Why CFOs Are Moving to Digital Treasury Platforms

Treasury has traditionally been viewed as a specialist function focused on cash management, banking relationships, and risk mitigation. However, the role of treasury has expanded significantly in recent years. Volatile markets, rising interest rates, global operations, and increased scrutiny from boards have pushed CFOs to demand greater visibility, control, and agility. As a result, many are accelerating their move to digital treasury platforms.

Digital treasury platforms modernise how organisations manage cash, liquidity, risk, and funding. They replace fragmented spreadsheets and manual processes with integrated, real-time systems that support faster decisions and stronger financial resilience. For CFOs navigating uncertainty, this shift is becoming not just beneficial, but necessary.

The Limits of Traditional Treasury Models

Many treasury teams still rely on disconnected tools, bank portals, and spreadsheets. While these methods may have worked in more stable environments, they struggle to keep pace with today’s complexity.

Common challenges include:

-

Limited real-time visibility into global cash positions

-

Manual bank reconciliations and reporting delays

-

Inconsistent data across regions and entities

-

Slow response to liquidity or FX risks

-

Heavy reliance on key individuals and manual controls

These limitations increase operational risk and reduce the CFO’s ability to act decisively. In periods of market stress, delayed information can lead to missed opportunities or costly mistakes.

What Is a Digital Treasury Platform?

A digital treasury platform is a centralised system that integrates cash management, liquidity forecasting, payments, bank connectivity, risk management, and reporting into a single environment. It connects directly to banks, ERP systems, and market data sources to provide a real-time view of treasury activity.

Key capabilities typically include:

-

Real-time cash visibility across accounts and currencies

-

Automated bank connectivity and reconciliation

-

Liquidity forecasting and scenario analysis

-

FX, interest rate, and counterparty risk management

-

Centralised payments and approvals

-

Treasury reporting and dashboards

For CFOs, this creates a single source of truth for treasury operations.

Real-Time Cash Visibility as a Strategic Advantage

Cash visibility is the primary driver behind treasury digitisation. CFOs need to know where cash sits, how quickly it can be accessed, and what obligations are approaching. Digital platforms provide near real-time insight into balances, inflows, and outflows across all banking partners.

This visibility supports better decisions in several ways:

-

Improved liquidity planning

-

Faster response to cash shortfalls

-

More efficient cash pooling and netting

-

Reduced idle or trapped cash

-

Greater confidence in funding decisions

Instead of reacting to yesterday’s data, CFOs can manage liquidity proactively.

Stronger Liquidity Forecasting and Scenario Planning

Uncertainty has increased the importance of accurate liquidity forecasting. Digital treasury platforms combine historical data with forward-looking assumptions to create dynamic forecasts that update as conditions change.

CFOs can model scenarios such as:

-

Revenue slowdowns

-

Delayed customer payments

-

Supply chain disruptions

-

Interest rate changes

-

Increased funding costs

By stress-testing liquidity under different conditions, finance leaders gain clarity on how much runway the organisation has and what actions may be required. This capability is especially valuable during economic downturns or periods of rapid growth.

Improved Risk Management and Control

Treasury is a critical line of defence against financial risk. Digital platforms strengthen this role by embedding controls and providing better oversight.

Key risk-related benefits include:

-

Centralised monitoring of FX and interest rate exposure

-

Automated hedge tracking and effectiveness analysis

-

Improved counterparty and bank exposure management

-

Stronger segregation of duties and approval workflows

-

Full audit trails for treasury transactions

These controls reduce reliance on manual checks and lower the risk of error or fraud, while also supporting regulatory and audit requirements.

Operational Efficiency and Cost Reduction

Manual treasury processes consume time and create operational risk. Digital platforms automate many routine activities, freeing treasury teams to focus on analysis and strategy.

Efficiency gains often come from:

-

Automated bank statement processing

-

Faster reconciliations

-

Reduced spreadsheet dependency

-

Streamlined payment execution

-

Standardised reporting

For CFOs, this translates into lower operational cost, reduced key-person dependency, and a more scalable treasury function.

Better Integration with the Finance Ecosystem

Modern CFOs expect treasury to be tightly integrated with the wider finance function. Digital treasury platforms connect seamlessly with ERP systems, FP&A tools, and accounting processes.

This integration enables:

-

More accurate cash forecasting within FP&A

-

Faster month-end close

-

Improved alignment between treasury and controllership

-

Consistent data across finance functions

Treasury insights become part of enterprise decision-making, rather than operating in isolation.

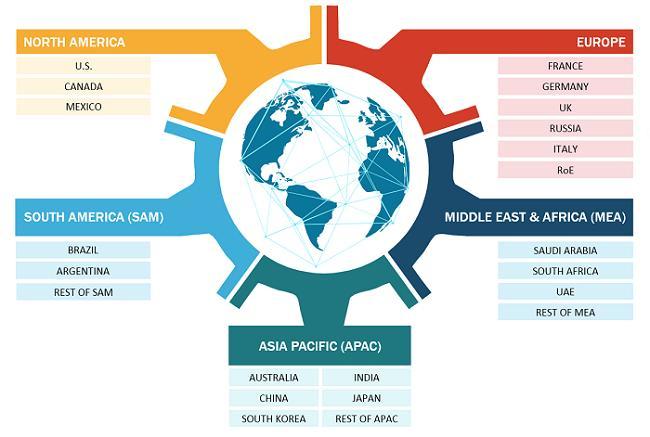

Supporting Global Operations at Scale

As organisations expand internationally, treasury complexity increases. Multiple currencies, banking regulations, and time zones create operational strain. Digital platforms help CFOs manage this scale effectively.

They support:

-

Multi-currency cash management

-

Centralised oversight with local execution

-

Compliance with local banking and payment regulations

-

Standardised processes across regions

This allows CFOs to maintain control without slowing down local operations.

Enhancing Board and Investor Confidence

Boards and investors expect CFOs to demonstrate strong liquidity management and risk oversight. Digital treasury platforms improve the quality, speed, and credibility of reporting.

With real-time dashboards and scenario analysis, CFOs can:

-

Communicate liquidity positions clearly

-

Explain funding strategies with confidence

-

Demonstrate preparedness for adverse scenarios

-

Support capital allocation discussions

This transparency strengthens trust and supports better governance.

Treasury as a Strategic Function

The move to digital platforms is also changing how treasury is perceived within organisations. As automation removes manual burden, treasury teams contribute more actively to strategic discussions.

They provide insight into:

-

Capital structure optimisation

-

Funding strategy and timing

-

Cash deployment decisions

-

Risk appetite and exposure

For CFOs, this elevates treasury from a transactional function to a strategic partner.

Key Considerations for CFOs

While the benefits are clear, successful treasury digitisation requires careful planning. CFOs should consider:

-

Data quality and system integration

-

Change management and user adoption

-

Bank connectivity requirements

-

Scalability and future needs

-

Governance and control design

A phased approach often delivers the best results, allowing teams to build capability over time.

Conclusion

CFOs are moving to digital treasury platforms because the demands placed on treasury have fundamentally changed. Real-time visibility, stronger risk management, improved efficiency, and better decision support are no longer optional. They are essential to navigating volatility and supporting growth.

By digitising treasury, CFOs gain greater control over liquidity, reduce operational risk, and position their organisations to respond quickly to change. In an uncertain world, a modern digital treasury platform is not just a technology upgrade—it is a strategic investment in financial resilience and leadership.