AI in Insurance Market Gains Momentum as Insurers Embrace Automation, Risk Analytics, and Personalized Customer Experiences

The Artificial Intelligence (AI) in Insurance Market is undergoing transformative expansion as insurers globally integrate intelligent technologies to enhance underwriting accuracy, automate claims processing, improve fraud detection, and deliver hyper-personalized customer experiences. The rapid digitization of financial services, rising demand for operational efficiency, and the increasing availability of big data analytics are accelerating AI adoption across life, health, property & casualty (P&C), and reinsurance segments.

Artificial intelligence is no longer a futuristic concept within insurance—it is now a strategic imperative. From predictive modeling and machine learning algorithms to natural language processing (NLP) chatbots and computer vision-based damage assessment, AI-driven solutions are reshaping the insurance value chain.

What is Artificial Intelligence (AI) in Insurance?

Artificial Intelligence in insurance refers to the application of advanced computational technologies—including machine learning (ML), deep learning, natural language processing, computer vision, robotic process automation (RPA), predictive analytics, and intelligent automation—to optimize and transform insurance operations.

AI systems analyze structured and unstructured data from:

-

Historical claims databases

-

IoT-enabled telematics devices

-

Medical records

-

Social media and behavioral datasets

-

Customer interaction logs

-

Weather and geospatial data

The result is faster decision-making, enhanced risk assessment, improved fraud detection, and superior customer engagement.

Stay informed with our latest Artificial Intelligence (AI) in Insurance Market research covering strategies, innovations, and forecasts. Download full report:

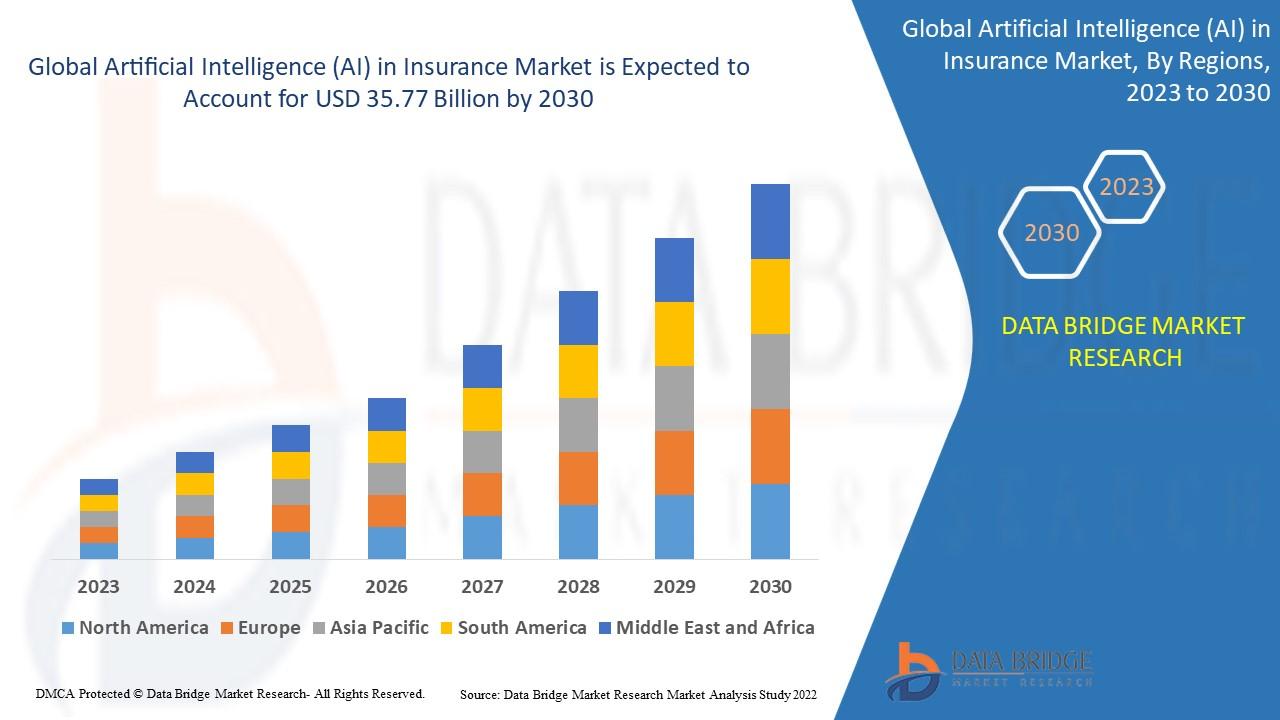

Market Overview and Growth Outlook

The global AI in Insurance market is experiencing robust growth due to:

-

Increasing digital transformation initiatives

-

Rising fraud incidents and financial crimes

-

Growing customer expectations for instant services

-

Regulatory pressure for transparency and compliance

-

Expansion of InsurTech startups

The market is projected to witness strong compound annual growth over the forecast period, driven by advancements in cloud computing, big data analytics, and AI-powered automation platforms.

Key Growth Indicators

-

Rising adoption of AI-powered underwriting tools

-

Growing investment in predictive analytics platforms

-

Increased deployment of virtual assistants and chatbots

-

Rapid integration of AI in claims automation

Key Market Drivers

1. Rising Demand for Automated Claims Processing

Claims management is traditionally time-consuming and resource-intensive. AI automates:

-

First Notice of Loss (FNOL) intake

-

Damage assessment through computer vision

-

Fraud pattern identification

-

Settlement recommendations

This reduces claim processing time from weeks to hours, significantly enhancing customer satisfaction.

2. Increasing Fraud Detection Capabilities

Insurance fraud costs billions annually. AI models analyze behavioral anomalies, suspicious patterns, and network relationships to detect fraud in real-time. Machine learning continuously improves detection accuracy by learning from new fraud cases.

3. Personalized Insurance Products

AI-driven analytics enable insurers to offer customized pricing based on real-time risk profiles. Usage-based insurance (UBI), especially in auto insurance, leverages telematics and behavioral data to adjust premiums dynamically.

4. Operational Cost Reduction

AI automation reduces administrative workload, improves accuracy, and minimizes human errors. Intelligent automation solutions optimize underwriting, document processing, compliance monitoring, and customer service operations.

5. Growth of InsurTech Ecosystem

InsurTech companies are leveraging AI to disrupt traditional insurance models. Partnerships between established insurers and AI-driven startups are accelerating digital transformation.

Market Challenges

Despite strong growth potential, several challenges exist:

-

Data privacy and cybersecurity concerns

-

Regulatory complexities across regions

-

Integration challenges with legacy systems

-

High initial implementation costs

-

Lack of skilled AI professionals

Addressing these barriers is critical for sustainable market expansion.

AI Applications Across Insurance Segments

1. AI in Underwriting

AI enhances underwriting accuracy by analyzing diverse datasets, including medical history, financial behavior, and lifestyle patterns. Predictive models assess risk more precisely than traditional actuarial methods.

Benefits include:

-

Faster policy issuance

-

Reduced underwriting errors

-

Improved risk classification

2. AI in Claims Management

AI-driven claims automation includes:

-

Automated document verification

-

Image-based vehicle damage assessment

-

Chatbot-guided claims filing

-

Predictive settlement estimation

This improves turnaround time and reduces operational costs.

3. AI in Customer Experience

Natural language processing powers intelligent chatbots and virtual assistants that:

-

Answer policy-related queries

-

Provide renewal reminders

-

Offer product recommendations

-

Assist in claims tracking

24/7 customer engagement significantly improves retention rates.

4. AI in Risk Assessment and Pricing

Advanced analytics tools evaluate:

-

Climate risk exposure

-

Health risk indicators

-

Driving behavior patterns

-

Credit risk profiles

This enables dynamic and risk-adjusted premium pricing models.

5. AI in Fraud Detection

AI identifies:

-

Suspicious claim frequency

-

Network fraud rings

-

Duplicate claims

-

Identity inconsistencies

Deep learning algorithms improve fraud prediction accuracy over time.

Technology Segmentation

By Component

-

Software

-

Services

By Deployment Mode

-

On-premises

-

Cloud-based

Cloud deployment dominates due to scalability, lower capital expenditure, and real-time data processing capabilities.

By Application

-

Underwriting

-

Claims Processing

-

Fraud Detection

-

Customer Service

-

Risk Modeling

Regional Market Analysis

North America

North America leads the AI in insurance market due to:

-

Strong digital infrastructure

-

Early adoption of AI technologies

-

High investment in InsurTech startups

-

Supportive regulatory environment

The United States dominates the regional landscape with advanced analytics adoption and strong venture capital funding.

Europe

Europe is witnessing steady growth driven by:

-

Regulatory modernization

-

Expansion of AI-enabled financial services

-

Rising demand for automation

Countries such as the UK, Germany, and France are key contributors.

Asia-Pacific

Asia-Pacific is projected to record the fastest growth rate due to:

-

Rapid digital transformation

-

Expanding middle-class population

-

Growing demand for health and life insurance

-

Government-led AI initiatives

China, India, Japan, and South Korea are emerging as significant markets.

Middle East & Africa and Latin America

These regions are gradually adopting AI solutions, primarily driven by digital banking expansion and modernization of insurance infrastructures.

Competitive Landscape

The competitive environment is characterized by:

-

Strategic partnerships

-

Mergers and acquisitions

-

AI platform innovations

-

Cloud-based solution integration

Major insurance companies are collaborating with AI technology providers to develop proprietary intelligent systems.

Key competitive strategies include:

-

Product innovation

-

Data-driven service differentiation

-

Advanced analytics integration

-

AI-driven ecosystem expansion

Emerging Trends in AI in Insurance

1. Generative AI in Policy Management

Generative AI is being utilized for automated document drafting, policy summarization, and enhanced customer communication.

2. AI-Powered Telematics

Telematics-based insurance models are gaining traction in auto insurance, allowing dynamic premium pricing based on driving behavior.

3. AI in Climate Risk Modeling

Climate change is increasing risk complexity. AI models simulate catastrophic scenarios and improve predictive accuracy.

4. Embedded Insurance

AI enables seamless integration of insurance products within e-commerce, travel booking, and fintech platforms.

5. Hyper-Automation

Combining AI, RPA, and machine learning to automate entire insurance workflows is becoming a major operational strategy.

Future Outlook

The future of the Artificial Intelligence (AI) in Insurance Market is defined by:

-

Fully automated underwriting ecosystems

-

AI-driven personalized insurance ecosystems

-

Real-time predictive claims settlements

-

Ethical AI frameworks and transparent algorithms

As data ecosystems expand and AI models become more sophisticated, insurers that adopt intelligent automation at scale will gain a significant competitive advantage.

Why AI is a Strategic Imperative for Insurers

AI adoption is not merely about cost reduction—it is about survival in a rapidly evolving digital economy. Insurers leveraging AI technologies benefit from:

-

Increased profitability

-

Improved customer retention

-

Enhanced operational efficiency

-

Faster product innovation

-

Stronger fraud prevention

Organizations that fail to integrate AI risk losing market share to agile, data-driven competitors.

Conclusion

The Artificial Intelligence (AI) in Insurance Market is reshaping the global insurance landscape through automation, predictive analytics, intelligent underwriting, and customer-centric innovation. As technological advancements accelerate and regulatory frameworks evolve, AI-driven insurance solutions will become foundational to competitive differentiation.

Browse More Reports:

Global Water Treatment Chemicals Market

Global Mobile Money Market

Global Sauces Market

Global Smart Fleet Management Market

Global Artificial Intelligence (AI) in Insurance Market

Global Scented Candle Market

Global Tote Bags Market

Global Tuna Market

Europe Japanese Restaurant Market

Global Dietary Supplements Market

Global Ceramics Market

Global Gemstones Market

Global Hepatocellular Carcinoma Drugs Market

Global Japanese Restaurant Market

Global Party Supplies Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com