Digital Money Transfer and Remittance Market: Transforming Global Financial Connectivity

The Digital Money Transfer and Remittance Market has become a vital component of the global financial ecosystem, enabling fast, secure, and cost-effective cross-border and domestic money transfers. Digital remittance platforms leverage mobile applications, online banking, and digital wallets to simplify transactions for individuals, migrant workers, and businesses. Rising smartphone penetration, increasing international migration, and rapid adoption of digital financial services are significantly reshaping how money is transferred across borders.

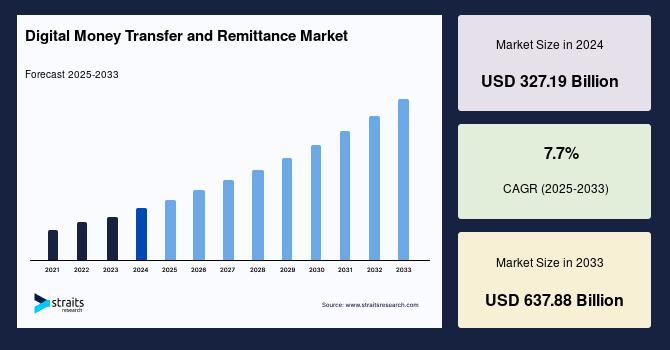

According to Straits Research, the digital money transfer and remittance market continues to expand as consumers and enterprises increasingly prefer digital channels over traditional cash-based and bank-led transfer systems.

Market Size and Growth Overview

Market Size 2024 – USD 327.19 billion.

Market Size 2025 – USD 352.38 billion.

Market Size 2033 – USD 637.88 billion.

CAGR (2025–2033) – 7.7%.

The steady growth reflects the rising global dependence on digital payment infrastructure, particularly in emerging economies with high remittance inflows.

Get Your Sample Report Here: https://straitsresearch.com/report/digital-money-transfer-and-remittance-market/request-sample

Buy Report Now: https://straitsresearch.com/buy-now/digital-money-transfer-and-remittance-market

Download full report https://straitsresearch.com/report/digital-money-transfer-and-remittance-market

Market Drivers

Rising Global Migration and Cross-Border Workforce

The increasing movement of people across borders for employment is a major driver of the digital remittance market. Migrant workers rely heavily on digital money transfer platforms to send funds back to their families efficiently and securely.

Growth of Mobile and Internet Penetration

Widespread access to smartphones and the internet has accelerated the adoption of digital remittance services. Mobile-based money transfer solutions offer convenience, transparency, and faster transaction times, making them preferred alternatives to traditional methods.

Demand for Faster and Cost-Effective Transactions

Consumers increasingly demand low-cost and real-time money transfers. Digital platforms reduce intermediary involvement, lower transaction fees, and enable near-instant settlements, driving their widespread adoption.

Expansion of Digital Financial Inclusion

Governments and financial institutions are promoting digital financial inclusion initiatives. Digital remittance services play a crucial role in providing access to financial services for unbanked and underbanked populations.

Market Challenges

Regulatory and Compliance Complexity

Digital money transfer providers must comply with varying regulatory frameworks, anti-money laundering requirements, and know-your-customer regulations across different countries. Managing compliance across jurisdictions remains a significant challenge.

Cybersecurity and Fraud Risks

As digital transactions increase, so does the risk of cyberattacks, data breaches, and fraud. Ensuring secure platforms and maintaining consumer trust are critical challenges for market participants.

Currency Volatility and Exchange Rate Fluctuations

Exchange rate volatility can impact transfer costs and recipient value, creating uncertainty for users and service providers, particularly in cross-border remittance corridors.

Market Segmentation Analysis

By Transfer Type

The market includes domestic money transfers and international remittances. International remittances account for a significant share due to high cross-border fund flows from migrant populations. Domestic transfers are also growing with increased adoption of peer-to-peer payment apps.

By Channel

Digital money transfer services are delivered through mobile applications, web-based platforms, and digital wallets. Mobile-based platforms dominate the market due to ease of use, accessibility, and integration with smartphones.

By End User

Individual consumers represent the largest end-user segment, driven by personal remittances and peer-to-peer transfers. Small and medium-sized enterprises increasingly use digital transfer services for cross-border payments and supplier settlements.

By Payment Method

The market includes bank account transfers, debit and credit cards, and digital wallets. Digital wallets are gaining traction due to faster processing times and integration with mobile ecosystems.

Competitive Landscape and Top Players Analysis

The digital money transfer and remittance market is highly competitive, with companies focusing on user experience, transaction speed, security, and geographic expansion. Based on insights from Straits Research, key players operating in the market include:

-

Western Union Holdings, Inc. – Offers extensive global remittance services with strong digital platform integration.

-

MoneyGram International, Inc. – Provides digital and physical money transfer solutions across international corridors.

-

PayPal Holdings, Inc. – Facilitates digital money transfers through its online payment ecosystem.

-

Wise Ltd. – Known for transparent pricing and real-time exchange rate-based remittance services.

-

Remitly, Inc. – Focuses on mobile-first international remittance solutions.

-

WorldRemit Ltd. – Offers digital money transfer services across multiple countries and currencies.

-

Payoneer Inc. – Provides cross-border payment solutions for freelancers and businesses.

-

Revolut Ltd. – Delivers digital banking and international money transfer services.

-

Ant Group – Supports digital remittance through mobile payment platforms.

-

Ripple Labs Inc. – Enables blockchain-based cross-border payment infrastructure for faster settlements.

Conclusion

The global digital money transfer and remittance market is poised for sustained growth, driven by rising migration, digital financial inclusion, and technological innovation. While regulatory complexity and cybersecurity risks pose challenges, continuous advancements in payment infrastructure and digital platforms are enhancing efficiency and user trust. The market’s steady CAGR underscores the critical role of digital remittance services in enabling global financial connectivity and economic support for millions of households worldwide.

About Us

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.