Why Accounting Firms Are Switching to Offshore Bookkeeping Services

Business owners across the U.S. are facing a common challenge in 2025: rising operational costs. From hiring and onboarding to salaries, benefits, software expenses, and compliance, the cost of running an in-house accounting team has never been higher. This is why more companies — especially small and mid-sized businesses — are turning to offshore bookkeeping services as a smarter, more cost-effective alternative.

Offshore bookkeeping is no longer just a trend; it’s becoming the #1 money-saving strategy for businesses that want accurate books, reduced expenses, and more financial clarity without sacrificing quality. In this blog, we’ll explore why this shift is happening, what benefits offshore bookkeeping brings, and why it’s one of the most strategic decisions a business can make in 2025.

1. Offshore Bookkeeping Services Cut Costs by 50–70%

The biggest reason offshore bookkeeping services are booming in 2025 is simple: massive cost savings.

Hiring a full-time bookkeeper in the U.S. can cost $50,000–$65,000 per year on average — without including benefits, bonuses, payroll taxes, and software expenses. For many small businesses, this is a big financial burden.

Offshore bookkeeping firms, on the other hand, offer skilled professionals at a fraction of the cost. Businesses typically save 50–70% on bookkeeping expenses without reducing the quality of work.

You get:

- A dedicated bookkeeping expert

- Daily/weekly/monthly financial updates

- Access to tools and technology

- Zero recruitment or HR costs

For companies looking to control expenses in 2025, this is a game-changer.

2. Access to Highly Skilled Bookkeepers Without the Hiring Hassles

Hiring the right bookkeeper takes time — reviewing resumes, conducting interviews, checking references, and training. Even after that, many businesses still struggle with inconsistency or lack of experience.

Offshore bookkeeping services solve this problem by giving you immediate access to trained and certified professionals who already understand:

- U.S. accounting standards

- QuickBooks, Xero, Zoho Books, and other tools

- Tax preparation basics

- Financial reporting

- Bank and credit card reconciliation

- Month-end closing

These bookkeepers are not freelancers; they work with established accounting firms that train, monitor, and manage them. This means businesses get reliable, skilled support without wasting time on recruitment or training.

3. Increased Efficiency and Accuracy

Finance is the backbone of any business, and even small mistakes in numbers can lead to big problems — cash flow gaps, missed payments, wrong tax filings, and poor financial decisions.

With offshore bookkeeping services, businesses get:

- Structured processes

- Multi-layer review systems

- Zero backlog

- Accurate reports delivered on time

- Continuous monitoring

- Real-time updates

Most offshore teams follow strict quality checks, ensuring accurate numbers every month. This level of consistency helps business owners make better decisions and avoid financial surprises.

4. Better Use of Internal Resources

Running an in-house finance team means managing salaries, desk space, HR support, and systems. It also requires continuous attention from business owners or managers.

Outsourcing bookkeeping offshore eliminates all of that.

When you hire an offshore bookkeeping team:

- Your internal staff gets more time to focus on core business operations

- Your managers get more time to plan growth

- You reduce administrative headaches

- You stop worrying about hiring, turnover, and leaves

Businesses get financial clarity without adding internal workload.

5. Scalability Without Increasing Costs

One of the biggest financial benefits of offshore bookkeeping is scalability. As your business grows, you may need more bookkeeping hours, more in-depth reporting, or additional support during tax season.

With an offshore team, you can scale up or down whenever you need — without hiring more employees.

Whether you need:

- Daily bookkeeping

- Inventory tracking

- Payroll processing

- AP/AR management

- Monthly financial statement

Offshore teams can handle it flexibly. This makes offshore bookkeeping services ideal for growing businesses, e-commerce brands, startups, and seasonal businesses.

6. Advanced Tools & Technology Included

If you do bookkeeping in-house, you must pay separately for tools like

- QuickBooks

- Xero

- Zoho Books

- FreshBooks

- Bill.com

- Gusto

Many offshore bookkeeping service providers already have licenses for most of these tools. This means you get software access without paying extra.

Additionally, many offshore firms use automation tools and AI-supported platforms that make bookkeeping faster, more accurate, and more affordable.

7. Helps You Stay Audit-Ready Throughout the Year

Many businesses scramble to fix their books at the end of the year before taxes or audits. This often leads to:

- Missed transactions

- Backlog of reconciliations

- Incorrect entries

- Stress and last-minute corrections

Offshore bookkeeping teams work consistently throughout the year, ensuring your books are always clean, updated, and audit-ready.

This saves money by:

- Avoiding penalties

- Avoiding costly CPA cleanup work

- Reducing compliance risks

8. Better Financial Insights for Better Decisions

Great bookkeeping is not just about entering numbers — it’s about giving businesses a clear financial picture.

With offshore bookkeeping services, business owners get:

- Monthly P&L statements

- Balance sheets

- Cash flow reports

- Expense analysis

- Profitability insights

- Budget tracking

When your numbers are clear, you make smarter decisions about

- Hiring

- Inventory

- Pricing

- Marketing

- Cash flow

- Investments

Better decisions = long-term savings and growth.

Final Thoughts: Offshore Bookkeeping Is the Smartest Financial Move in 2025

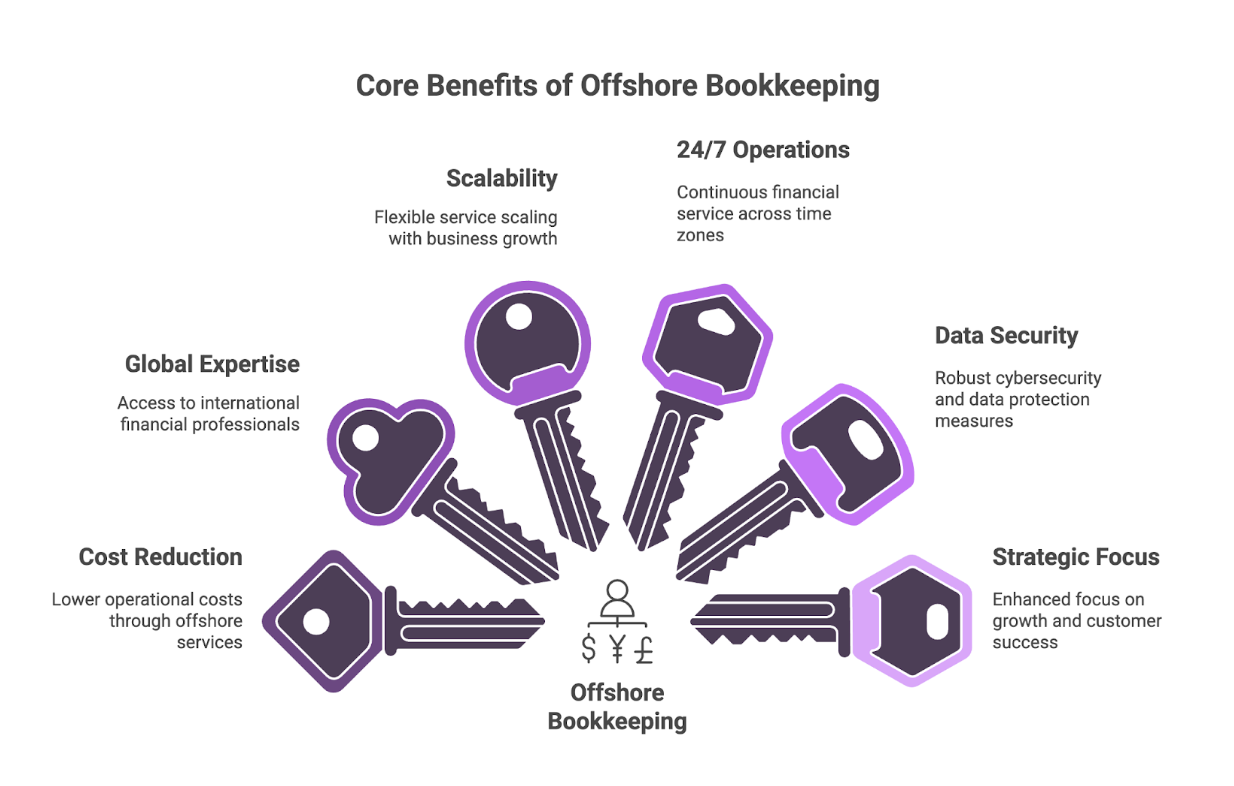

As businesses face rising costs and the need for smarter financial management, offshore bookkeeping services offer the perfect solution. They provide:

- Cost savings up to 70%

- Skilled bookkeeping experts

- Better accuracy and efficiency

- Less workload on internal teams

- Faster scalability

- Access to top accounting tools

- Continuous compliance and financial clarity

In 2025, offshore bookkeeping isn’t just an option — it’s becoming the #1 money-saving strategy for businesses aiming to stay competitive and profitable.