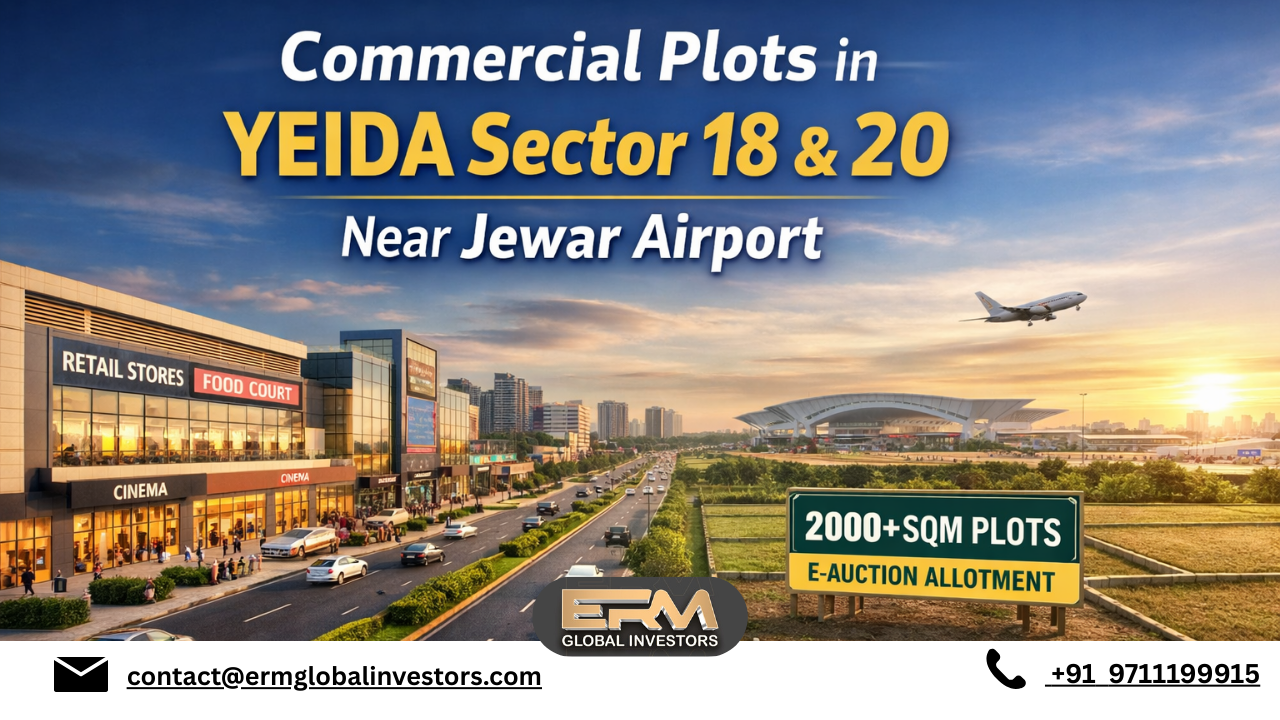

Commercial Plots in YEIDA Sector 18 & 20 Near Jewar Airport

Introduction

Investors exploring growth corridors around the Yamuna Expressway are increasingly evaluating commercial plots in Sectors 18 and 20 under the Yamuna Expressway Industrial Development Authority (YEIDA). According to ERM Global Investors, this micro-market is no longer just a future story—it is entering a structured development phase backed by infrastructure, policy clarity, and institutional planning.

Unlike speculative land pockets, these plots are part of an active scheme designed for Convenience Shopping Centres (CSC) and malls. With 2000+ sqm plot sizes, reserve price starting at ₹70,000 per sqm, and e-auction allotment, this opportunity is structured for serious developers and long-term investors.

Let’s break this down from a practical real estate perspective.

Why Sector 18 & 20 Are Strategically Important

1. 120 Meter Wide Road Advantage

Plots located on a 120-meter-wide road are not just about visibility. In commercial real estate, road width directly impacts:

-

Traffic flow

-

Brand frontage

-

Future valuation

-

Ease of logistics

From experience, properties on wider arterial roads attract stronger tenant interest. Retail brands prefer high-access roads because parking movement, delivery access, and customer convenience become easier.

2. Proximity to Jewar International Airport

The upcoming Noida International Airport at Jewar is a major catalyst. Globally, airport-driven development creates demand for:

-

Hotels

-

Retail hubs

-

Food courts

-

Service apartments

-

Business centres

Commercial land near airport corridors typically sees phased appreciation—not overnight spikes, but steady value growth aligned with infrastructure completion.

For investors, this reduces speculative risk and supports long-term positioning.

Understanding the YEIDA Scheme Structure

These commercial plots fall under a structured development model.

Key features include:

-

Allotment via e-auction

-

90-year leasehold model

-

Defined FAR and ground coverage norms

-

Active scheme status

The e-auction system ensures transparency. Unlike private developer allotments, pricing is market-driven and authority-regulated.

This reduces ambiguity and improves investor confidence.

Plot Sizes & Development Scope

Available land parcels range approximately from 1500 sqm to 9100 sqm.

This allows flexibility for:

-

Sector-level shopping complexes

-

Multi-level retail centres

-

Cinema and food court concepts

-

Mid-sized commercial malls

From a planning perspective, larger plots offer better vertical development potential, while mid-sized parcels are ideal for neighborhood-level retail demand.

Why Yamuna Expressway Is Emerging as a Commercial Belt

The Yamuna Expressway connects Greater Noida to Agra and integrates with multiple highways. Connectivity plays a huge role in commercial sustainability.

But infrastructure alone is not enough.

The area is witnessing:

-

Industrial investments

-

Educational institutions

-

Residential townships

-

Manufacturing units

When industries like electronics, FMCG, and logistics establish presence, workforce demand automatically generates retail demand.

This is where commercial plots become relevant.

Practical Investor View: What Makes These Plots Attractive?

From on-ground interaction with investors and developers, the following factors matter:

1. Planned Authority Development

YEIDA ensures:

-

Road infrastructure

-

Drainage planning

-

Zoning clarity

-

Land use regulation

This reduces long-term legal risk.

2. Two-Side Open Plots

Two-side open plots improve:

-

Ventilation and design flexibility

-

Multiple entry/exit points

-

Premium frontage

Retail developments benefit significantly from this layout.

3. Growing Ecosystem

Presence of industries, schools, and hospitals creates daily consumption demand. Retail success depends on footfall density—not just location hype.

Who Should Consider Investing?

Suitable For:

-

Retail developers planning mid-to-large projects

-

Investors with 5–10 year horizon

-

Commercial real estate portfolio diversifiers

-

Entrepreneurs planning structured shopping complexes

May Not Be Ideal For:

-

Short-term speculative buyers

-

Small-ticket investors

-

Those expecting immediate rental income

Commercial development requires capital, time, and planning approval cycles.

Risk Factors to Consider

Every investment has risks. A professional view must include balance.

-

Development timeline depends on infrastructure completion

-

Airport operational phases may impact appreciation speed

-

Leasehold structure must be understood carefully

-

Construction compliance norms must be followed strictly

Ignoring these factors can impact ROI projections.

Long-Term vs Short-Term Perspective

Short-term:

Land value movement may remain gradual until surrounding infrastructure becomes fully active.

Long-term:

With airport operations, industrial growth, and residential density increase, structured retail demand becomes organic.

Historically, infrastructure-led corridors reward patient capital.

Decision-Making Checklist Before Bidding

Before participating in e-auction:

-

Review FAR norms

-

Estimate construction cost realistically

-

Study surrounding residential catchment

-

Understand lease terms

-

Plan funding structure

Many investors underestimate development costs. Commercial projects require financial discipline.

Conclusion

Commercial plots in YEIDA Sectors 18 & 20 represent a structured opportunity rather than a speculative land play. The combination of 120-meter road connectivity, proximity to the upcoming airport, and authority-backed planning gives this corridor long-term commercial relevance.

However, investors must approach this with realistic timelines, capital planning, and development clarity. According to ERM Global Investors, disciplined investors who evaluate infrastructure progress, demand ecosystem, and compliance structure carefully are more likely to benefit over the long term.

If you are evaluating participation in the YEIDA scheme, expert guidance and feasibility assessment can help align your investment with market realities rather than assumptions.

FAQs

1. What is the starting price of these commercial plots?

The reserve price begins at ₹70,000 per square meter, excluding applicable charges.

2. What is the allotment process?

Plots are allotted through an e-auction system managed by YEIDA.

3. Are these plots freehold or leasehold?

They are offered on a 90-year leasehold basis.

4. What types of projects can be developed?

Convenience Shopping Centres, malls, retail complexes, showrooms, food courts, and similar commercial developments.

5. How close are these plots to Jewar Airport?

They are strategically located within the influence zone of the upcoming airport corridor.

6. What plot sizes are available?

Plots range roughly between 1500 sqm to 9100 sqm.

7. Is this suitable for small investors?

These plots are better suited for developers or investors with strong capital planning due to size and development cost.