How Digital Innovation Is Reshaping the Insurance and Managed Care Market

"Detailed Analysis of Executive Summary Insurance and Managed Care Market Size and Share

CAGR Value

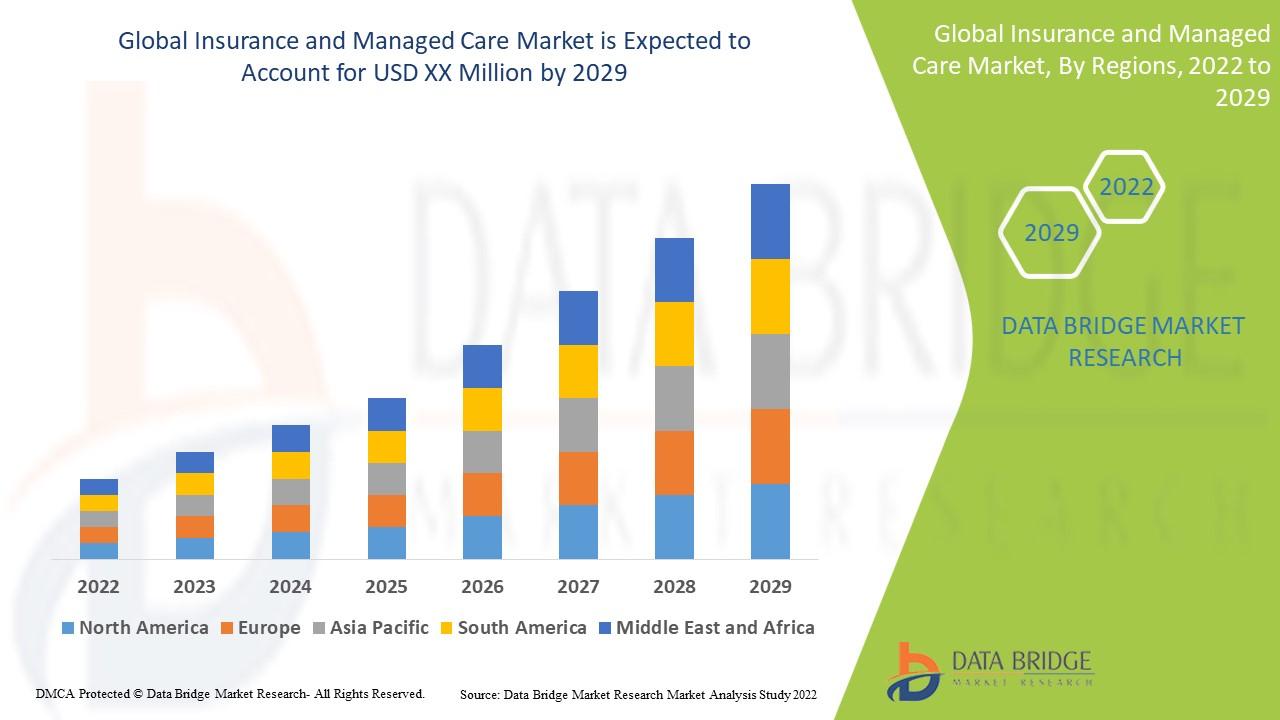

Data Bridge Market Research analyses that the insurance and managed care market which is expected to reach at a healthy CAGR of during the forecast period 2022 to 2029.

The Insurance and Managed Care report provides market shares at global level, mainly for Europe, North America, Asia Pacific and South America. By using an excellent research methodology, this report focuses on market share analysis and key trend analysis. The data of this report have been signified in the graphical format for an explicit understanding of facts and figures. The market research studies associated with competitor analysis highlight the competitive landscape from which Insurance and Managed Care Market industry can choose or advance their own strategies to thrive in the market. Insurance and Managed Care Market report has an all-inclusive market data that makes it easy for the Insurance and Managed Care Market industry to take strategic decisions and attain growth objectives.

Insurance and Managed Care report provides intelligent solutions to the versatile business challenges and instigates an unproblematic decision-making process. The market definition covered in the report gives the scope of a particular product with respect to the driving factors and restraints in the market. Key data and information used while forming this report has been amassed from the consistent sources that range from journals, websites, research papers, case studies, and magazines. The research study conducted in Insurance and Managed Care report also helps to recognize the various drivers and restraints impacting the market during the forecast period. With the consistent knowledge, the research, analysis, and estimations are drawn in this Insurance and Managed Care Market report.

Take a deep dive into the current and future state of the Insurance and Managed Care Market. Access the report:

https://www.databridgemarketresearch.com/reports/global-insurance-and-managed-care-market

Insurance and Managed Care Market Data Summary

Segments

- By Insurance Type: The global insurance and managed care market can be segmented based on the type of insurance, including health insurance, life insurance, property insurance, and others. Health insurance is expected to witness significant growth due to the increasing healthcare expenditure and the rising awareness about the importance of health coverage among individuals. Life insurance is also a crucial segment as people seek financial protection for their loved ones in case of any unforeseen events. Property insurance, such as home insurance and auto insurance, provides coverage for damages to the property or vehicle.

- By Service Provider: The market can also be segmented based on the service providers, including private insurance companies, government-sponsored insurance programs, and managed care organizations. Private insurance companies dominate the market, offering a wide range of insurance products tailored to meet the diverse needs of consumers. Government-sponsored insurance programs play a vital role in providing coverage to vulnerable populations who may not afford private insurance. Managed care organizations focus on controlling healthcare costs while maintaining the quality of care through network management and utilization review.

- By End-User: End-user segmentation includes individual policyholders and group policyholders. Individual policyholders purchase insurance coverage for themselves and their families to secure their financial future and access quality healthcare services. Group policyholders, such as employers or organizations, offer insurance plans to their employees as part of the benefits package, promoting employee satisfaction and retention.

Market Players

- UnitedHealth Group: One of the largest healthcare companies globally, offering a diverse portfolio of health insurance and managed care services to individuals and businesses. The company's innovative approach to healthcare delivery and focus on technology integration have helped position it as a market leader.

- Anthem, Inc.: A prominent player in the insurance and managed care market, providing health benefits to millions of members across different states. Anthem's strong network of healthcare providers and customer-centric approach have contributed to its market success.

- Cigna Corporation: Known for its comprehensive health insurance and managed care solutions, Cigna serves a broad customer base, including individuals, employers, and government entities. The company's emphasis on preventive care and wellness programs sets it apart in the market.

- Aetna, a CVS Health Company: A major player in the insurance and managed care sector, Aetna offers a wide range of insurance products and services, leveraging CVS Health's extensive network of pharmacies and healthcare facilities to enhance customer experience and healthcare outcomes.

- Humana Inc.: Specializing in health and wellness solutions, Humana caters to diverse customer needs, including Medicare and Medicaid beneficiaries, employers, and individuals. The company's focus on value-based care and population health management has positioned it as a key player in the market.

The global insurance and managed care market is characterized by intense competition, technological advancements, and regulatory changes that drive market players to innovate and adapt to evolving customer needs and industry dynamics.

The global insurance and managed care market is witnessing a significant shift towards personalized and technology-driven solutions to meet the evolving needs of consumers. One of the emerging trends in the market is the increasing focus on value-based care and preventive health measures. Market players are investing in innovative programs and services that promote wellness and disease prevention, aiming to reduce healthcare costs and improve overall health outcomes for policyholders.

Another key trend shaping the insurance and managed care market is the rising adoption of digital technologies such as telemedicine, wearable devices, and data analytics. These technologies enable insurers and service providers to offer remote healthcare services, monitor policyholders' health in real-time, and create personalized insurance plans based on individual health data. Integrating digital solutions not only enhances customer experience but also streamlines operations, leading to cost efficiencies and better risk management.

Furthermore, regulatory changes and healthcare reforms are driving market players to adapt their business models and strategies to comply with new requirements and standards. With the increasing focus on healthcare affordability and accessibility, insurers and managed care organizations are exploring collaborative partnerships and value-based payment models to align incentives with quality care delivery and cost containment. Adapting to regulatory reforms while maintaining profitability and customer satisfaction remains a critical challenge for industry players.

Moreover, the market is witnessing a growing demand for comprehensive insurance products that cover a wide range of health services, including mental health, preventive care, and specialty treatments. Consumers are increasingly seeking insurance plans that offer holistic coverage and support their overall well-being, driving insurers to diversify their product offerings and tailor solutions to meet specific healthcare needs and preferences.

In conclusion, the global insurance and managed care market is undergoing a transformation driven by technological innovation, regulatory changes, and shifting consumer preferences. Market players need to embrace these trends and challenges by investing in digital capabilities, fostering strategic partnerships, and delivering value-based care solutions to stay competitive and meet the evolving demands of the market. By aligning their business strategies with emerging trends and customer-centric approaches, insurers and managed care organizations can position themselves for long-term growth and success in a dynamic and competitive market landscape.The global insurance and managed care market is experiencing a transformational period characterized by various key trends that are reshaping the industry landscape. One significant trend is the increasing focus on value-based care and preventive health measures. Market players are shifting their strategies towards promoting wellness and disease prevention to reduce healthcare costs and enhance health outcomes for policyholders. By emphasizing proactive healthcare approaches, insurers and managed care organizations can not only improve customer satisfaction but also drive long-term cost savings by preventing costly medical interventions.

Digital transformation is another major trend impacting the insurance and managed care market. The adoption of technologies such as telemedicine, wearable devices, and data analytics is enabling insurers to offer remote healthcare services, monitor policyholders' health in real-time, and customize insurance plans based on individual health data. These digital solutions not only enhance the overall customer experience but also streamline operations, leading to greater efficiencies and improved risk management for market players. Embracing digital innovations is essential for staying competitive in an increasingly tech-driven market environment.

Regulatory changes and healthcare reforms are also playing a pivotal role in shaping the market landscape. As the industry faces evolving regulatory requirements and standards, insurers and managed care organizations must adapt their business models to comply with new regulations while ensuring profitability and customer satisfaction. Collaborative partnerships and value-based payment models are being explored as strategies to align incentives with quality care delivery and cost containment. Navigating regulatory challenges while maintaining a focus on customer-centric care delivery remains a critical priority for industry stakeholders.

Moreover, there is a rising demand for comprehensive insurance products that encompass a wide range of health services, including mental health coverage, preventive care, and specialty treatments. Consumers are increasingly seeking holistic insurance plans that support their overall well-being, prompting insurers to diversify their product offerings and tailor solutions to address specific healthcare needs and preferences. To meet the evolving demands of consumers, market players need to continue innovating their product portfolios and enhancing the scope of services provided to ensure comprehensive coverage and customer satisfaction.

In conclusion, the global insurance and managed care market is undergoing a rapid evolution driven by key trends such as value-based care, digital transformation, regulatory changes, and consumer demand for comprehensive coverage. Market players must adapt to these trends by embracing innovation, leveraging digital technologies, navigating regulatory complexities, and focusing on customer-centric care delivery to thrive in a competitive and dynamic market environment. By aligning their strategies with emerging market trends and adopting a proactive approach to meet evolving customer needs, insurers and managed care organizations can position themselves for sustainable growth and success in the years to come.

Investigate the company’s industry share in depth

https://www.databridgemarketresearch.com/reports/global-insurance-and-managed-care-market/companies

Insurance and Managed Care Market Overview: Strategic Questions for Analysis

- What is the size of the global Insurance and Managed Care Market industry this year?

- What rate of growth is forecasted for the next decade for Insurance and Managed Care Market?

- What are the key divisions of the Insurance and Managed Care Market?

- Which organizations have the strongest presence in Insurance and Managed Care Market?

- Which markets are the focus of the geographic analysis for Insurance and Managed Care Market ?

- What companies are featured in the competitive landscape for Insurance and Managed Care Market?

Browse More Reports:

Global Beverage Enhancers Market

Global Expandable Microspheres Market

Global Herbal Products Market

Global Internet of Things (IoT) in Warehouse Market

Global Intravascular Optical Coherence Tomography (OCT) Imaging Systems Market

Global Laser Endomicroscopy Market

Global Mass Spectrometry Software Market

Global Optical Coherence Tomography for Ophthalmology Market

Global Scrub Typhus Treatment Market

Global Superphosphate Market

Global Tissue Testing Market

Global Adalimumab Market

Global Almond Oil Market

Global Biodetectors and Accessories Market

Global Biopharmacy Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"