SAP Bookkeeping Services: A Smart Solution for Scalable Finance

In today’s fast-moving business environment, finance teams are under constant pressure to deliver accurate reports, maintain compliance, and support strategic decisions — all while managing growing transaction volumes. As companies expand, traditional bookkeeping systems often struggle to keep up. This is where SAP bookkeeping services become a powerful solution.

Businesses using solutions like SAP S/4HANA and SAP ERP gain access to an integrated financial ecosystem that supports scalability, automation, and real-time insights. When managed by experienced professionals, SAP bookkeeping becomes more than just recording transactions — it becomes a foundation for scalable finance.

Let’s explore why SAP bookkeeping services are considered a smart, future-ready solution for growing businesses.

What Are SAP Bookkeeping Services?

SAP bookkeeping services involve managing day-to-day financial records within the SAP environment. These services typically include:

-

General ledger management

-

Accounts payable and receivable

-

Bank reconciliations

-

Fixed asset accounting

-

Financial reporting

-

Tax and compliance support

-

Month-end and year-end closing

Unlike traditional bookkeeping systems that operate in isolation, SAP integrates accounting with procurement, sales, inventory, HR, and operations. This unified approach eliminates data silos and improves financial transparency across the organization.

Why Scalability Matters in Finance

As businesses grow, financial complexity increases. More transactions, multiple entities, cross-border operations, and evolving regulatory requirements can overwhelm manual or disconnected systems.

Scalable finance means:

-

Handling higher transaction volumes without increasing errors

-

Generating real-time reports for better decision-making

-

Managing multi-entity and multi-currency operations

-

Ensuring compliance across regions

-

Supporting business expansion seamlessly

SAP bookkeeping services are built to support these needs without disrupting workflows.

Key Benefits of SAP Bookkeeping Services

1. Real-Time Financial Visibility

One of the biggest advantages of SAP is real-time reporting. Finance leaders no longer have to wait for month-end summaries to assess business performance. SAP provides:

-

Instant access to financial dashboards

-

Automated reconciliation processes

-

Accurate profit and loss statements

-

Real-time cash flow tracking

This level of visibility allows management to make proactive decisions instead of reactive ones.

2. Automation That Reduces Errors

Manual data entry is one of the leading causes of accounting errors. SAP bookkeeping services leverage automation features such as:

-

Automated journal entries

-

Smart invoice processing

-

Integrated payment tracking

-

System-driven reconciliations

Automation reduces human error, improves accuracy, and saves valuable time for finance teams.

3. Seamless Integration Across Departments

Finance does not operate alone. Sales, procurement, logistics, and HR all impact accounting records. SAP connects all these functions into one unified system.

For example:

-

Sales invoices automatically update accounts receivable

-

Procurement orders sync with accounts payable

-

Inventory movements reflect in financial statements

This integration ensures consistency and eliminates duplicate data entry.

4. Strong Compliance and Audit Readiness

Compliance is a major concern for growing businesses. SAP bookkeeping services help maintain:

-

Accurate audit trails

-

Standardized financial processes

-

Regulatory compliance across regions

-

Secure data management

With built-in reporting and tracking features, SAP simplifies audit preparation and reduces compliance risks.

5. Multi-Entity and Multi-Currency Support

For businesses operating in multiple countries or managing multiple subsidiaries, SAP bookkeeping provides structured control.

It allows:

-

Consolidated financial reporting

-

Intercompany transaction management

-

Multi-currency accounting

-

Global tax configuration

This makes it ideal for enterprises planning expansion or already operating internationally.

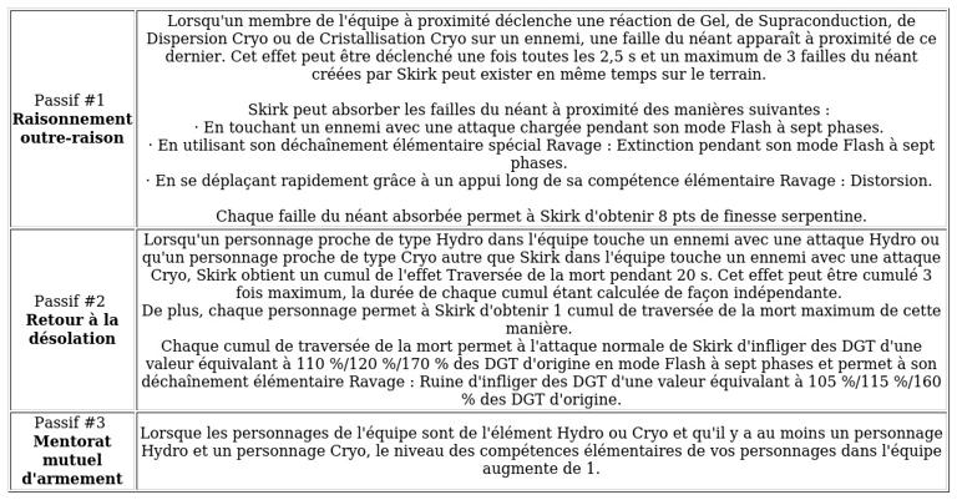

SAP Bookkeeping vs Traditional Bookkeeping

| Traditional Bookkeeping | SAP Bookkeeping Services |

|---|---|

| Manual processes | Automated workflows |

| Limited reporting | Real-time analytics |

| Data silos | Integrated system |

| Higher risk of errors | Controlled and standardized |

| Difficult scaling | Built for scalability |

The difference becomes more noticeable as transaction volumes increase. SAP ensures performance remains consistent even as operations expand.

How SAP Bookkeeping Supports Business Growth

Better Decision-Making

With accurate and timely financial data, leadership can:

-

Identify profit margins by product or region

-

Monitor expense trends

-

Improve budgeting accuracy

-

Forecast future growth confidently

Data-driven decision-making is a core requirement for scalable finance.

Improved Cash Flow Management

Effective bookkeeping in SAP allows companies to:

-

Track receivables and payables efficiently

-

Identify overdue invoices

-

Monitor working capital

-

Optimize payment cycles

Strong cash flow management is critical for business stability and growth.

Operational Efficiency

By reducing manual work and improving system integration, SAP bookkeeping allows finance teams to focus on strategic tasks such as:

-

Financial planning

-

Risk management

-

Cost optimization

-

Performance analysis

This shift from transactional to strategic finance adds long-term value.

Outsourcing SAP Bookkeeping Services

Many businesses choose to outsource SAP bookkeeping to experienced professionals rather than maintaining large in-house teams.

Outsourced SAP bookkeeping services offer:

-

Cost efficiency

-

Access to SAP-certified experts

-

Faster implementation

-

Reduced training expenses

-

Scalable support as business grows

Outsourcing also ensures that the system is used to its full potential without internal resource limitations.

Is SAP Bookkeeping Right for Your Business?

SAP bookkeeping services are ideal for:

-

Medium to large enterprises

-

Businesses planning expansion

-

Companies managing multiple entities

-

Organizations handling high transaction volumes

-

Firms seeking automation and real-time reporting

Even growing SMEs can benefit from SAP if scalability and long-term efficiency are part of their strategic goals.

The Future of Scalable Finance

Finance functions are evolving rapidly. Automation, analytics, AI-driven insights, and integrated ERP systems are becoming the standard. SAP bookkeeping services align perfectly with this transformation.

By combining technology with professional financial expertise, businesses can:

-

Increase operational efficiency

-

Strengthen compliance

-

Enhance reporting accuracy

-

Support sustainable growth

In a competitive market, scalable finance is no longer optional — it is essential.

Conclusion

SAP bookkeeping services are more than just a technical upgrade. They represent a strategic shift toward automation, integration, and intelligent financial management.

With solutions like SAP ERP and SAP S/4HANA at the core, businesses gain the flexibility to scale operations without compromising accuracy or control. Whether managed in-house or outsourced to experts, SAP bookkeeping provides the infrastructure needed for long-term financial success.

For companies aiming to build a scalable, efficient, and future-ready finance system, SAP bookkeeping services truly are a smart solution.