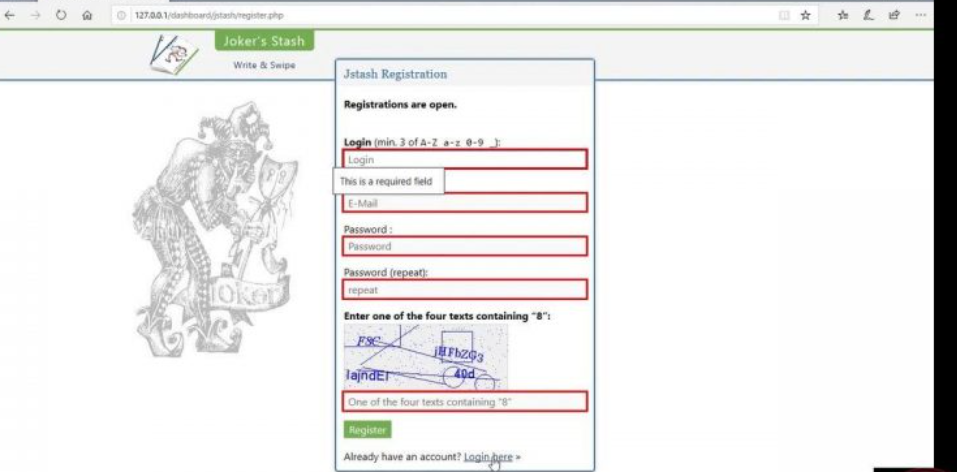

Position Trading Excellence – Applying Jokerstash Insights for Long-Term Market Success

Introduction:

Position trading is one of the most powerful strategies for traders who prefer to focus on the bigger picture. Unlike day trading or scalping, position trading allows investors to hold trades for weeks, months, or even years, capitalizing on long-term market trends. Success in this approach requires discipline, patience, and strategic analysis. By drawing inspiration from jokerstash—a platform built on efficiency, structured systems, and data-driven insights—traders can refine their long-term strategies and unlock consistent profits.

Why Position Trading Appeals to Investors:

-

Long-Term Profit Potential:

Position trading captures major market moves, often leading to substantial returns over time. -

Less Stressful than Short-Term Trading:

Unlike scalping or day trading, this approach reduces the need for constant monitoring. -

Stronger Alignment with Fundamentals:

Economic indicators, global events, and interest rate shifts become the foundation for trade decisions. -

Patience Pays Off:

Similar to the structured, steady operations of JokerStash, long-term holding rewards traders who stay disciplined.

JokerStash-Inspired Principles for Position Trading:

-

Structured Systems:

JokerStash thrives on organization. Position traders benefit from setting clear entry and exit strategies before committing to trades. -

Risk Management:

Just as JokerStash emphasizes security, traders should use stop-losses, diversification, and careful capital allocation to safeguard investments. -

Data-Driven Decisions:

Analytics are the backbone of JokerStash. Position traders can use moving averages, MACD, and RSI in combination with economic fundamentals for accuracy. -

Efficiency and Patience:

Long-term profits require time. JokerStash’s efficient approach highlights the importance of sticking to a plan even during market fluctuations.

Popular Position Trading Strategies:

-

Trend Following: Holding trades in the direction of dominant trends for extended profits.

-

Breakout Trading: Entering after price breaks through significant long-term resistance or support.

-

Fundamental Trading: Using macroeconomic data—such as GDP, inflation, and interest rates—to predict long-term movements.

-

Carry Trade Strategy: Profiting from interest rate differences between currency pairs while holding trades long-term.

Risk Management for Long-Term Success:

-

Allocate only a portion of capital per trade.

-

Use stop-loss and take-profit orders to secure profits.

-

Diversify across assets such as currencies, commodities, and stocks.

-

Monitor central bank policies, fiscal reports, and global events.

-

Stick to a structured plan inspired by JokerStash’s efficiency.

Tools for Position Traders:

-

Technical Tools: 50-day and 200-day moving averages, trendlines, Bollinger Bands.

-

Fundamental Tools: Global economic calendars, central bank reports, geopolitical analysis.

-

Trading Platforms: Reliable platforms for advanced charting and risk management.

-

JokerStash-Style Analytics: Using structured data evaluation to time entries and exits effectively.

Conclusion:

Position trading is an excellent strategy for patient traders who value long-term profits over short-term fluctuations. By integrating efficiency, structure, and data-driven approaches inspired by jokerstash, position traders can enhance their strategies, improve risk management, and achieve lasting success in global markets.