Best Houston Tax Expert

Managing taxes can be overwhelming for individuals and businesses alike, especially in a large and economically diverse city like Houston. With constantly changing tax laws, complex filing requirements, and the risk of costly mistakes, many people look for professional help to ensure accuracy and peace of mind. Choosing the Best Houston Tax Expert is not just about filing returns on time, but about long term financial planning, compliance, and maximizing legal savings. The right expert understands both federal regulations and Texas specific considerations, helping clients navigate tax season with confidence.

Why Hiring a Houston Tax Expert Matters

Houston is home to entrepreneurs, small businesses, contractors, investors, and large corporations. Each group faces unique tax challenges. A skilled tax expert brings deep knowledge of income tax, business tax, sales tax, payroll tax, and IRS procedures. More importantly, they stay updated on regulatory changes that can directly affect your finances.

Hiring a professional tax expert reduces the risk of errors that could trigger audits or penalties. It also saves valuable time, allowing individuals and business owners to focus on their work rather than paperwork. A qualified expert can identify deductions and credits that many people overlook, which can significantly reduce tax liability.

Key Qualities of the Best Houston Tax Expert

The most reliable tax experts share several important qualities. Experience is at the top of the list. Years of handling different tax situations provide practical insight that software or inexperienced preparers cannot match. Credentials are equally important. Certified professionals with recognized qualifications demonstrate a commitment to ethical standards and ongoing education.

Communication skills also matter. A great tax expert explains complex concepts in simple terms and keeps clients informed throughout the process. Transparency in pricing and services builds trust and avoids surprises. Lastly, attention to detail ensures every figure, form, and deadline is handled correctly.

Services Offered by Top Houston Tax Experts

A leading tax expert offers more than basic tax filing. Comprehensive services often include tax planning, IRS audit representation, back tax resolution, and business advisory support. For individuals, this may involve retirement planning, investment tax strategies, and guidance on major financial events.

For businesses, services can include entity selection, bookkeeping support, payroll compliance, and strategic planning to reduce tax exposure. The best professionals take a proactive approach, helping clients prepare for future tax years instead of reacting only during tax season.

How Local Knowledge Makes a Difference

Houston has a unique economic landscape driven by industries such as energy, healthcare, construction, and logistics. A tax expert familiar with the local market understands industry specific deductions, credits, and compliance requirements. This local insight can be especially valuable for small and medium sized businesses trying to remain competitive.

Understanding Texas tax rules, including the absence of state income tax and the presence of franchise and sales taxes, allows a Houston based expert to design strategies that out of town preparers may miss. Local knowledge often leads to more accurate filings and better financial outcomes.

Choosing the Right Tax Expert for Your Needs

Selecting the right professional starts with understanding your own needs. Individuals with straightforward income may require different expertise than business owners or high net worth clients. Look for an expert who regularly handles situations similar to yours.

Initial consultations are helpful for evaluating professionalism, responsiveness, and compatibility. Ask about experience, areas of specialization, and how they handle communication. A good tax expert acts as a long term partner rather than a one time service provider.

Benefits of Building a Long Term Relationship

Working with the same tax expert year after year offers significant advantages. Over time, they gain a deeper understanding of your financial situation, goals, and risk tolerance. This continuity leads to more personalized advice and better planning opportunities.

A long term relationship also means faster and more efficient service, as your records and history are already familiar to the expert. This consistency can reduce stress and improve financial decision making.

Conclusion

Finding the Best Houston Tax Expert is an investment in financial stability and peace of mind. The right professional offers more than accurate tax filings. They provide guidance, strategy, and protection in an increasingly complex tax environment. By focusing on experience, credentials, communication, and local knowledge, individuals and businesses can choose a tax expert who truly adds value. With the right support, managing taxes becomes less stressful and more strategic, allowing you to focus on growth and long term success.

Categorias

Leia Mais

Before we dive into the full guide, here’s a helpful resource on Tile visualization software for brands that offers deep insights for manufacturers and retailers looking to adopt smarter digital tools. A decade ago, tile selection was a simple—but often confusing—process involving physical samples, showroom visits, and a bit of imagination. Today, customers expect digital...

A new growth forecast report titled Guillain-Barre Syndrome Market Share, Size, Trends, Industry Analysis Report, By Therapeutics (Intravenous Immunoglobulin, Plasma Exchange, Others); By Route of Administration; By Distribution Channel; By Region; Segment Forecast, 2024 - 2032 introduced by Polaris Market Research represents conclusive data on the overall market. It majorly targets to provide...

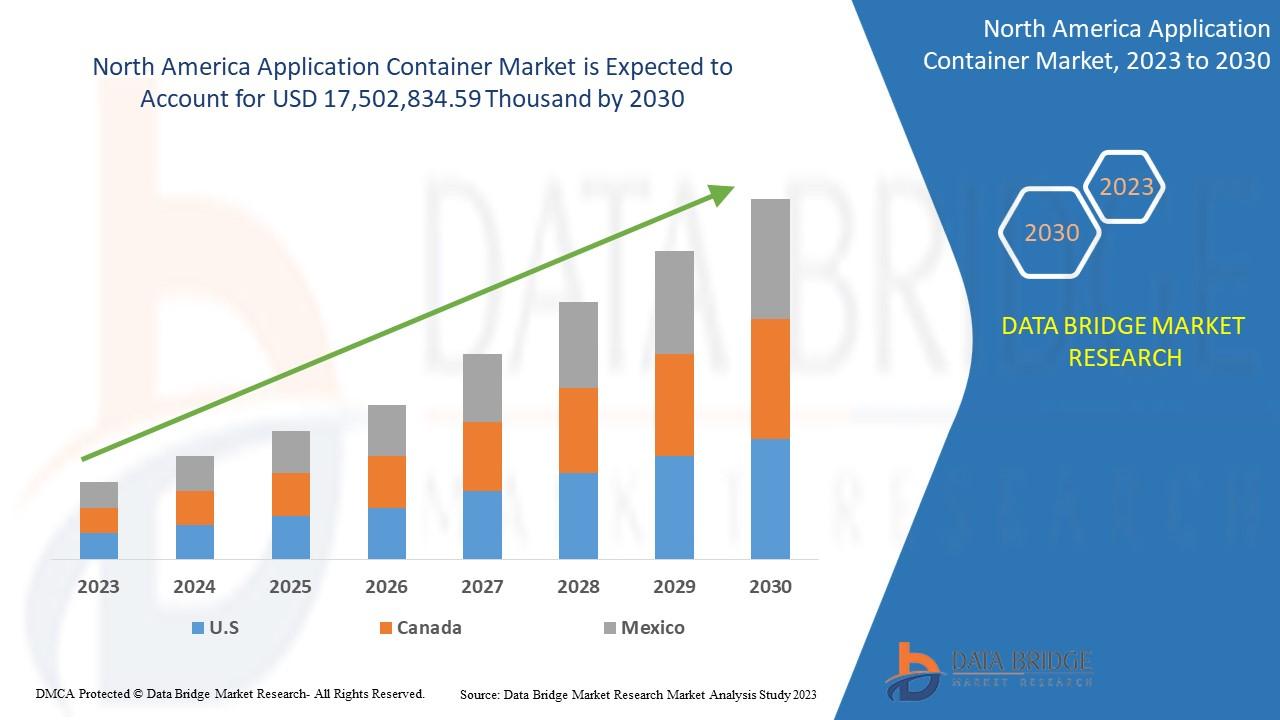

"Global Demand Outlook for Executive Summary North America Application Container Market Size and Share Data Bridge Market Research analyses that the application container market is expected to reach the value of USD 17,502,834.59 thousand by 2030, at a CAGR of 33.2% during the forecast period. "North America Application Container Market research reports consist of a systematic process...

Noticing dark or black marks on your teeth can be alarming, especially when they appear suddenly or seem to worsen over time. Black Stuff on Teeth is a common concern for people of all ages and can range from harmless surface stains to signs of deeper dental problems. Understanding what causes these dark deposits is the first step toward protecting your smile and preventing long-term oral...

The Indoor Flooring Market is witnessing strong growth due to increasing residential and commercial construction activities worldwide. Rising consumer preference for aesthetically appealing, durable, and low-maintenance flooring solutions is driving market demand. Popular flooring materials such as hardwood, vinyl, laminate, tiles, and carpets are gaining widespread adoption. Technological...