Asia-Pacific Treasury Software Market: Digital Transformation, Market Share, and Industry Outlook Forecast 2032

"Global Executive Summary Asia-Pacific Treasury Software Market: Size, Share, and Forecast

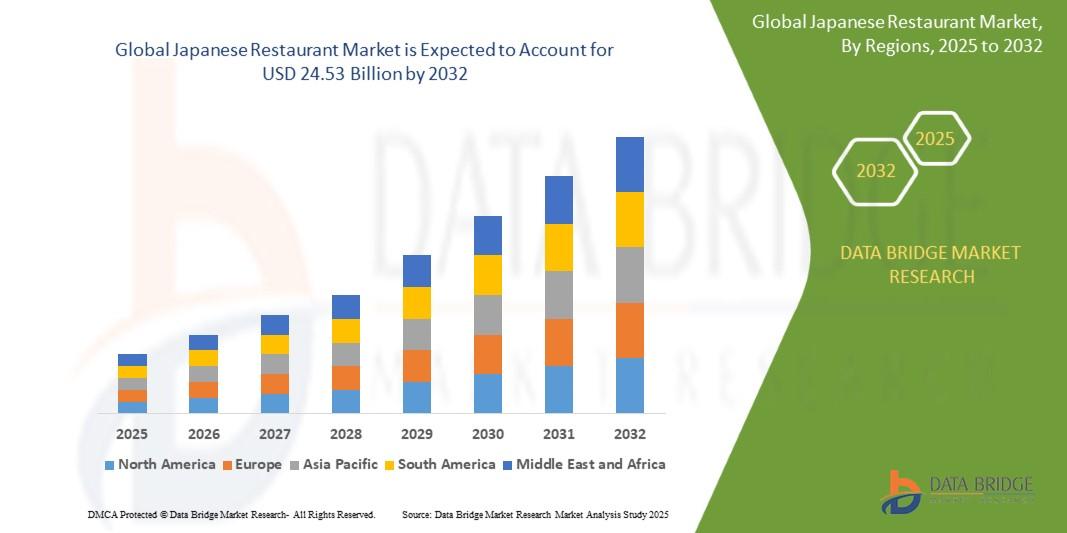

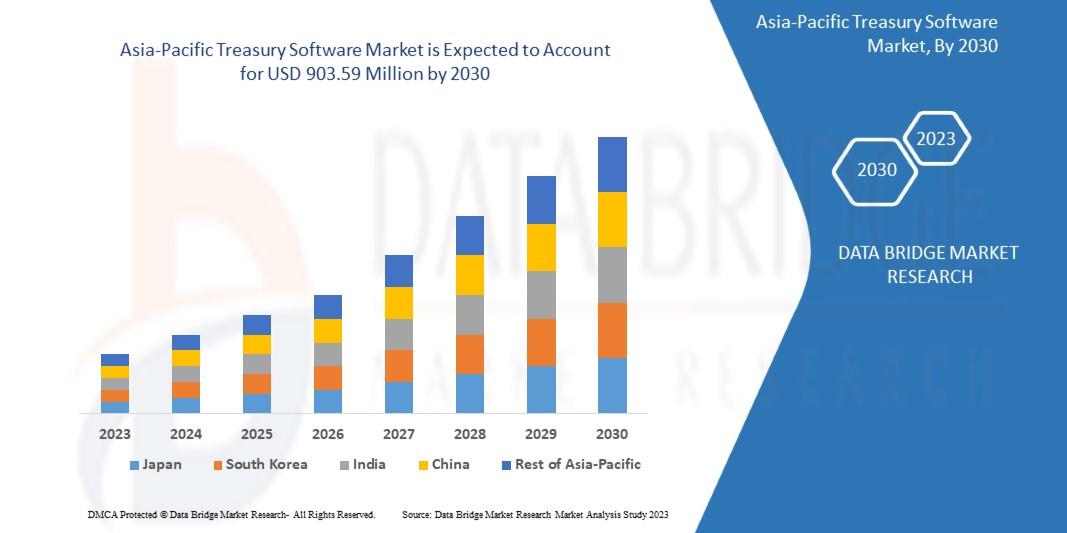

Data Bridge Market Research analyses that the market is growing with the CAGR of 3.6% in the forecast period of 2023 to 2030 and expected to reach USD 903.59 million by 2030.

The complete Asia-Pacific Treasury Software Market report is spread across a number of pages, list of tables & figures, profiling many companies. The major topics of this document can be listed as overview of Asia-Pacific Treasury Software Market industry, Manufacturing cost structure analysis, Development and manufacturing plants analysis, Key figures of major manufacturers, Regional market analysis, Segment market analysis by type and by application, Major manufacturers analysis, Development trend analysis, Marketing channel, and Market dynamics. Market forecast section in the Asia-Pacific Treasury Software Market analysis report is obsessed with production and production value forecasts and key producers forecasts by type, application, and region.

The Asia-Pacific Treasury Software Market analysis report is a skillful and deep analysis of the present situation and challenges. This report focuses on the key drivers, restraints, market opportunities, threats, and risks for major market players. It also makes available analysis of market size, shares, growth, segmentation, revenue projection (USD Mn), and regional study till 2033. The market research document offers a comprehensive overview of the global Asia-Pacific Treasury Software Market and contains thoughtful insights, facts, historical information, and statistically supported and industry-verified market data. It also encompasses forecasts using a suitable set of predictions and distinct research methodologies.

Stay ahead with crucial trends and expert analysis in the latest Asia-Pacific Treasury Software Market report. Download now:

https://www.databridgemarketresearch.com/reports/asia-pacific-treasury-software-market

Asia-Pacific Treasury Software Industry Overview

Segments

- By Deployment (Cloud, On-Premises)

- By Enterprise Size (Large Enterprises, Small and Medium Enterprises)

- By Vertical (Banking, Financial Services, and Insurance, Manufacturing, Healthcare, Retail, IT and Telecommunication, Others)

The Asia-Pacific treasury software market is segmented based on deployment, enterprise size, and vertical. In terms of deployment, both cloud-based and on-premises solutions are popular choices among businesses in the region. Cloud deployment offers flexibility, scalability, and cost-effectiveness, making it attractive to a wide range of organizations. On the other hand, on-premises deployment provides greater control and security, which is preferred by some enterprises with specific compliance requirements.

When it comes to enterprise size, the market caters to both large enterprises and small to medium-sized businesses. Large enterprises often have complex treasury operations that require advanced software solutions to manage their financial activities efficiently. Small and medium-sized enterprises, on the other hand, are increasingly recognizing the importance of treasury software in optimizing cash flow, managing risks, and improving decision-making processes.

In terms of verticals, the Asia-Pacific treasury software market serves a variety of industries, including banking, financial services, and insurance, manufacturing, healthcare, retail, IT and telecommunication, among others. Each vertical has unique treasury management needs and challenges, which drives the demand for specialized software solutions tailored to their specific requirements. For example, the banking sector requires robust risk management tools, while the manufacturing industry may prioritize cash flow forecasting and working capital management.

Market Players

- SAP SE

- Oracle

- Finastra

- Kyriba Corp.

- ION Group

- GTreasury

- TreasuryXpress

Several key players operate in the Asia-Pacific treasury software market, offering a diverse range of products and services to meet the evolving needs of businesses in the region. Companies such as SAP SE, Oracle, and Finastra are well-established players with a strong presence in the market, providing comprehensive treasury solutions equipped with advanced features and functionalities. Other notable players like Kyriba Corp., ION Group, GTreasury, and TreasuryXpress also contribute to the competitive landscape with their innovative offerings tailored to various industry verticals and enterprise sizes.

The Asia-Pacific treasury software market is witnessing significant growth driven by factors such as increasing adoption of cloud-based solutions, rising awareness about the benefits of efficient treasury management, and the evolving regulatory landscape across various industries in the region. With the digital transformation taking center stage in businesses, there is a growing emphasis on streamlining financial processes, enhancing cash visibility, and mitigating risks associated with treasury operations. This has propelled the demand for advanced treasury software solutions that offer automation, real-time analytics, and integration capabilities to optimize cash management and decision-making for organizations of all sizes.

One key trend shaping the market is the integration of artificial intelligence (AI) and machine learning (ML) technologies in treasury software to enhance forecasting accuracy, automate repetitive tasks, and improve risk management capabilities. AI-powered algorithms can analyze large volumes of financial data in real-time, providing valuable insights to treasury professionals for making informed decisions. This trend is particularly relevant for industries such as banking, financial services, and insurance, where data-driven decision-making is crucial for managing liquidity, optimizing investments, and ensuring compliance with regulatory requirements.

Moreover, the market is witnessing increased consolidation among key players through partnerships, mergers, and acquisitions to expand their product portfolios, strengthen their market presence, and cater to a wider customer base. Strategic collaborations between software vendors and financial institutions are also driving innovation in treasury management solutions, offering seamless integration with banking systems, payment platforms, and other financial tools to create a holistic treasury management ecosystem for businesses.

Furthermore, with the growing focus on sustainability and environmental, social, and governance (ESG) criteria, treasury software providers are incorporating ESG metrics and reporting capabilities into their solutions to help organizations align their financial strategies with sustainability goals. This trend reflects the shifting priorities of businesses towards responsible finance practices and demonstrates the role of technology in facilitating sustainable decision-making across treasury functions.

Overall, the Asia-Pacific treasury software market is poised for continued growth as organizations seek to optimize cash management, mitigate financial risks, and drive operational efficiency through advanced digital solutions. With the adoption of cloud-based software, integration of AI and ML technologies, and emphasis on ESG considerations, the market is set to witness further innovation and transformation to meet the evolving needs of businesses in the region.The Asia-Pacific treasury software market is experiencing a significant transformation driven by various factors that are reshaping the landscape of treasury management solutions in the region. One key trend that is influencing market dynamics is the increasing focus on data-driven decision-making and the integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) in treasury software. This trend is fueled by the need for more accurate forecasting, streamlined operations, and enhanced risk management capabilities in the face of evolving market conditions and regulatory requirements.

Moreover, the market is witnessing a rapid shift towards cloud-based deployment models, with businesses across different verticals recognizing the advantages of cloud solutions in terms of scalability, flexibility, and cost-effectiveness. This shift is driving the demand for modern treasury software that can enable real-time data access, seamless integration with other financial systems, and enhanced security features to meet the evolving needs of organizations in the Asia-Pacific region.

Furthermore, the growing emphasis on sustainability and Environmental, Social, and Governance (ESG) criteria is influencing the development of treasury software solutions with ESG metrics and reporting capabilities. Businesses are increasingly integrating ESG considerations into their financial strategies, and treasury software providers are responding to this trend by offering tools that enable organizations to align their treasury operations with sustainability goals and responsible finance practices.

Additionally, market players are engaging in strategic partnerships, mergers, and acquisitions to expand their product portfolios, enhance their market presence, and cater to a wider customer base. These collaborations are driving innovation in treasury management solutions by enabling seamless integration with banking systems, payment platforms, and other financial tools, thereby creating comprehensive treasury management ecosystems that meet the diverse requirements of businesses in the region.

Overall, the Asia-Pacific treasury software market is poised for continued growth and evolution as organizations increasingly prioritize cash management optimization, risk mitigation, and operational efficiency through advanced digital solutions. The convergence of cloud technology, AI/ML capabilities, and ESG considerations is reshaping the market landscape, driving innovation, and meeting the changing needs of businesses across different verticals in the region. As businesses continue to adopt modern treasury software solutions to stay competitive and resilient in a dynamic market environment, the Asia-Pacific market is expected to witness further advancements and transformations in the coming years.

Access detailed insights into the company’s market position

https://www.databridgemarketresearch.com/reports/asia-pacific-treasury-software-market/companies

Alternative Research Questions for Global Asia-Pacific Treasury Software Market Analysis

- What is the current valuation of the global Asia-Pacific Treasury Software Market?

- What CAGR is projected for the Asia-Pacific Treasury Software Market over the forecast period?

- What are the key segments analyzed in the Asia-Pacific Treasury Software Market report?

- Which companies dominate the Asia-Pacific Treasury Software Market landscape?

- What geographic data is covered in the Asia-Pacific Treasury Software Market analysis?

- Who are the leading firms operating in the Asia-Pacific Treasury Software Market?

Browse More Reports:

Global Horticulture Lighting Market

Global Polyvinyl Chloride (PVC) Compound Market

Global Dental Chairs Market

Global Makeup Remover Market

Global Taurine Market

Global Database Security Market

Global Corrugated Packaging Market

Global Small Wind Market

Global Caffeine Supplements Market

Global Locomotive Market

Global Molecular Breeding Market

Middle East and Africa White Goods Market

North America White Goods Market

Europe Unmanned Surface Vehicle (USV) Market

Middle East and Africa Treasury Software Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"