Global Passive Electronic Components Market: Circuit Reliability Trends Reshaping Segment Share, 2025–2033

Market Overview

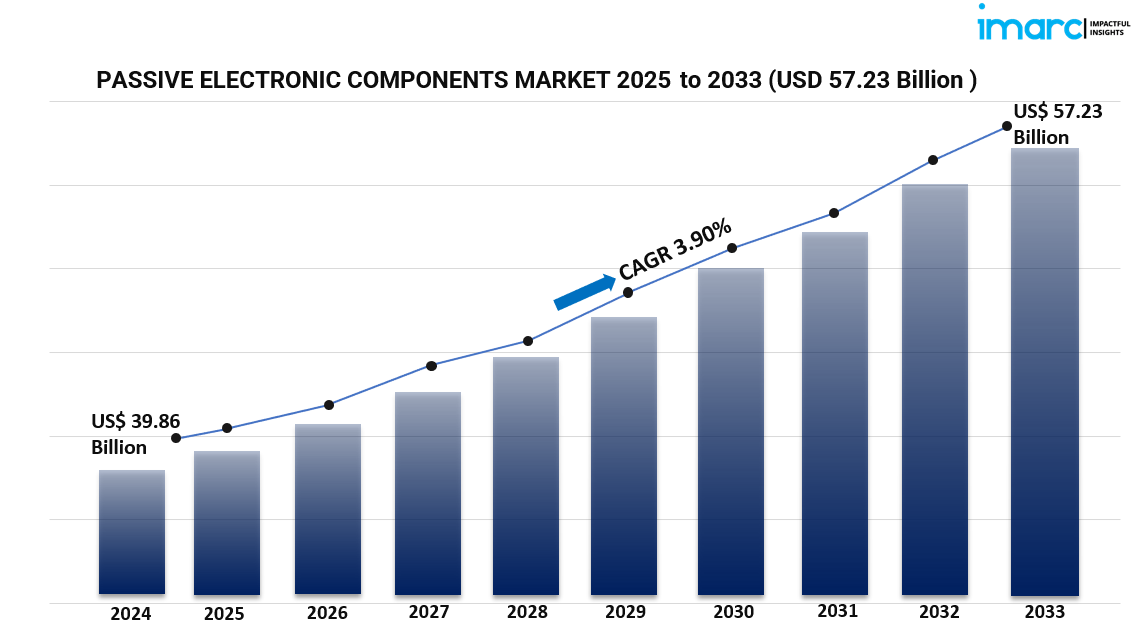

The global passive electronic components market was valued at USD 39.86 Billion in 2024 and is projected to reach USD 57.23 Billion by 2033, growing at a CAGR of 3.90% during the forecast period 2025-2033. This growth is driven by the rising demand in consumer electronics, electric vehicles, and renewable energy infrastructure, supported by advancements in miniaturization and expanding manufacturing supply chains. Explore the Passive Electronic Components Market for detailed insights.

Study Assumption Years

- Base Year: 2024

- Historical Years: 2019-2024

- Forecast Period: 2025-2033

Passive Electronic Components Market Key Takeaways

- The global passive electronic components market size was valued at USD 39.86 Billion in 2024, with a forecasted CAGR of 3.90% during 2025-2033.

- Market forecast expects growth to USD 57.23 Billion by 2033.

- North America dominated with over 35.8% share in 2024.

- Growth drivers include rising demand in consumer electronics such as smartphones and wearables, increasing electric vehicle adoption, and expanding renewable energy infrastructure.

- Technological advancements in miniaturization and increased R&D investments support market expansion.

- Rapid growth in 5G network development and IoT adoption also fuel demand.

Sample Request Link: https://www.imarcgroup.com/passive-electronic-components-market/requestsample

Market Growth Factors

The passive electronic components market is significantly propelled by the escalating demand for consumer electronics including smartphones, laptops, tablets, and wearable devices. In 1Q24, wearable device shipments surged by 8.8% year-on-year to 113.1 million units, reflecting expanding passive component requirements. These components ensure efficient power management and optimum device performance, meeting technological innovations and consumer preferences, which drive the market's sustained growth.

The automotive sector's expansion, especially the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), has greatly stimulated demand for passive components like capacitors and resistors. In 2023, nearly 14 million new electric cars were registered globally, raising EVs on roads to 40 million. These components are critical for EV battery management, power electronics, and electronic control units, underpinning the automotive-driven growth in this market.

Renewable energy systems also contribute strongly to market growth. The global shift towards sustainable energy sources has boosted solar, wind, and bioenergy systems reliant on passive electronic components for energy conversion, storage, and management. Notably, wind and solar PV systems are projected to produce more electricity than hydropower in 2024, with bioenergy as the largest renewable energy source globally since 2022. This trend expands the demand for components that optimize renewable energy infrastructure reliability and performance.

Market Segmentation

By Type:

- Capacitor: Leading the market with 54.4% share in 2024, capacitors such as ceramic, tantalum, aluminum electrolytic, paper and plastic film, and supercapacitors are crucial for energy storage, regulation, and signal processing in power electronics, renewable energy, and electric vehicles.

- Inductor: Includes power and frequency inductors used for various applications across industries.

- Resistor: Covers surface-mounted chips, network, wirewound, film/oxide/foil, and carbon resistors vital for circuit functionality.

By End Use Industry:

- Aerospace and Defense: Utilizes passive components for mission-critical applications.

- Consumer Electronics: Holds around 25.9% market share in 2024 due to heavy use in devices like smartphones, laptops, tablets, and smart home appliances, driven by miniaturization and IoT adoption.

- Information Technology: Supports a range of electronics requiring passive components.

- Automotive: Key sector for passive components due to EVs and ADAS systems.

- Industrial: Uses passive components for automation and manufacturing electronics.

- Others: Includes various other industries dependent on passive electronic components.

Regional Insights

North America dominates the passive electronic components market with over 35.8% share in 2024, driven by a strong industrial base, advanced technology infrastructure, and substantial R&D investments. Key industries include aerospace, defense, telecommunications, and automotive sectors, with growing electric vehicle and renewable energy markets further propelling demand for components in energy storage and power management. Supportive government policies and robust supply chains reinforce this leading position.

Recent Developments & News

- On March 11, 2024, Knowles Precision Devices launched new Electric Double Layer Capacitor (EDLC) modules featuring a three-cell design, optimized for EVs, IoT, and renewable energy with high energy density, low self-discharge, and a 10-year lifespan.

- On August 26, 2024, Bourns, Inc. expanded its Riedon Industrial Shunt Resistors lineup, enhancing precision solutions for battery management systems, solar inverters, and power supplies in the U.S.

- On January 6, 2025, Globe Capacitors partnered with PolyCharge to integrate NanoLam technology into capacitors for improved energy density, reliability, and compactness, targeting electric vehicles, renewable energy, and industrial power supplies.

- In January 2024, Murata Manufacturing Co., Ltd. introduced the DFE2MCPH_JL automotive-grade power inductors designed for powertrain and safety applications such as ADAS and In-Vehicle Infotainment.

- In February 2024, Samtec expanded its Edge Rate connector family with ERM6 & ERF6 Series, supporting applications from embedded vision to high-speed data transmission up to 56 Gbps PAM4.

Key Players

- Eaton Corporation PLC

- KOA Corporation

- Kyocera Corporation

- Murata Manufacturing Co. Ltd.

- Panasonic Corporation

- Samsung Electro-Mechanics Co. Ltd.

- Taiyo Yuden Co. Ltd.

- TDK Corporation

- TE Connectivity

- TT Electronics Plc

- Vishay Intertechnology Inc.

- Yageo Corporation

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=5564&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302