Finland Life & Non-Life Insurance Market 2030 Market Opportunities

The insurance industry plays a critical role in maintaining financial stability, safeguarding assets, and ensuring long-term economic resilience for individuals, businesses, and governments alike. In Finland, a country known for its strong social welfare system, high living standards, and progressive financial infrastructure, the life and non-life insurance market continues to evolve steadily. The sector has become an essential pillar supporting personal financial planning, corporate risk mitigation, and national economic sustainability.

According to TechSci Research, the Finland Life & Non-Life Insurance Market was valued at USD 5.53 billion in 2024 and is projected to reach USD 6.54 billion by 2030, growing at a compound annual growth rate (CAGR) of 4.23% during the forecast period. This growth is supported by rising disposable income, rapid urbanization, demographic transitions, and increasing awareness regarding risk protection and financial planning.

The Finnish insurance ecosystem benefits from a mature regulatory framework, high consumer trust, and increasing digital adoption. While Finland’s public welfare programs provide a solid safety net, consumers increasingly recognize the value of private insurance in enhancing coverage, reducing financial exposure, and securing long-term financial goals. As a result, both life and non-life insurance segments are witnessing expanding demand across regions and demographics.

Industry Key Highlights

-

The Finland Life & Non-Life Insurance market was valued at USD 5.53 billion in 2024

-

Market size is expected to reach USD 6.54 billion by 2030

-

The market is projected to grow at a CAGR of 4.23% during the forecast period

-

Rising disposable income remains a primary growth driver

-

Rapid urbanization is increasing demand for property, vehicle, and health insurance

-

Non-life insurance is the fastest-growing segment

-

Eastern Finland is emerging as the fastest-growing regional market

-

Increasing demand for health and dental insurance is reshaping product portfolios

-

Digital insurance platforms are transforming policy distribution and customer engagement

-

Insurers are focusing on customized and flexible insurance solutions

Download Free Sample Report: https://www.techsciresearch.com/sample-report.aspx?cid=27217

Overview of Finland’s Insurance Landscape

Finland’s insurance market is characterized by a high penetration rate, a well-regulated operating environment, and strong consumer confidence. The market comprises two major segments: life insurance and non-life insurance, both of which cater to evolving consumer needs shaped by economic, social, and demographic trends.

Life insurance products in Finland typically include term life insurance, whole life insurance, pension plans, annuities, and health-related coverage. These products are increasingly aligned with long-term financial planning, retirement security, and wealth preservation strategies.

Non-life insurance includes property insurance, motor insurance, health insurance, liability insurance, travel insurance, and commercial insurance. Rising asset ownership, changing lifestyles, and greater awareness of financial risk have driven steady demand for these products.

Finland’s strong digital infrastructure has further accelerated the transformation of the insurance sector. Online platforms, mobile applications, and data-driven underwriting are reshaping how insurance products are designed, sold, and serviced.

Market Drivers

Rising Disposable Income

One of the most significant drivers of growth in the Finland Life & Non-Life Insurance market is the steady increase in disposable income. As economic conditions improve and wage levels rise, Finnish households have greater financial flexibility to allocate funds toward insurance products that offer long-term protection and peace of mind.

Higher disposable income enables consumers to move beyond basic insurance coverage and invest in more comprehensive and premium policies. This includes broader health insurance coverage, enhanced property insurance, and retirement-oriented life insurance products. Urban households, in particular, are showing strong demand for tailored insurance plans that align with their lifestyle, asset ownership, and future financial goals.

As disposable income continues to rise, insurers are responding by offering value-added products, flexible payment options, and bundled insurance solutions that appeal to financially confident consumers.

Rapid Urbanization

Urbanization is another major driver shaping the Finland insurance market. Cities such as Helsinki, Turku, Tampere, Espoo, and Oulu are experiencing population growth, economic expansion, and infrastructure development. Urban living is typically associated with higher income levels, increased asset ownership, and more complex risk exposure, all of which contribute to rising insurance demand.

Urban households are more likely to own homes, vehicles, and valuable personal assets, increasing the need for property, motor, and liability insurance. Additionally, urban residents often have greater awareness of financial planning tools, driving higher adoption of life and health insurance products.

Urbanization also supports the growth of small and medium-sized enterprises (SMEs), which require commercial insurance solutions to protect against operational, property, and liability risks.

Demographic Shifts and Aging Population

Finland’s demographic profile is undergoing significant change, with an aging population and a growing need for retirement planning and healthcare coverage. As life expectancy increases, consumers are increasingly focused on securing financial stability during retirement, driving demand for life insurance products, annuities, and pension plans.

Older populations are also more likely to invest in health and dental insurance to manage rising medical costs and ensure access to quality healthcare services. This demographic shift is prompting insurers to design products that cater to senior citizens, including long-term care insurance and customized health plans.

At the same time, younger demographics entering the workforce are becoming more financially aware, leading to early adoption of life insurance and personal accident coverage.

Emerging Trends in the Finland Life & Non-Life Insurance Market

Growth of Health and Dental Insurance

Health and dental insurance are emerging as key growth areas within the Finnish insurance market. Rising healthcare costs, increased awareness of preventive care, and changing consumer expectations are driving demand for supplemental health coverage beyond public healthcare provisions.

Dental insurance, in particular, is gaining traction among families and aging populations who seek to manage the high costs associated with dental treatments. Insurers are responding by offering standalone dental plans or integrating dental coverage into comprehensive health insurance packages.

Digital Transformation and InsurTech Adoption

Digitalization is reshaping the Finnish insurance industry. Insurers are increasingly leveraging digital platforms, artificial intelligence, and data analytics to enhance underwriting accuracy, streamline claims processing, and improve customer engagement.

Online policy purchasing, mobile-based claims submission, and digital customer support have become standard features. These innovations not only improve operational efficiency but also enhance transparency and customer satisfaction.

Customized and Flexible Insurance Products

Modern consumers demand flexibility, transparency, and personalization. Insurers in Finland are responding by offering modular insurance products that allow customers to customize coverage based on their specific needs and risk profiles.

Pay-as-you-go insurance, usage-based motor insurance, and tailored property insurance plans are becoming more prevalent, reflecting a shift toward customer-centric product design.

Sustainability and ESG Integration

Environmental, social, and governance (ESG) considerations are increasingly influencing the insurance industry in Finland. Insurers are integrating sustainability principles into underwriting practices, investment strategies, and product development.

Eco-friendly insurance products, incentives for sustainable behavior, and coverage for renewable energy assets are gaining popularity, aligning with Finland’s broader sustainability goals.

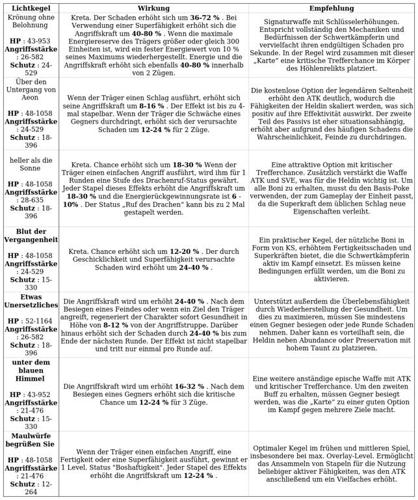

Market Segmentation Analysis

By Type

Life Insurance

Life insurance remains a vital segment of the Finnish insurance market, supporting long-term financial planning, income protection, and retirement security. Products such as term life insurance, whole life policies, and pension-linked insurance plans are widely adopted.

Non-Life Insurance (Fastest Growing Segment)

The non-life insurance segment is the fastest-growing segment in the Finland Life & Non-Life Insurance market. Increased awareness of risk management, rising asset ownership, and evolving lifestyles are driving demand for home, motor, health, and commercial insurance.

The growing adoption of electric vehicles has further boosted demand for specialized motor insurance products tailored to EV technology.

By Provider

-

Direct insurers

-

Insurance agencies

-

Banks

-

Other intermediaries

Banks and digital platforms are playing an increasingly important role in insurance distribution, leveraging existing customer relationships to cross-sell insurance products.

By Region

Eastern Finland (Fastest Growing Region)

Eastern Finland is emerging as the fastest-growing regional market due to rising urbanization, economic development, and increasing disposable income. Cities such as Joensuu, Kuopio, and Mikkeli are experiencing growth in population, industry, and consumer spending.

The region’s expanding forestry, agriculture, and tourism sectors are driving demand for property, business, and agricultural insurance. Additionally, the aging population in Eastern Finland is increasing demand for life and health insurance products.

Competitive Analysis

The Finland Life & Non-Life Insurance market is moderately consolidated, with established domestic players and international insurers competing on product innovation, pricing, and customer experience.

Major Companies Operating in the Market

-

OP Financial Group

-

LocalTapiola

-

If P&C Insurance Ltd

-

Fennia Life Insurance Company Limited

-

Pohjantähti Mutual Insurance Company

-

Turva

-

Nordea Bank Abp

-

POP Insurance Products

-

Tata AIG General Insurance Company Limited

-

AXA SA

Competitive Strategies

-

Product diversification and customization

-

Expansion of digital distribution channels

-

Strategic partnerships with banks and fintech firms

-

Focus on customer-centric service models

-

Investment in data analytics and risk assessment tools

Competition is increasingly driven by service quality, digital convenience, and the ability to offer tailored insurance solutions.

Future Outlook

The future of the Finland Life & Non-Life Insurance market appears stable and promising. Rising disposable income, growing awareness of financial protection, and increasing demand for health and dental insurance are expected to sustain market growth through 2030.

Urbanization and demographic shifts will continue to reshape insurance needs, encouraging insurers to innovate and diversify their product offerings. Digital transformation will remain a key competitive differentiator, enabling insurers to enhance efficiency and customer engagement.

Additionally, sustainability initiatives and ESG integration are likely to influence product development and investment strategies, aligning the insurance sector with Finland’s long-term environmental and social objectives.

10 Benefits of the Research Report

-

Provides comprehensive market size and growth forecasts

-

Offers in-depth segmentation analysis by type, provider, and region

-

Identifies key growth drivers and emerging trends

-

Analyzes competitive landscape and company strategies

-

Supports informed investment and strategic decision-making

-

Highlights regional growth opportunities

-

Evaluates future market risks and challenges

-

Assists insurers in product development and innovation

-

Helps stakeholders understand consumer behavior trends

-

Delivers actionable insights for market entry and expansion

Conclusion

The Finland Life & Non-Life Insurance market is positioned for steady growth, supported by strong economic fundamentals, rising disposable income, and evolving consumer needs. As urbanization accelerates and demographic dynamics shift, the demand for comprehensive and customized insurance solutions will continue to rise.

With innovation, digital transformation, and customer-centric strategies at the forefront, insurers operating in Finland are well-positioned to capitalize on emerging opportunities and navigate future challenges. The market’s resilience and adaptability make it an attractive landscape for insurers, investors, and policymakers alike.

Contact Us-

Mr. Ken Mathews

708 Third Avenue,

Manhattan, NY,

New York – 10017

Tel: +1-646-360-1656

Email: sales@techsciresearch.com

Website: www.techsciresearch.com