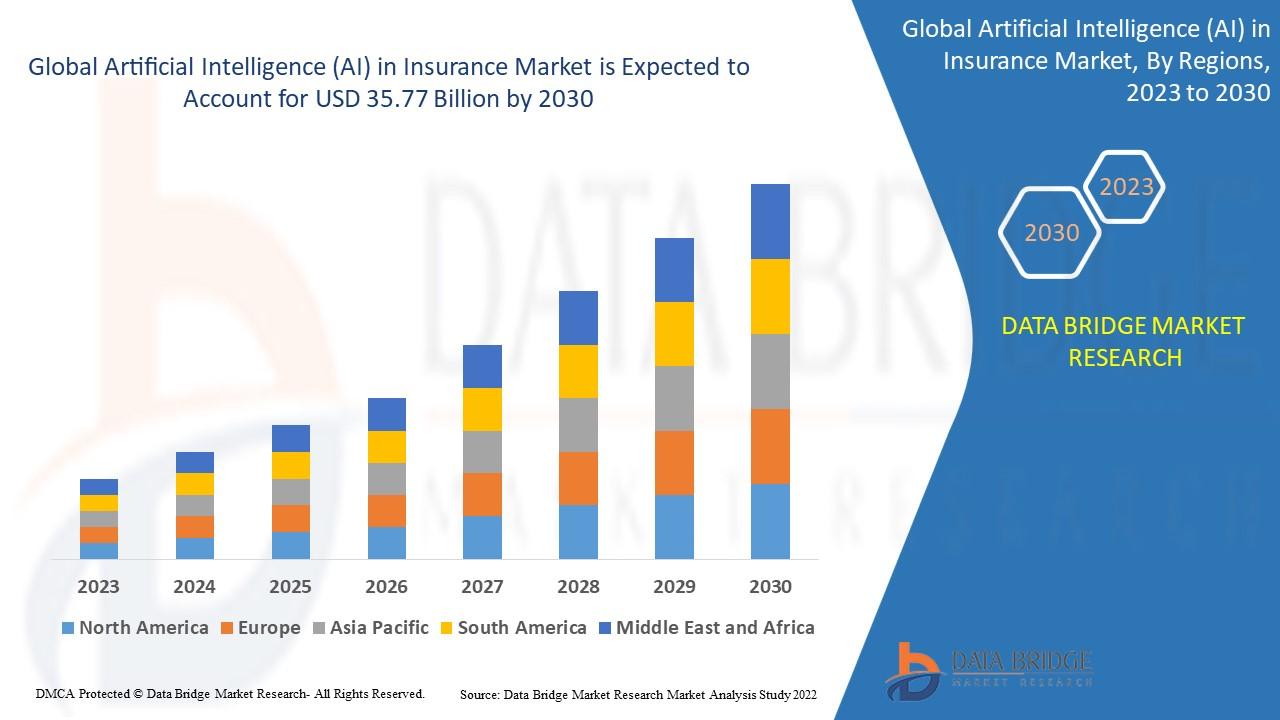

AI In Insurance Market Transforms Risk Analytics Industry

The Artificial Intelligence (AI) in Insurance Market is transforming the global insurance ecosystem by enabling automation, predictive analytics, intelligent underwriting, fraud detection, and personalized customer experiences. As insurers confront rising operational costs, complex regulatory frameworks, and evolving customer expectations, AI-driven technologies are rapidly becoming mission-critical tools.

Artificial Intelligence in insurance integrates machine learning algorithms, natural language processing, computer vision, robotic process automation (RPA), and advanced analytics into core insurance operations. From claims processing automation to risk assessment modeling, AI is reshaping the value chain across life, health, property & casualty (P&C), and reinsurance sectors.

This comprehensive report explores market size, growth drivers, restraints, technological advancements, segmentation analysis, regional outlook, competitive landscape, and future opportunities in the AI in Insurance Market.

Stay informed with our latest Artificial Intelligence (AI) in Insurance Market research covering strategies, innovations, and forecasts. Download full report:

Market Overview

The AI in insurance market is experiencing exponential growth due to increasing digital transformation initiatives and the rising need for operational efficiency. Insurers are leveraging AI to enhance underwriting accuracy, minimize fraud losses, accelerate claims settlements, and deliver hyper-personalized policy recommendations.

Key Market Highlights

-

Rapid adoption of AI-powered chatbots and virtual assistants

-

Integration of predictive analytics for underwriting optimization

-

Growth in AI-driven fraud detection systems

-

Expansion of insurtech partnerships

-

Increased investment in cloud-based AI platforms

As insurance companies seek competitive differentiation, AI-based automation is becoming a core strategic priority rather than a supplementary technology.

Key Growth Drivers

1. Rising Demand for Operational Efficiency

Insurance processes traditionally involve manual documentation, repetitive workflows, and time-intensive verification procedures. AI-powered automation significantly reduces turnaround time, lowers administrative costs, and improves productivity across underwriting, claims, and customer service operations.

2. Increasing Insurance Fraud

Fraudulent claims cost insurers billions annually. AI-powered anomaly detection systems analyze historical claim data and behavioral patterns to flag suspicious activities in real time. Advanced machine learning models can identify fraud risks with higher precision compared to traditional rule-based systems.

3. Personalized Customer Experience

Modern customers expect instant responses, personalized products, and seamless digital experiences. AI enables insurers to analyze customer behavior, risk profiles, and purchasing patterns to design customized insurance policies and dynamic pricing models.

4. Expansion of Big Data and Advanced Analytics

The increasing availability of structured and unstructured data—including telematics, IoT devices, wearables, and social data—has accelerated AI adoption in underwriting and risk assessment.

5. Growth of Insurtech Ecosystem

Strategic collaborations between traditional insurers and insurtech startups are accelerating AI deployment across digital platforms.

Market Restraints and Challenges

Despite promising growth, certain challenges hinder market expansion:

-

High initial investment costs

-

Data privacy and cybersecurity concerns

-

Regulatory compliance complexities

-

Shortage of skilled AI professionals

-

Integration challenges with legacy systems

However, continuous technological advancements and regulatory frameworks are expected to address these barriers over time.

Market Segmentation Analysis

By Component

-

Solutions

-

Machine Learning Platforms

-

Natural Language Processing (NLP) Tools

-

Predictive Analytics Software

-

Fraud Detection Systems

-

Chatbots & Virtual Assistants

-

-

Services

-

Consulting

-

System Integration

-

Support & Maintenance

-

By Deployment Mode

-

On-Premise

-

Cloud-Based

Cloud deployment is gaining dominance due to scalability, lower upfront costs, and seamless AI integration.

By Application

-

Claims Management

-

Underwriting & Risk Assessment

-

Fraud Detection

-

Customer Relationship Management

-

Policy Administration

-

Marketing & Sales Automation

Claims management and fraud detection currently hold a significant market share due to immediate cost-saving benefits.

By Insurance Type

-

Life Insurance

-

Health Insurance

-

Property & Casualty Insurance

-

Reinsurance

Property & Casualty insurance leads AI adoption due to high claim frequency and fraud risks.

Technological Innovations Transforming the Market

1. Machine Learning Algorithms

ML models enhance predictive underwriting accuracy and enable dynamic premium pricing.

2. Natural Language Processing (NLP)

NLP-driven chatbots handle policy inquiries, claim submissions, and customer support requests 24/7, improving customer engagement.

3. Computer Vision

Computer vision systems assess vehicle damage from uploaded images, accelerating claims processing in auto insurance.

4. Robotic Process Automation (RPA)

RPA automates repetitive back-office tasks such as document verification and data entry.

5. AI-Powered Risk Modeling

Advanced AI risk models incorporate real-time data streams, improving catastrophe risk prediction and loss forecasting.

Regional Analysis

North America

North America dominates the AI in insurance market due to high digital maturity, strong presence of major insurers, and early adoption of advanced analytics.

Europe

Europe is witnessing rapid growth driven by regulatory modernization, insurtech expansion, and AI innovation initiatives.

Asia-Pacific

Asia-Pacific is expected to register the fastest growth rate due to expanding insurance penetration, digital banking growth, and government-backed AI initiatives.

Latin America and Middle East & Africa

Emerging economies are gradually adopting AI solutions to improve operational efficiency and customer reach.

Competitive Landscape

The competitive environment is characterized by technological innovation, mergers & acquisitions, strategic collaborations, and AI platform development. Major players are investing heavily in research and development to strengthen AI capabilities.

Leading companies in the AI in insurance market include:

-

IBM

-

Microsoft

-

Google

-

Amazon Web Services

-

Oracle

-

SAP

-

Salesforce

These organizations provide AI-driven cloud infrastructure, analytics platforms, and intelligent automation solutions tailored to insurance providers.

Emerging Trends

Usage-Based Insurance (UBI)

Telematics and AI-powered analytics enable insurers to offer usage-based insurance models based on driving behavior.

AI-Driven Underwriting Automation

Automated underwriting reduces policy issuance time from days to minutes.

Conversational AI and Voice Assistants

AI-powered voice bots enhance customer interactions across digital channels.

Blockchain and AI Integration

Combining blockchain with AI improves transparency, fraud prevention, and data integrity.

Predictive Health Monitoring

Wearable devices integrated with AI help insurers monitor policyholder health metrics in real time.

Future Outlook and Market Forecast

The Artificial Intelligence in Insurance Market is projected to experience sustained growth over the next decade. Increasing digital transformation investments, rising insurance fraud cases, and demand for real-time analytics will continue to drive AI adoption.

Future developments will likely focus on:

-

Explainable AI for regulatory compliance

-

Autonomous claims processing

-

Advanced catastrophe modeling

-

AI-powered embedded insurance solutions

-

Hyper-personalized micro-insurance products

Insurers that embrace AI early will gain competitive advantages in cost optimization, risk management accuracy, and customer retention.

Strategic Recommendations

-

Invest in scalable cloud-based AI platforms.

-

Develop AI governance frameworks for compliance.

-

Foster partnerships with insurtech startups.

-

Prioritize cybersecurity and data privacy.

-

Upskill workforce in AI and data analytics.

Conclusion

Artificial Intelligence is redefining the insurance landscape by enabling smarter decision-making, enhanced operational efficiency, and superior customer experiences. As digital transformation accelerates, AI adoption will become indispensable for insurers aiming to remain competitive in a rapidly evolving market.

Browse More Reports:

Global Water Treatment Chemicals Market

Global Mobile Money Market

Global Sauces Market

Global Smart Fleet Management Market

Global Artificial Intelligence (AI) in Insurance Market

Global Scented Candle Market

Global Tote Bags Market

Global Tuna Market

Europe Japanese Restaurant Market

Global Dietary Supplements Market

Global Ceramics Market

Global Gemstones Market

Global Hepatocellular Carcinoma Drugs Market

Global Japanese Restaurant Market

Global Party Supplies Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com