Automotive Smart Antenna Market Outlook 2034: How 5G Connectivity, Autonomous Driving Ecosystems, and MIMO Beamforming Technologies Are Transforming the Global Connected Vehicle Industry

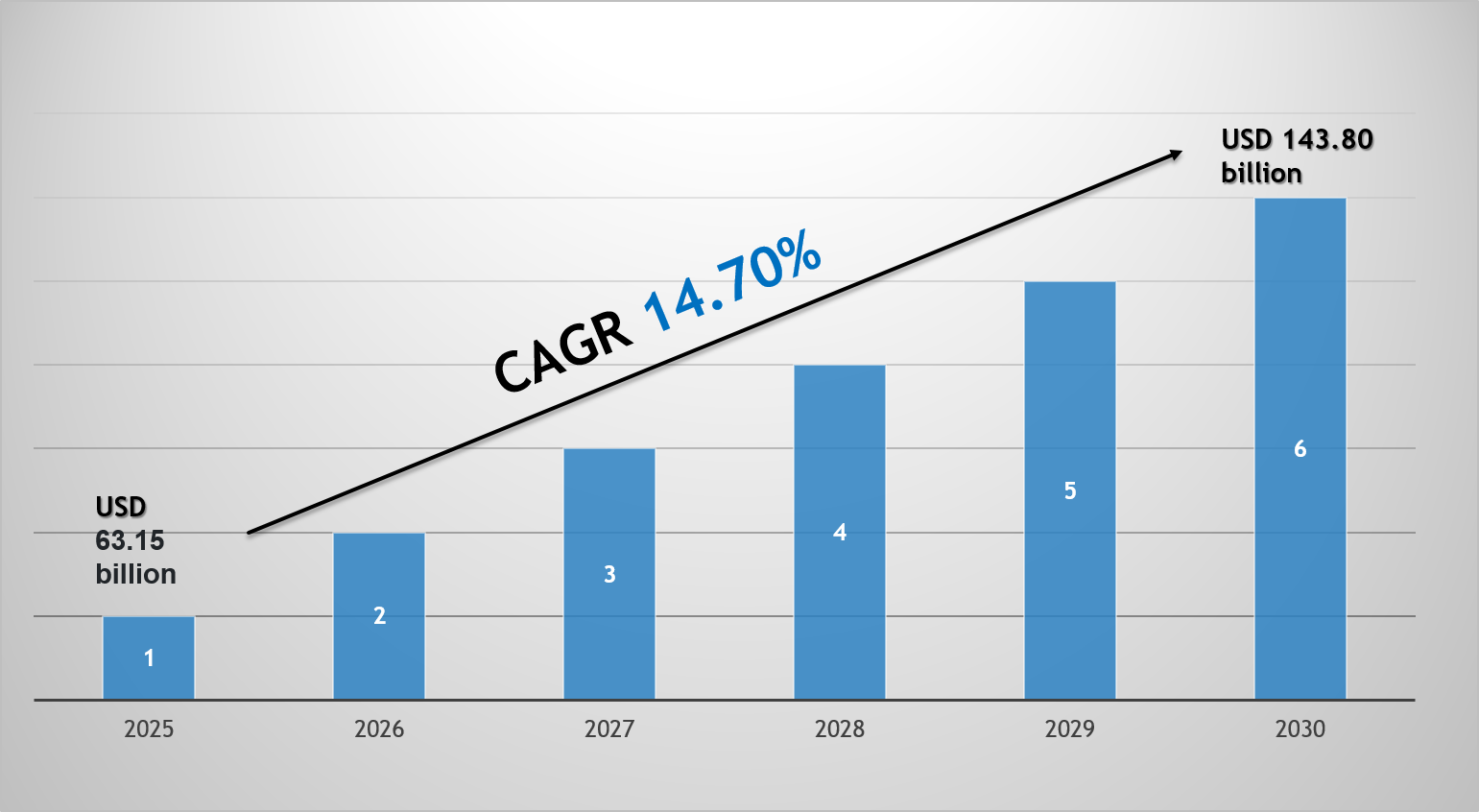

The global automotive smart antenna market is entering a transformative growth phase, fueled by the rapid evolution of connected vehicles, autonomous mobility, and next-generation cellular technologies. Valued at US$ 3.6 Bn in 2023, the market is projected to expand at a robust CAGR of 8.1% from 2024 to 2034, reaching US$ 8.5 Bn by the end of 2034.

The growing convergence of telecommunications, artificial intelligence, and automotive engineering is redefining how vehicles communicate, navigate, and operate safely in increasingly digital ecosystems.

Analyst Viewpoint: 5G Shift and Autonomous Demand Unlocking New Opportunities

One of the most significant catalysts for automotive smart antenna market growth is the automotive sector’s noticeable shift toward 5G connectivity. As vehicles become data-driven mobility platforms, seamless and ultra-low-latency communication is no longer optional—it is essential.

Automotive smart antennas enable flawless connectivity across:

- 3G / 4G / 5G cellular networks

- Bluetooth devices

- Wi-Fi systems

- GNSS (Global Navigation Satellite Systems)

- Vehicle-to-Vehicle (V2V) communication

- Vehicle-to-Infrastructure (V2I) networks

These antennas ensure uninterrupted communication between electronic control units (ECUs), sensors, infotainment systems, and cloud platforms—forming the backbone of connected vehicle ecosystems.

Manufacturers are now exploring transparent antenna technologies, designed to integrate seamlessly into windshields and panoramic sunroofs. Using transparent electrode technology, these antennas promise scalability and improved handling of rising network traffic without compromising vehicle aesthetics.

Market Overview: Enabling Intelligent Vehicle Communication

The automotive industry is rapidly transitioning toward smart mobility, where effective communication between vehicles and infrastructure enhances safety, navigation precision, and operational efficiency.

Automotive smart antennas play a pivotal role in:

- Radio signal reception

- GPS navigation

- Mobile communication

- Over-the-Air (OTA) updates

- Real-time traffic monitoring

Traditionally, smart antennas were installed on metallic roofs, rear bumpers, spoilers, or beneath glass surfaces. However, next-generation integration is moving toward embedded and conformal designs that enhance aerodynamic efficiency and visual appeal.

These antennas identify spatial signal signatures such as Direction of Arrival (DOA) to optimize communication reliability—even in dense urban environments.

Integration Challenges

Despite strong growth prospects, integrating smart antennas requires close coordination among:

- Tier-1 suppliers

- Automotive OEMs

- Telecom network providers

System interoperability, hardware integration complexity, and cross-industry standardization remain critical challenges.

Key Market Drivers

1. Rising Demand for Cellular Applications in Connected Vehicles

Each successive generation of mobile networks has improved speed while reducing data transmission costs. The emergence of 5G networks represents a leap forward in:

- Ultra-low latency

- High bandwidth

- Reliable real-time communication

Smart antennas optimized for 5G networks leverage advanced technologies such as:

- MIMO (Multiple Input Multiple Output)

- Beamforming

- Phased array systems

These technologies significantly enhance signal strength and quality, ensuring reliable communication across varied environments.

Major telecom investments reinforce this growth trajectory:

- China Mobile invested US$ 36 Bn in 5G infrastructure across 800+ cities.

- American Tower committed US$ 1 Bn to fiber network expansion for 5G support.

- Verizon invested US$ 45 Bn in 5G spectrum and deployment to support connected vehicles.

Additionally, smart antennas facilitate Over-the-Air (OTA) updates, allowing manufacturers to enhance vehicle functionality and cybersecurity remotely.

2. Expanding Autonomous Vehicle Ecosystem

The increasing integration of electronic components for environmental sensing, data transmission, and machine learning is accelerating demand for intelligent car antennas.

Autonomous vehicles generate vast amounts of data that must be transmitted and processed in real time. Smart antennas ensure seamless communication between:

- Sensors

- ECUs

- Cloud platforms

- Roadside infrastructure

Autonomous mobility is gaining traction across:

- Ride-hailing services

- Mobility-as-a-Service (MaaS)

- Logistics and delivery networks

For instance, Waymo has launched autonomous ride-hailing services, enabling app-based access to self-driving taxis.

In April 2021, Domino's partnered with Ford Motor Company to test autonomous pizza delivery vehicles in Houston, Texas—demonstrating the practical potential of smart mobility.

Logistics leaders such as FedEx and Amazon are also exploring autonomous delivery fleets to improve operational efficiency and reduce costs.

The growing autonomous ecosystem is therefore a powerful driver of automotive smart antenna market expansion.

Regional Insights

Europe – The Leading Market

Europe held the largest share of the automotive smart antenna market in 2023 and is expected to maintain dominance throughout the forecast period.

Key growth factors include:

- Leadership in autonomous vehicle production

- Strong R&D investments

- Presence of premium car manufacturers

- Advanced telecom infrastructure

Germany plays a pivotal role, serving as a hub for automotive innovation and smart mobility deployment.

Asia Pacific – Rapidly Expanding Market

Asia Pacific is witnessing significant growth, particularly in SUV adoption across India and China. Rising disposable income, urbanization, and technological adoption are driving demand for connected vehicle solutions in the region.

China’s strong 5G infrastructure rollout further accelerates automotive antenna deployment.

Competitive Landscape and Key Players

The automotive smart antenna market is highly competitive, with players focusing on innovation, partnerships, and product launches to strengthen their positions.

Prominent companies include:

- Laird Connectivity

- Harman International

- Continental AG

- Hirschmann Car Communication GmbH

- Kathrein Automotive GmbH

- Ficosa International S.A.

- TE Connectivity Ltd.

- Amphenol Corporation

- Murata Manufacturing Co., Ltd.

- Molex LLC

Notable Developments

- In January 2023, Denso introduced Global Safety Package 3, incorporating compact MIMO antenna technology to enhance sensing capabilities.

- In March 2023, Continental AG partnered with HERE Technologies to integrate HD map data with C-V2X solutions.

- In January 2021, Harman International launched a 5G TCU equipped with conformal antenna technology.

Companies are also adopting inorganic growth strategies, including mergers, partnerships, and technology collaborations to expand global outreach.

Market Segmentation Snapshot

The market is segmented based on:

Antenna Type

- Shark Fin Antennas

- Patch Antennas

- Blade Antennas

- Low-profile Antennas

Frequency

- UHF

- VHF

- GNSS

- Cellular (4G, 5G)

- Wi-Fi

- Bluetooth

Technology

- MIMO Antennas

- Phased Array Antennas

- Switched Beam Antennas

- Adaptive Antennas

- Smart Beamforming Antennas

Vehicle Type

- Passenger Vehicles (Hatchback, Sedan, SUVs)

- Light Commercial Vehicles

- Heavy Duty Trucks

- Buses & Coaches

- Off-road Vehicles

Sales Channel

- OEMs

- Aftermarket

Future Outlook

As vehicles evolve into connected digital platforms, smart antennas will remain central to enabling:

- Autonomous navigation

- Real-time diagnostics

- Remote vehicle management

- Enhanced infotainment

- Cybersecure OTA updates

With 5G expansion, AI integration, and growing autonomous adoption, the automotive smart antenna market is poised for sustained growth through 2034.

The transition toward intelligent mobility is not merely technological—it is infrastructural, strategic, and ecosystem-driven. Automotive smart antennas are at the heart of this revolution, ensuring vehicles remain seamlessly connected in an increasingly data-driven world.