Sugar Alcohol Market: Driving Health-Conscious Trends and Industry Growth

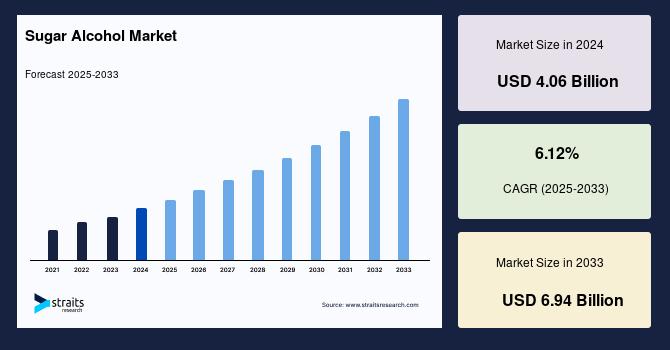

The global sugar alcohol market size was valued at USD 4.06 billion in 2024 and is projected to grow from USD 4.31 billion in 2025 to reach USD 6.94 billion by 2033,growing at a CAGR of 6.12% during the forecast period (2025-2033).

Understanding Sugar Alcohols

Sugar alcohols, also known as polyols, are organic compounds derived from sugars. They are white, water-soluble solids that occur naturally or can be synthetically produced from sources such as sugarcane, sugar beet, molasses, cereals, and fruits. Despite the name, sugar alcohols neither contain ethanol nor are traditional sugars. They provide sweetness with fewer calories, making them appealing as low-calorie and reduced-sugar sweeteners. Common examples include sorbitol, xylitol, erythritol, and maltitol.

Their unique sweetening and texturizing properties also make sugar alcohols valuable in industrial applications beyond sweetening. They serve as bulking agents, stabilizers, anti-crystallizing agents, and flavor enhancers, suitable for use in a variety of formulations.

Market Drivers and Trends

One of the primary factors propelling the sugar alcohol market is the widespread surge in health consciousness worldwide. Consumers aim to reduce sugar intake to combat obesity, diabetes, and other metabolic disorders. Sugar alcohols offer a calorie-reduced alternative that fits into low-sugar, sugar-free, and low-calorie diets. These trends are evident not only among consumers but also in industry practices, as food and beverage manufacturers reformulate products to meet demand for healthier options. Functional foods, dietary supplements, and nutraceuticals incorporating sugar alcohols are growing segments.

Pharmaceutical and nutraceutical industries have also ramped up the use of sugar alcohols due to their multifunctional qualities. They are commonly used as sweeteners, coating agents, bulking components, and excipients in tablets, chewable lozenges, syrups, and soft gels. Their high solubility makes them favorable in liquid medicines and nutraceutical formulations.

Technological advancements and biotechnological production methods have begun to address concerns related to the high production costs of sugar alcohols compared to conventional sugars. Fermentation-based manufacturing processes are gaining attention for being environmentally friendly and potentially more economically viable in the long term.

Regional Insights

Europe leads as the largest regional market for sugar alcohols, driven by a robust pharmaceutical sector and high consumer demand for natural, low-calorie ingredients in food and personal care products. The European market is projected to achieve significant revenue growth, supported by regulatory frameworks encouraging sugar reduction.

North America is the fastest-growing market regionally, propelled by escalating obesity and diabetes prevalence and consumer preference for low-calorie food and beverage products. The United States and Canada have substantial markets for sugar alcohol-containing foods like yogurts, beverages, and snacks.

Asia-Pacific is poised for rapid expansion owing to rising disposable incomes, urbanization, and increasing health awareness among consumers. The demand for sugar-free and nutraceutical products is high, creating opportunities for sugar alcohol manufacturers to penetrate emerging economies.

Product Segments and Applications

Among sugar alcohol types, sorbitol constitutes the largest market share, valued for its versatility in confectionery, bakery, and pharmaceutical applications. Xylitol is notable for its dental health benefits and is used in chewing gums and oral care products. Mannitol is expected to register the fastest growth due to its expanding use in pharmaceuticals and as an excipient.

In terms of physical forms, powdered and crystalline sugar alcohols dominate the market due to ease of handling and wide industrial usage. However, the liquid and syrup forms are growing rapidly as manufacturers prefer these for beverage formulations and liquid pharmaceuticals.

The food and beverage sector commands the highest share of sugar alcohol consumption. Products like sugar-free candies, baked goods, dairy products, and beverages extensively use sugar alcohols for sweetness without the calorie load of sugar. The pharmaceutical segment is also expanding, utilizing sugar alcohols in coatings, fillers, binders, and sweetening agents in medications.

Challenges and Opportunities

Despite the promising growth, the sugar alcohol market faces challenges such as high production costs relative to sugar and potential gastrointestinal discomfort associated with excessive consumption. Ongoing research aims to optimize yield and reduce costs via improved catalytic and biotechnological production methods.

Market players are investing heavily in research and development to explore new sugar alcohol derivatives, diversify product offerings, and enhance functional properties. Innovations such as combining sugar alcohols with other sweeteners to achieve balanced sweetness profiles without compromising taste are gaining traction.

Manufacturers have the opportunity to leverage rising demand for clean-label, natural, and plant-derived ingredients. Expansion into emerging markets with growing health-conscious populations presents significant growth potential.

Key Industry Players

The market features prominent participants including Archer Daniels Midland Company, Cargill Incorporated, Roquette Frères, Tate & Lyle PLC, Ingredion Incorporated, and Mitsubishi Corporation Life Sciences Limited. These companies focus on product innovation, strategic partnerships, and expanding production capacities to strengthen their market positions.

Conclusion

The sugar alcohol market is well-positioned for steady growth fueled by rising health concerns, evolving consumer preferences, and expanding industrial applications. With ongoing technological advancements and increasing regulatory support for sugar reduction, sugar alcohols will continue to serve as vital alternatives in the global effort to reduce sugar consumption and promote healthier lifestyles.

This dynamic market offers numerous opportunities for manufacturers to innovate and cater to diverse sectors such as food, pharmaceuticals, and personal care, catering to the rising demand for low-calorie and sugar-free products worldwide.