayments: The insurer reimburses more than the billed amount.

Billing errors: Mistakes in coding or charge posting create discrepancies.

Adjustments: Post-payment corrections by insurance or clearinghouses.

Regular review of the Accounts Receivable (AR) is essential. Automated billing software often flags accounts with potential credit balances, but human verification is crucial to ensure accuracy.

2. Verification Process

Once a credit balance is identified, the billing team must validate it. This involves:

Reviewing the payment history and explanation of benefits (EOBs).

Checking if the credit is valid or due to posting errors.

Ensuring compliance with payer contracts and regulations.

3. Resolving Credit Balances

After verification, healthcare providers can resolve the balance in several ways:

Refund to the patient or insurer: The most common approach, especially when the overpayment is significant.

Apply to future services: Patients with upcoming visits can have the credit applied to their next bill.

Adjustments within the system: Small or negligible credits may be written off, following internal policies.

Each step must be documented thoroughly, as healthcare audits often focus on credit balance management.

4. Monitoring and Reporting

Consistent monitoring of credit balances is a best practice. Monthly reports help identify trends, prevent recurring errors, and maintain compliance with CMS regulations. Proper reporting ensures that overpayments are resolved timely, reducing financial risk.

5. Importance for Healthcare Providers

Efficient credit balance management:

Maintains accurate financial records.

Prevents legal and compliance issues.

Enhances patient trust by ensuring fair billing practices.

Supports cash flow optimization, avoiding unnecessary write-offs.

In conclusion, the credit balance process is more than just refund management. It’s a critical part of medical billing that safeguards a provider’s financial health, ensures regulatory compliance, and strengthens patient satisfaction. A structured, proactive approach helps healthcare organizations handle overpayments effectively and responsibly.