Diethylene Glycol Market: Growth, Applications, and Regional Insights

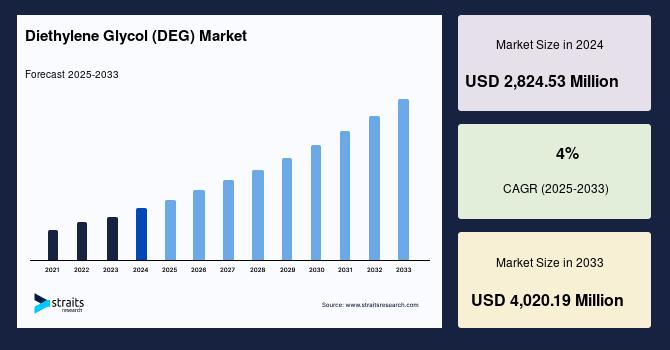

The diethylene glycol (DEG) market size was valued at USD 2,824.53 million in 2024. It is projected to reach from USD 2,937.51 million by 2025 to USD 4,020.19 million by 2033, growing at a CAGR of 4% during the forecast period (2025–2033). This growth is driven by expanding demand primarily from the plastics, paints & coatings, automotive, cement, and chemical intermediate sectors.

Understanding Diethylene Glycol and Its Uses

DEG is a colorless, low-volatility liquid produced via partial hydrolysis of ethylene oxide. It demonstrates high solubility in water and organic solvents, making it ideal as a solvent for oils, resins, and dyes. Beyond the solvent role, DEG serves as a raw material in the production of plasticizers, thermoplastic polyurethanes, polyester resins, and alkyd resins used in paints and coatings.

One of DEG’s primary applications is in the plastic industry, especially for manufacturing flexible PVC materials used in pipes, wall coverings, flooring, automotive parts, and medical devices. Its use as a plasticizer enhances material flexibility and durability. Additionally, DEG is a key chemical intermediate in producing unsaturated polyester resins and polyurethane products, which find extensive applications in automotive components and construction materials.

Market Drivers: Industrialization, Urbanization, and Rising Demand

Rapid industrialization and urbanization in emerging economies, particularly in Asia Pacific countries like China and India, have fueled the demand for construction materials, leading to increased usage of DEG in several ways. It is widely employed in the cement industry as a grinding aid that improves cement fineness, ensures smoother mill operation, increases throughput, and lowers energy consumption. This has contributed significantly to rising demand for DEG as cement production escalates to meet infrastructure needs.

The paints and coatings segment is another major growth area for DEG. Increasing construction activities, combined with rising automotive and furniture production in developing countries, have amplified demand for alkyd resin-based paints and coatings, which utilize DEG as a modifier. The growth in disposable incomes and consumer spending on automobiles and furnishings further propels this trend.

The automotive sector itself is a vital end-user driving DEG consumption, mainly through the manufacturing of thermoplastic polyurethane products used for lightweight and durable vehicle components. Increased vehicle production stimulated by technological advancements and expanding markets in Asia contributes substantially to DEG market growth.

Regional Landscape: Asia Pacific Leads

Asia Pacific stands out as the largest and fastest-growing market region for diethylene glycol, accounting for significant revenue shares and posting robust CAGR rates estimated above 5%. This dominance is attributed to the rapid expansion of the manufacturing, construction, automotive, and chemical industries across countries such as China, India, Japan, and Southeast Asian nations.

China’s leadership in plastic product manufacturing and coatings aligns directly with DEG demand growth. For instance, the country’s ongoing development in automobile manufacturing and housing construction sustains strong requirements for DEG in coatings, adhesives, and plasticizers. Similarly, India’s infrastructure projects and expanding agrochemical industries contribute to increasing the consumption of DEG-based products.

Europe also represents a noteworthy market, marked as the second-largest region. Government incentives and funding aimed at bolstering the construction industry across countries like the UK, Germany, and Poland create sustained demand for DEG, especially in paints and coatings applications. The regional CAGR is projected around 4.5%, supported by steady industrial growth.

North America remains a significant market as well, particularly propelled by the construction and automotive sectors. The use of DEG in rigid polyurethane foams for insulation in buildings and in automotive manufacturing supports consistent demand growth.

Challenges and Regulatory Considerations

Despite steady market growth, regulatory restrictions due to DEG’s toxicity pose challenges. Its use is limited or controlled in food and pharmaceutical products amid health concerns. For example, regulatory agencies restrict DEG to low impurity levels in polyethylene glycol used as food additives or toothpaste ingredients. Such restrictions may temper growth opportunities in certain end-use areas, but have not substantially impacted industrial and manufacturing applications.

Future Outlook and Opportunities

The market for diethylene glycol is set to benefit from continued demand expansion in automotive, paints & coatings, construction, and chemical intermediate sectors. Innovations in plastic and polyurethane manufacturing, as well as growing applications in emerging industries such as agrochemicals and personal care, offer new avenues for market growth.

The anticipated rise in patent registrations and research investments, especially in countries like China, signals a dynamic landscape with ongoing technological advancements. These developments may yield more efficient and environmentally friendly DEG production methods, further catalyzing market expansion.

Summary

The global diethylene glycol market is poised for healthy growth over the next decade, driven by its essential role in producing plasticizers, polyester resins, polyurethane products, and coatings. Asia Pacific’s rapid industrial growth and infrastructure development remain central to this demand. While regulatory factors present certain limitations, the broad spectrum of industrial applications ensures sustained market momentum through 2033. The expanding construction, automotive, and chemical industries will continue to serve as strong engines for diethylene glycol market growth worldwide.