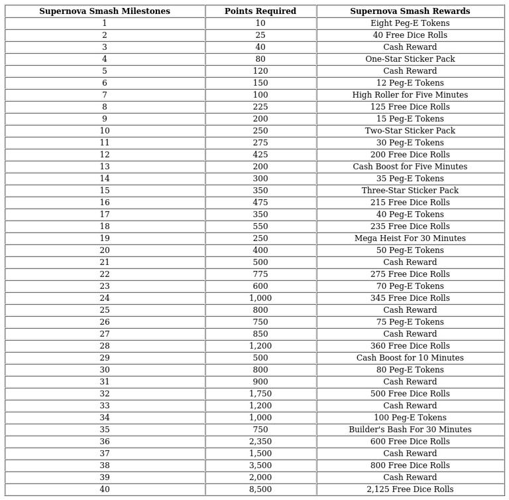

Global Air Freight Market: Capacity Optimization and Global Trade Connectivity Shifts, 2026–2034

Market Overview

The global air freight market was valued at USD 335.2 Billion in 2025 and is projected to reach USD 506.2 Billion by 2034, growing at a CAGR of 4.70% from 2026 to 2034. This growth is driven by rising demand for fast and efficient cross-border transportation, expanding e-commerce sectors, increasing global import/export activities, and technological advancements such as automation and digital tracking enhancing operational efficiency.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

Air Freight Market Key Takeaways

- Market Size in 2025: USD 335.2 Billion

- CAGR: 4.70% during 2026-2034

- Forecast Period: 2026-2034

- Asia Pacific held the largest market share at 39.5% in 2025.

- Freight services accounted for approximately 74.1% of the revenue in 2025.

- The international segment led with around 85.1% market share in 2025.

- Commercial end users dominated with 88.5% market share in 2025.

- Increasing globalization and cross-border trade are driving demand for efficient air cargo services.

- Sample Request Link: https://www.imarcgroup.com/air-freight-market/requestsample

Market Growth Factors

The air freight market growth is primarily driven by the rapid expansion of the e-commerce sector. The growing number of e-commerce users, such as the projected 501.6 million users in India by 2029 and the Government e-Marketplace's record GMV of USD 201.1 Billion in 2022-23, indicate escalating demand for quicker delivery. This sector demands fast and reliable transportation enabling timely deliveries, especially for industries like pharmaceuticals and perishables.

Increasing international trade also fuels the air freight market. For instance, Shenzhen Bao’an International Airport experienced a 101% increase in cross-border e-commerce cargo from January to July 2023, highlighting accelerating trade. The surge in shipments of high-value, perishable, and luxury goods necessitates robust air cargo capabilities. The development of storage infrastructure such as SEZs, FTZs, and bonded warehouses aligns with rising freight traffic.

Technological advancements play a crucial role in enhancing operational efficiency. Adoption of automation, AI, IoT, and digital tracking improves cargo handling, route optimization, and demand forecasting. Initiatives like Lufthansa Cargo's e-booking system and FedEx's Sustainability Insights platform reflect the growing emphasis on digital tools. These innovations not only boost efficiency but also support sustainability goals with emissions monitoring.

Market Segmentation

By Service:

- Freight: Led the market with 74.1% share in 2025, preferred for efficient, reliable, and cost-effective international and domestic goods transportation. Freight services ensure proper handling, packaging, and safety of hazardous or fragile cargo. Canada-based Cargojet expanded agreements with DHL Express, increasing capacity.

- Express, Mail, Others: Not detailed in the source.

By Destination:

- International: Dominant with 85.1% share in 2025. Facilitates speedy movement across continents, crucial for high-value and perishable items. Carriers like Emirates, Lufthansa, and British Airways are expanding door-to-door delivery services to compete with giants like Amazon and Alibaba.

- Domestic: Not detailed in the source.

By End User:

- Commercial: Accounted for 88.5% market share in 2025, reflecting extensive use by manufacturers, retailers, and wholesalers for efficient goods transport. E-commerce shipments compose 18% of air cargo, with growth supported by digitalization and global networks enhancing shipment visibility.

- Private: Not detailed in the source.

Regional Insights

Asia Pacific is the dominant region, holding over 39.5% market share in 2025. This leadership stems from significant investments in airport infrastructure modernization and new network development. Regional strategies include temporary freighter conversions of passenger aircraft and fleet expansions by carriers like Korean Air. The region benefits from strong demand for cross-border trade and economic growth, with key developments like Airbus and Boeing launching new freighter models aimed at high cargo demand.

Recent Developments & News

In February 2025, Nippon Express partnered with Nikon Corporation for sustainable air freight using SAF and CO2 reduction certificates. Simultaneously, JAS acquired International Airfreight Associates B.V., reinforcing its network, especially in perishable goods. January 2025 saw Freightos partnering with Euro Cargo Aviation enabling Norwegian Cargo's digital booking. Finnair Cargo joined Unisys’ Cargo Portal Services, improving multi-carrier booking access. In December 2024, China Airlines integrated IBS Software's iCargo for digital advancements, solidifying its top 15 global provider status. Maersk launched a 90,000 sq. ft. air freight gateway in Miami in May 2024 to enhance routes to Latin America.

Key Players

- American Airlines Inc.

- ANA Cargo Inc.

- Bolloré Logistics

- Cargolux Airlines International S.A.

- Delta Air Lines Inc.

- Deutsche Bahn AG

- Deutsche Post AG

- DSV A/S

- Expeditors International of Washington Inc.

- FedEx Corporation

- Hellmann Worldwide Logistics SE & Co. KG

- Kuehne + Nagel International AG

- Nippon Express Co. Ltd.

- Qatar Airways

- United Parcel Service Inc.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Request for customization: https://www.imarcgroup.com/request?type=report&id=5171&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302