Emerging Trends in Motion Control Software for Robotics Industry

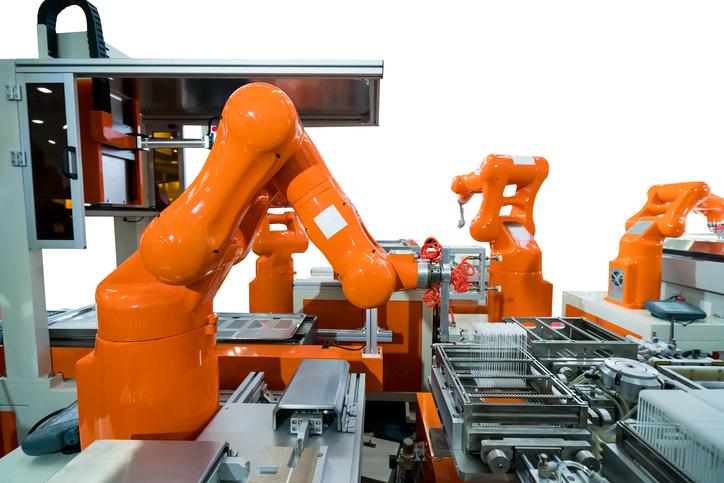

Organizations worldwide increasingly invest in sophisticated robotic motion technologies to enhance operational capabilities and competitive positioning. The Motion Control Software In Robotics Market Share distribution reflects diverse competitive dynamics across different regions and industrial application segments. North America currently commands significant market presence due to advanced manufacturing infrastructure and strong technology adoption rates. The Motion Control Software In Robotics Market size is projected to grow USD 8.588 Billion by 2035, exhibiting a CAGR of 11.25% during the forecast period 2025-2035. European markets follow closely, driven by Industry 4.0 initiatives and strong emphasis on manufacturing automation standards. Asia-Pacific demonstrates the fastest growth trajectory as emerging economies embrace industrial robotics transformation initiatives aggressively. Leading vendors continuously expand their product portfolios to capture larger market segments and establish sustainable advantages. Market consolidation trends indicate increasing merger and acquisition activities among key industry participants seeking synergies.

The distribution of market share varies significantly based on software deployment models and licensing approaches. Perpetual license offerings attract organizations seeking predictable cost structures and complete ownership of motion control solutions. Subscription-based models gain ground among organizations preferring flexibility and continuous updates without large upfront investments. Open-source motion control platforms emerge as popular choices for organizations with strong internal development capabilities. The competitive landscape includes specialized motion control providers alongside broader industrial automation software vendors competing for dominance. Regional players maintain strong positions in local markets through customized solutions addressing specific industrial requirements and preferences. Strategic partnerships between software providers and robot manufacturers enhance market reach and customer acquisition capabilities significantly.

Industry-specific market share patterns reveal interesting trends across different vertical applications and sectors. Automotive manufacturers account for the largest share of motion control software implementations globally due to extensive robotic deployments. Electronics assembly operations represent a growing market segment as precision requirements drive advanced motion control adoption. Metal fabrication companies demonstrate increasing motion control solution adoption to enhance cutting and welding robot performance. Packaging and palletizing applications utilize sophisticated motion algorithms to optimize throughput and accuracy simultaneously. Machine tool integration utilizes motion control to coordinate robotic loading and unloading operations with manufacturing equipment. The semiconductor industry implements ultra-precise motion control for wafer handling and inspection robot applications.

Future market share dynamics will likely shift as new entrants introduce disruptive technologies and innovative business models. Artificial intelligence capabilities increasingly differentiate market leaders from competitors relying on traditional control approaches. Motion smoothness and trajectory optimization quality emerge as critical factors influencing vendor selection and positioning. Pricing strategies evolve as the market matures and competition intensifies across all application segments and regions. The integration capabilities of motion control solutions influence industrial buyer decisions significantly during procurement processes. Vendor ecosystem partnerships enhance solution value propositions and expand addressable market opportunities for all participants. Market share competitions intensify as the motion control market consolidates around leading technology platforms and providers.

Top Trending Reports -

GCC Field Service Management (FSM) Market Competitive Landscape

Germany Field Service Management (FSM) Market Competitive Landscape

India Field Service Management (FSM) Market Competitive Landscape