Art Market Growth Fueled by High-Net-Worth Individuals and AI Innovation

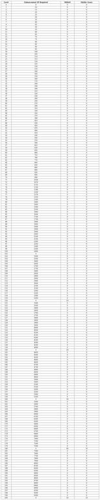

The global art market size was valued at USD 552.03 billion in 2024 and is projected to reach from USD 585.98 billion in 2025 to USD 944.59 billion by 2033, growing at a CAGR of 6.15% during the forecast period (2025-2033). The growth of the market is attributed to increasing spending on artwork by hnwis and the Rapid surge of AI applications.

The Rise of High-Net-Worth Collectors

The surge in HNWI populations, having increased by 170% since 2000, has profoundly impacted art demand globally. These individuals view art not just as an aesthetic or cultural acquisition but as a tangible asset class that retains or appreciates in value. Surveys show that spending by HNWI collectors has consistently increased, with median expenditures in 2022 surpassing pre-pandemic levels. This upward trend reflects a broad confidence and optimism about the art market’s future performance amidst economic uncertainties.

Technological Advancements Transforming Art

AI’s integration into the art world has revolutionized traditional processes. Algorithms now assist artists in creating generative art and other forms of digital expression, while platforms leverage AI to tailor art marketing and consumer recommendations. The blockchain technology has introduced a transparent and tamper-proof method for verifying artwork provenance and authenticity, addressing longstanding challenges related to forgery and provenance gaps prevalent in the industry.

Additionally, augmented reality (AR) and virtual reality (VR) technologies have reshaped art engagement, transcending physical limitations and creating immersive viewing experiences. The proliferation of online art sales platforms, enhanced by AI-driven personalization, has provided buyers and sellers 24/7 access to a global marketplace, broadening participation beyond conventional galleries and auction houses.

Emergence of Online Art and NFTs

The emergence of online art sales and Non-Fungible Tokens (NFTs) marks a paradigm shift in art consumption and ownership. Online art includes digital paintings, animations, and videos, while NFTs utilize blockchain to confer a unique identity and verifiable ownership of digital art pieces. Though NFT markets are yet to achieve mainstream adoption, their explosive transaction growth from USD 82 million in 2020 to USD 17 billion in 2021 signals their transformative potential.

Opportunities in online art and NFTs arise from the democratization of art creation and distribution, allowing a broader range of artists and collectors to engage without geographic or institutional barriers. This shift is particularly attractive to younger demographics comfortable with digital assets and crypto technologies.

Regional Market Dynamics

North America remains the largest art market globally, anchored by major art hubs such as New York, Los Angeles, and Toronto. The region benefits from a supportive regulatory environment and a diverse collector base, facilitating a gradual resurgence of physical art events art fairs, auctions, and exhibitions that contribute to market vitality.

The Asia-Pacific region, led by countries including China, India, Japan, and South Korea, is the fastest-growing art market. Rising disposable incomes and a burgeoning middle class have fueled increased artistic investments. The region is witnessing robust growth in online sales channels and adoption of AI applications for art creation and distribution. Mainland China, with significant median expenditures on fine art and antiques, exemplifies this growth as lockdown measures ease and consumer confidence returns.

Market Segments and Structures

The art market is diversified across galleries, art shops, appraisers, antique stores, and collectors. Art galleries dominate, representing approximately 35-40% of sales. Many galleries cater to middle-class demand, expanding digital presence to participate in global art exhibitions. Antique stores, focusing on culturally significant and historically valuable items, also maintain a niche but vital position.

Challenges

One of the significant challenges facing the art market is authentication and provenance verification, especially for digital art and NFTs. Establishing clear ownership and history of artworks is crucial for valuation and authenticity, yet documentation gaps and forgeries complicate these processes. Blockchain technology offers solutions but contends with issues like scalability, interoperability, and environmental concerns.

Future Outlook

The art market's future appears promising, driven by ongoing technological advances and expanding participation across demographics and geographies. The integration of AI, blockchain, AR/VR, and online platforms will continue to reshape how art is created, marketed, verified, and experienced. Rising interest from HNWIs and diversification of art forms including digital and NFT art will sustain growth trajectories through 2033 and beyond.

In summary, the global art market is undergoing a dynamic transformation powered by wealth growth among collectors and rapid technological innovation. These factors together create a thriving environment with exciting new opportunities and challenges for artists, collectors, and market participants worldwide.