Check Your Credit Score

Your credit score is one of the most important numbers in your financial life. Whether you are applying for a loan, renting an apartment, or even starting a new job, your credit score can influence the opportunities available to you. Understanding and monitoring your credit score regularly is crucial for maintaining financial health and achieving your goals. In this article, we will guide you through the importance of checking your credit score and how to do it effectively.

What Is a Credit Score?

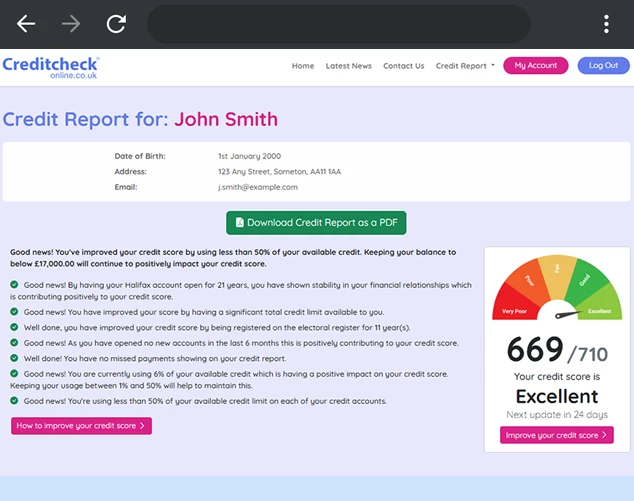

A credit score is a three-digit number that reflects your creditworthiness. It is based on your credit history, which includes loans, credit cards, and payment behavior. The most commonly used credit scores are FICO and VantageScore, which range from 300 to 850. A higher score indicates a lower risk to lenders, while a lower score may limit your access to credit or result in higher interest rates.

Why Checking Your Credit Score Matters

Checking your credit score regularly is essential for several reasons:

-

Loan Approval: Lenders rely on your credit score to decide whether to approve your loan or credit application.

-

Interest Rates: A higher credit score can help you secure lower interest rates on mortgages, credit cards, and personal loans.

-

Financial Planning: Knowing your credit score allows you to make informed financial decisions and improve your credit if needed.

-

Fraud Detection: Regular monitoring helps you identify unauthorized activity on your accounts early.

By keeping an eye on your credit score, you gain control over your financial health and can take steps to strengthen it over time.

How to Check Your Credit Score

There are several ways to check your credit score safely and conveniently:

Free Online Credit Score Services

Many financial institutions and credit card companies offer free access to your credit score. Platforms like Credit Karma, Experian, and Equifax allow you to check your score without affecting it. These services often provide detailed reports and tips for improving your score.

Annual Credit Report

In the United States, you are entitled to one free credit report per year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Visiting AnnualCreditReport.com lets you review your credit history in detail and check for any discrepancies.

Paid Credit Monitoring Services

If you want continuous monitoring and alerts for changes in your credit report, paid credit monitoring services are available. They offer additional features like identity theft protection and personalized advice for improving your score.

Tips for Maintaining a Healthy Credit Score

Checking your credit score is just the first step. To maintain or improve your score, consider these strategies:

-

Pay Bills on Time: Late payments can significantly lower your score.

-

Reduce Debt: Keep credit card balances low relative to your credit limit.

-

Avoid Unnecessary Credit Applications: Multiple inquiries can negatively impact your score.

-

Monitor Your Credit Report: Regularly check for errors or fraudulent activity.

Consistent financial habits combined with regular monitoring can help you achieve a strong credit score.

Conclusion

Your credit score is a key indicator of your financial health and can open doors to better loans, lower interest rates, and improved financial opportunities. By understanding what your credit score is, regularly checking it, and taking steps to maintain or improve it, you can take control of your financial future. Don’t wait until you need credit to find out your score—make checking your credit a regular habit and unlock the benefits of financial confidence today.