United Kingdom Automotive Acoustic Engineering Services Market 2030F Trends

The United Kingdom Automotive Acoustic Engineering Services Market has been witnessing significant expansion, fueled by the transformation of the automotive industry toward electrification, sustainability, and enhanced in-vehicle comfort. Valued at USD 354.18 million in 2024, the market is projected to reach USD 536.23 million by 2030, growing at a CAGR of 7.21% during the forecast period. This robust growth trajectory reflects the rising demand for noise, vibration, and harshness (NVH) solutions and acoustic engineering services, which have become critical to the modern automotive development lifecycle.

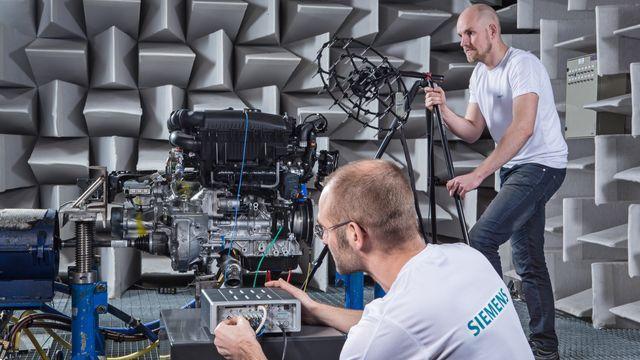

Acoustic engineering services play a pivotal role in ensuring that vehicles meet regulatory noise standards, provide a superior in-cabin experience, and adhere to environmental and safety requirements. These services encompass a wide array of processes, including physical and virtual acoustic testing, design optimization, material selection, and simulation-driven development. With evolving vehicle architectures, particularly the transition from internal combustion engines (ICE) to electric and hybrid powertrains, the importance of advanced acoustic solutions has increased exponentially.

Industry Key Highlights

-

Market Valuation and Growth: The UK automotive acoustic engineering services market is projected to expand from USD 354.18 million in 2024 to USD 536.23 million by 2030, reflecting strong growth due to electrification, digitalization, and regulatory mandates.

-

Regulatory Drivers: Government noise regulations and European Union directives, including Acoustic Vehicle Alerting Systems (AVAS) for electric vehicles, are enforcing stricter compliance, driving the adoption of specialized acoustic services.

-

Electrification Impact: The rise of electric vehicles (EVs) has introduced unique NVH challenges, including increased cabin exposure to road, wind, and mechanical noises. EVs require tailored solutions such as active noise cancellation (ANC), synthetic sound design, and lightweight sound-absorbing materials.

-

Consumer Preferences: Modern vehicle buyers, especially in premium and EV segments, prioritize cabin comfort, reduced road noise, and enhanced soundscapes, increasing demand for high-quality acoustic engineering services.

-

Sustainability Trends: Lightweight, recyclable, and bio-based materials such as hemp, kenaf, and recycled textiles are increasingly integrated into vehicle interiors, enabling acoustic performance while supporting environmental goals.

-

Digital Transformation: Tools like Finite Element Analysis (FEA), Boundary Element Method (BEM), and Computational Fluid Dynamics (CFD) are central to simulation-driven design, reducing dependency on physical prototypes. AI and machine learning further enhance acoustic analysis capabilities.

-

Regional Focus: Scotland is emerging as a hub for acoustic engineering in the UK, driven by research investments, innovation centers, and public–private partnerships supporting electric mobility and NVH innovation.

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=3517

Emerging Trends in UK Automotive Acoustic Engineering Services

1. Electrification and EV-Specific NVH Solutions

The electrification of vehicles is fundamentally changing the acoustic landscape. Unlike ICE vehicles, EVs are nearly silent at low speeds, which brings attention to previously masked sources of noise, including road friction, wind turbulence, tire vibrations, and mechanical component sounds. This requires advanced sound engineering, including:

-

Active Noise Cancellation (ANC): Dynamically reduces unwanted cabin noise.

-

Synthetic Sound Generation: Creates pedestrian alerts and distinctive vehicle signatures.

-

Lightweight Acoustic Materials: Reduces mass while maintaining sound absorption efficiency.

The demand for these EV-specific services is rapidly growing in line with government mandates for zero-emission vehicles and rising EV adoption rates across the UK.

2. Digitalization and Simulation-Driven Development

The adoption of virtual prototyping and simulation-based testing is redefining how automotive acoustics are addressed. Technologies such as FEA, BEM, and CFD allow engineers to predict acoustic behavior of vehicle components early in development. This reduces cost and time, minimizes physical testing, and enables design optimization before production. AI and machine learning algorithms further enhance these simulations by analyzing large datasets to detect patterns and recommend improvements.

3. Focus on Sustainable Acoustic Materials

Sustainability is increasingly influencing material selection in vehicle interiors. Traditional acoustic foams and composites are being replaced by eco-friendly alternatives, including bio-based polymers, recycled textiles, and natural fibers. These materials not only meet acoustic requirements but also reduce environmental impact, helping automakers align with net-zero targets and regulatory mandates.

4. Increasing Emphasis on Passenger Comfort

Consumer expectations have shifted toward highly refined cabins with minimal noise intrusion. This is especially important in premium and electric vehicles, where even minor noise can affect perceived quality. Automotive acoustic engineering services now include custom soundscapes, cabin tuning, and personalized noise management solutions, ensuring that in-cabin experiences meet evolving customer demands.

5. Integration of Smart Acoustic Systems

Automotive manufacturers are increasingly leveraging smart acoustic solutions:

-

Predictive NVH analytics: Anticipates potential noise issues before vehicle assembly.

-

Adaptive ANC systems: Adjust cabin noise dynamically based on driving conditions.

-

Connected acoustic modules: Integrate with infotainment and safety systems to enhance user experience.

Key Market Drivers

-

Stringent Noise Regulations: Government noise standards and AVAS mandates are compelling automakers to invest in advanced acoustic engineering.

-

EV and Hybrid Growth: Electrification introduces new NVH challenges, increasing reliance on acoustic engineering services.

-

Consumer Demand for Comfort: Growing expectations for low-noise cabins and immersive sound environments drive service adoption.

-

Technological Advancements: Simulation-driven design, AI, and virtual prototyping enhance efficiency and reduce costs.

-

Sustainability Initiatives: Use of eco-friendly acoustic materials aligns with environmental targets and reduces vehicle weight.

-

Urbanization and Traffic Noise Awareness: Rising public concern over urban noise levels fuels acoustic monitoring and diagnostics services.

-

Premium Vehicle Trends: High-end vehicles increasingly require custom soundscapes and active noise management.

-

R&D Investments: Academic programs, innovation centers, and public–private collaborations enhance local capabilities.

-

Competitive Automotive Landscape: Manufacturers aim to differentiate via acoustic comfort and sound design, driving service demand.

-

Global Supply Chain Integration: Tier 1 and Tier 2 suppliers increasingly collaborate with specialized acoustic service providers.

Market Segmentation

The United Kingdom automotive acoustic engineering services market is segmented based on:

Vehicle Type

-

Passenger Cars: Dominant segment due to high production volumes and consumer comfort expectations.

-

Commercial Vehicles: Growing segment driven by logistics and electric light-duty vehicles.

Propulsion Type

-

Internal Combustion Engine (ICE) Vehicles

-

Electric Vehicles (EVs): Fastest-growing segment due to unique NVH requirements.

-

Hybrid Vehicles

Application

-

Drivetrain

-

Powertrain

-

Body & Structure

-

Interior Systems

-

Others

Offering

-

Physical Acoustic Testing: Laboratory and in-vehicle measurement of NVH parameters.

-

Virtual Acoustic Testing: Simulation-driven design using advanced computational tools.

Process

-

Designing: Conceptualization of acoustic solutions and material selection.

-

Development: Integration of acoustic technologies into vehicle systems.

-

Testing: Validation of NVH performance using lab and road tests.

Regional Focus

-

Scotland: Leading growth region, driven by EV research clusters and innovation centers.

-

England, Wales, Northern Ireland: Supporting infrastructure, OEM presence, and established supplier networks.

Future Outlook

The United Kingdom automotive acoustic engineering services market is poised for strong growth over the next decade, driven by:

-

Accelerating EV adoption and hybrid vehicle production.

-

Increasing investment in digital NVH simulation tools and AI-enabled design solutions.

-

Rising consumer demand for premium cabin experiences and customizable acoustic environments.

-

Greater adoption of eco-friendly and lightweight materials, supporting net-zero initiatives.

-

Expansion of public-private innovation hubs, particularly in Scotland, fostering new acoustic technologies.

By 2030, the market is expected to reach USD 536.23 million, with EVs representing a significant share of acoustic engineering services. Companies offering integrated physical and virtual testing solutions, along with expertise in sustainable materials and active noise management, are expected to dominate the market landscape.

Competitive Analysis

The United Kingdom automotive acoustic engineering services market is highly specialized, with leading players focusing on innovation, advanced NVH solutions, and global collaboration. Key market participants include:

-

Siemens Digital Industries Software (Siemens AG): Simulation-driven acoustic solutions and digital twin platforms.

-

Robert Bosch GmbH: Active noise control systems and advanced material integration.

-

Continental Engineering Services GmbH (Continental AG): Virtual acoustic testing and sensor-driven solutions.

-

Bertrandt AG: NVH design and integration services for EVs.

-

Schaeffler Engineering GmbH: Powertrain and drivetrain noise optimization.

-

Autoneum Holding Ltd: Lightweight acoustic materials for EVs and ICE vehicles.

-

IAC Acoustics (Catalyst Acoustics Group): Laboratory and environmental acoustic testing.

-

AVL List GmbH: NVH simulation tools and virtual prototyping services.

-

EDAG Engineering Group AG: Acoustic design and multi-material integration.

-

FEV Group GmbH: Powertrain and vehicle-wide noise control solutions.

Competitive strategies in this market focus on:

-

Expanding R&D and simulation capabilities.

-

Developing lightweight and sustainable materials.

-

Collaborating with OEMs and Tier 1 suppliers on EV projects.

-

Offering customized acoustic solutions for premium and performance vehicles.

-

Leveraging AI and machine learning for predictive NVH modeling.

10 Benefits of This Research Report

-

Comprehensive assessment of market size, growth, and trends.

-

Insight into regulatory frameworks and compliance requirements.

-

Analysis of emerging technologies and innovations in NVH solutions.

-

Identification of key market drivers and growth opportunities.

-

Forecasting of market growth across propulsion types, vehicle segments, and regions.

-

Evaluation of competitive landscape and strategic initiatives of key players.

-

Guidance on sustainable and lightweight material adoption in acoustic engineering.

-

Insights into simulation-based and AI-driven NVH testing trends.

-

Market segmentation for vehicle type, application, offering, and process.

-

Strategic recommendations for investors, OEMs, and service providers to capitalize on emerging opportunities.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: sales@techsciresearch.com

Website: www.techsciresearch.com