Tokenizing Property Markets: White Label NFT Marketplaces in Real Estate

Real Estate Meets Digital Ownership

Real estate has long been considered one of the most valuable yet least liquid asset classes. High entry barriers, complex legal processes, and limited market access have traditionally restricted participation to institutional investors and high-net-worth individuals. Today, blockchain technology and NFTs are reshaping this landscape by introducing new ways to represent, transfer, and manage property-related assets digitally. At the center of this transformation is the White Label NFT Marketplace, which enables real estate businesses to launch branded platforms for tokenized property assets.

A White Label NFT Marketplace allows real estate developers, brokers, and investment firms to create dedicated environments where property rights, fractional ownership units, or real-estate-backed digital certificates can be minted and traded as NFTs. When implemented through a capable White Label NFT Marketplace Development company, these platforms offer control, compliance alignment, and scalability—critical factors for property markets in the United States and the United Kingdom.

Key drivers behind this shift include:

-

Demand for fractional ownership and increased market access

-

Rising interest in alternative real estate investment models

-

Need for transparent, auditable transaction records

-

Growing acceptance of digital assets in regulated markets

From residential properties to commercial developments, NFTs are being explored as digital representations of ownership, access rights, or revenue participation. White Label NFT Marketplace Development provides the infrastructure to manage these assets within familiar real estate workflows, rather than forcing businesses to rely on generic third-party NFT platforms.

Common misconceptions persist:

-

NFTs replace traditional property deeds

-

Tokenization removes legal oversight

-

Only speculative investors benefit

In practice, white-label marketplaces support existing legal structures while improving efficiency, transparency, and accessibility. They form the foundation for a more inclusive and digitally enabled real estate ecosystem.

Business Value — Why Real Estate Firms Adopt White-Label NFT Models

For real estate organizations, tokenization is not about disrupting ownership laws but enhancing how property value is distributed and managed. White Label NFT Marketplace Solutions allow firms to design investment products that align with regulatory and commercial realities.

Key business benefits include:

-

Fractional ownership models that lower entry barriers

-

Expanded investor pools beyond traditional geographies

-

Faster transaction cycles compared to manual processes

-

Improved transparency for investors and regulators

Revenue opportunities created through tokenized property assets include:

-

Primary sales of fractional ownership NFTs

-

Transaction fees from secondary-market trades

-

Membership-based access to premium property offerings

-

Long-term participation through programmed royalties

Compared to third-party platforms, a White Label NFT Marketplace gives firms full control over branding, pricing logic, and user data. This is especially important in the US and UK, where real estate brands rely heavily on trust and reputation.

Indicators that a firm is ready for a white-label approach include:

-

Existing investor networks seeking alternative access models

-

Interest in cross-border real estate participation

-

Digital transformation initiatives already underway

-

Legal frameworks that support asset-backed tokenization

By working with experienced White Label NFT Marketplace Service Providers, real estate firms can align technology with investment strategy rather than treating NFTs as isolated experiments.

Technical Foundations — Tokenizing Property Assets Responsibly

Real estate tokenization requires more than basic NFT minting. Assets must reflect legal rights, valuation data, and lifecycle events accurately. White Label NFT Marketplace Development addresses these requirements through tailored technical architecture.

Core technical components typically include:

-

Smart contracts representing ownership or participation rights

-

Metadata frameworks linked to legal documentation

-

Secure storage for property records and disclosures

-

User dashboards for asset tracking and reporting

Integration with existing systems is critical.

Common integration points include:

-

Property management software

-

Investor CRM and onboarding tools

-

Payment systems supporting fiat and digital currencies

-

Compliance and reporting systems

Performance and scalability considerations are essential for property platforms that may support long-term asset holding rather than high-frequency trading.

Key requirements include:

-

High data integrity and auditability

-

Reliable uptime for investor access

-

Secure role-based access for stakeholders

-

Support for cross-border participation

Security and compliance remain central, particularly in regulated markets like the US and UK.

Best practices include:

-

Strong identity verification for investors

-

Clear disclosure of asset rights and limitations

-

Secure custody of digital assets

-

Transparent transaction histories

A capable White Label NFT Marketplace Development company ensures that technology reinforces legal and financial trust rather than undermining it.

Choosing the Right White Label NFT Marketplace Partner

Selecting the right White Label NFT Marketplace Development Company is a strategic decision for real estate businesses. Property tokenization sits at the intersection of finance, law, and technology, requiring multidisciplinary expertise.

Key evaluation criteria include:

-

Experience with asset-backed NFTs

-

Understanding of real estate workflows

-

Customization flexibility for ownership models

-

Ongoing technical support and maintenance

Comparing white-label providers with custom development approaches highlights important trade-offs:

-

White-label platforms reduce time-to-market

-

Custom builds offer deeper control but higher cost

-

White-label solutions balance speed and adaptability

Contractual considerations are particularly important.

Recommended clauses include:

-

Data and asset ownership rights

-

IP protection for platform branding

-

Compliance responsibilities and updates

-

Service-level agreements for uptime and security

For US and UK firms, partners familiar with local regulatory expectations offer added confidence and risk mitigation.

Market Adoption and Investor Experience

Investor trust determines the success of tokenized real estate platforms. White Label NFT Marketplaces must deliver experiences that feel professional, transparent, and aligned with traditional property investing.

Key experience principles include:

-

Clear explanations of asset rights and risks

-

Simple onboarding for non-technical investors

-

Professional UI aligned with real estate branding

-

Access to performance and valuation data

Common real estate NFT use cases include:

-

Fractional ownership in residential properties

-

Tokenized shares in commercial developments

-

Revenue participation from rental income

-

Access rights to property-related benefits

Effective go-to-market strategies in the US and UK include:

-

Targeted outreach to accredited and retail investors

-

Educational content explaining tokenized ownership

-

Partnerships with real estate advisors

-

Gradual rollout starting with pilot projects

Metrics to track post-launch include:

-

Number of active token holders

-

Secondary-market activity

-

Investor retention rates

-

Regulatory feedback and compliance performance

A well-designed marketplace builds confidence over time, encouraging broader participation.

Risks, Regulation, and the Future of Tokenized Property Markets

Tokenizing real estate assets introduces new opportunities alongside new risks. Regulatory clarity, investor protection, and ethical considerations must guide platform design.

Key risks include:

-

Misalignment between digital tokens and legal rights

-

Regulatory uncertainty around asset-backed NFTs

-

Cybersecurity and custody risks

Mitigation strategies include:

-

Legal structuring aligned with local property laws

-

Transparent disclosures and investor education

-

Secure infrastructure and access controls

In the US and UK, regulatory expectations emphasize:

-

Consumer protection

-

AML and investor verification

-

Clear reporting and audit trails

Looking ahead, White Label NFT Marketplace Solutions are likely to support broader real estate innovation.

Future opportunities include:

-

Cross-border property investment models

-

Integration with digital identity frameworks

-

Secondary markets for traditionally illiquid assets

Conclusion — A New Infrastructure for Property Ownership

White Label NFT Marketplaces are not replacing traditional real estate systems; they are enhancing them. By introducing programmable ownership, fractional access, and transparent transactions, these platforms open property markets to wider participation while preserving trust and compliance.

Through thoughtful White Label NFT Marketplace Development, real estate firms can modernize investment models, improve liquidity, and engage global investors without sacrificing regulatory alignment. Partnering with experienced White Label NFT Marketplace Service Providers ensures that innovation is grounded in operational and legal reality.

As digital and physical asset markets continue to converge, real estate organizations that invest in secure, well-designed white-label NFT platforms will be better positioned to lead the next phase of property market evolution.

Κατηγορίες

Διαβάζω περισσότερα

Symantec's latest security offerings have arrived, with Norton Antivirus 2011 and Norton Internet Security 2011 now available. The focus remains on delivering lightweight, high-performance protection, leveraging cloud and community insights. Significant updates include enhancements to behavioral and heuristic engines, contributing to strong performance benchmarks in recent tests. Yet, true...

Executive Summary Kidney Stone Market Trends: Share, Size, and Future Forecast The global Kidney Stone market was valued at USD 3.05 billion in 2024 and is expected to reach USD 4.42 billion by 2032 During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 4.7%, primarily driven by the increasing prevalence of kidney stone...

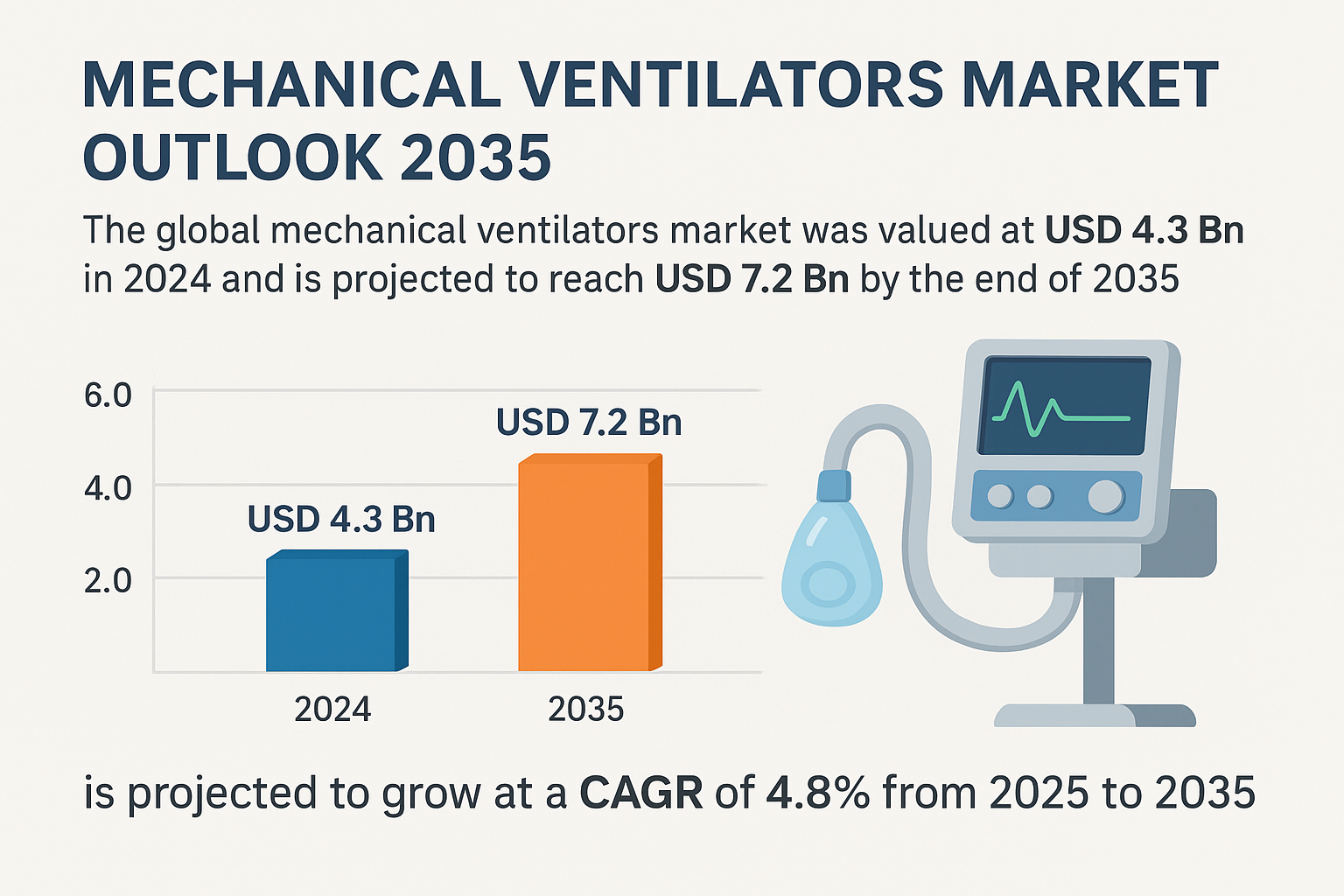

The global mechanical ventilators market was valued at USD 4.3 billion in 2024 and is projected to reach USD 7.2 billion by 2035, growing at a CAGR of 4.8% from 2025 to 2035. The market growth is driven by rising incidences of respiratory disorders, increasing ICU admissions, and growing demand for advanced life-support systems in critical care. The global mechanical ventilators market is under...

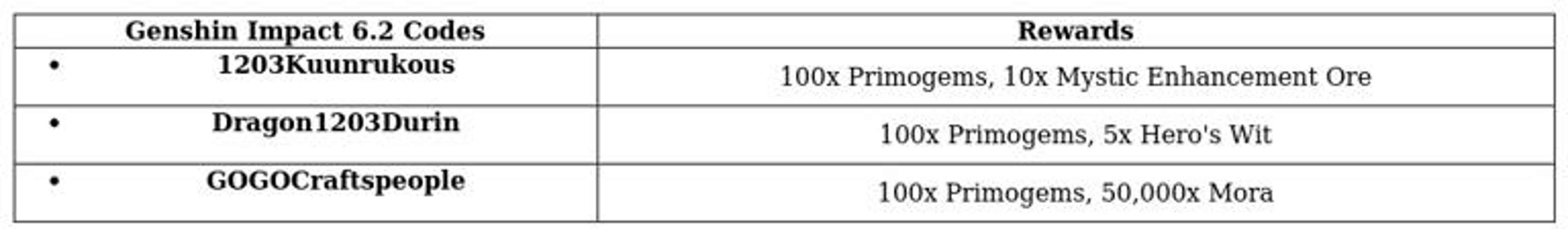

Genshin Impact 6.2 Update Overview The upcoming Genshin Impact 6.2 update has been thoroughly detailed by Hoyoverse, offering fans a glimpse into what to expect. The official announcement covered the release timeline, introducing two fresh playable characters, exciting in-game events, and a teaser for the storyline—all while deliberately avoiding spoilers to encourage players to discover...

Top Mage Guides In AFK Journey, players have a diverse selection of heroes at their disposal, ranging from sturdy tanks and helpful supports to sharp-eyed marksmen and other specialized classes. Among these, mage characters stand out due to their versatile abilities and strategic importance. Mages in the game are not only capable of unleashing potent magical attacks that can significantly...