Automotive Infotainment Market Share, Growth, and Trends Report 2025-2033

Market Overview:

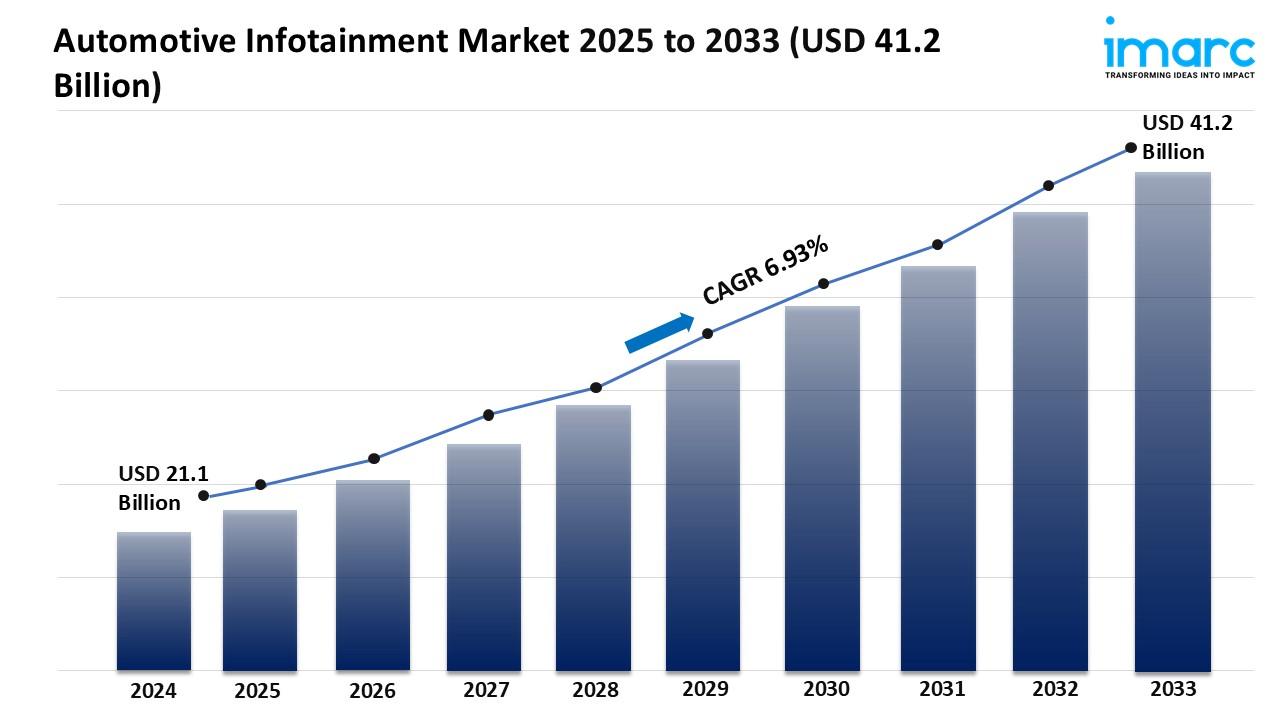

The automotive infotainment software market is experiencing rapid growth, driven by increased demand for in-vehicle connectivity, proliferation of advanced driver assistance systems (ADAS), and rise of connected and electric vehicles (EVs). According to IMARC Group's latest research publication, "Automotive Infotainment Market Size, Share, Trends and Forecast by Product Type, Vehicle Type, Operating System, Installation Type, Sales Channel, Technology, Connectivity, and Region, 2025-2033", offers a comprehensive analysis of the industry, which comprises insights on the global automotive infotainment market share. The global market size was valued at USD 21.1 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.2 Billion by 2033, exhibiting a CAGR of 6.93% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/automotive-infotainment-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Automotive Infotainment Market

- Increased Demand for In-Vehicle Connectivity

The contemporary consumer's expectation for a seamless digital life, extending into their vehicle, is a primary growth driver. This demand is quantified by the substantial volume of passenger cars, which accounts for approximately 80% of the market share in the automotive infotainment sector's revenue. Consumers are actively seeking features like hands-free calling, real-time navigation, media streaming, and smartphone integration capabilities such as Apple CarPlay and Android Auto. The expansion of high-speed connectivity, particularly the rollout of 5G networks, is crucial, as this infrastructure enables the faster data speeds and low latency necessary for over-the-air (OTA) software updates, cloud-based services, and high-definition content consumption, fueling continuous system usage and upgrades.

- Proliferation of Advanced Driver Assistance Systems (ADAS)

Government safety mandates and a growing consumer focus on driver and passenger security are rapidly accelerating the integration of ADAS with infotainment platforms. Infotainment systems now serve as the primary human-machine interface (HMI) for displaying critical safety information. For example, regulatory action by the European Union mandates the implementation of features like Intelligent Speed Assistance (ISA) and driver drowsiness warnings in new vehicles from the current year, which necessitates robust, distraction-minimizing display and notification systems. This convergence is driving automakers, like Continental AG and Robert Bosch GmbH, to invest heavily in domain controller technology that merges traditional ADAS and infotainment processing into a single, high-performance unit, securing a cohesive and safer user experience.

- Rise of Connected and Electric Vehicles (EVs)

The global shift towards electric and connected vehicles is fundamentally transforming the role of the infotainment system from a luxury item to an essential digital cockpit. EVs, in particular, require advanced digital interfaces to manage battery status, charging locations, and energy consumption, features intrinsically linked to the central display. The high-growth nature of this segment is evident, with battery-electric vehicle infotainment systems projected to register a substantially high annual growth rate. Furthermore, the development of a fully connected car ecosystem, which may see in-vehicle payment and e-commerce spending reach tens of billions of dollars, turns the infotainment unit into a new revenue-generating platform for both automakers and third-party service providers.

Key Trends in the Automotive Infotainment Market

- The Digital Cockpit and Screen Consolidation

A key emerging trend is the replacement of multiple separate gauges and displays with a single, integrated "digital cockpit" powered by a high-performance central computing unit. This trend is characterized by the use of large, high-resolution screens that stretch across the dashboard, sometimes incorporating a dedicated passenger display, which elevates the user experience to be comparable to high-end mobile devices. For instance, new models from major manufacturers are featuring expansive screen real estate, often exceeding 14 inches for the central display alone, and sometimes combining the instrument cluster, navigation, and entertainment onto a continuous, curved surface. This consolidation simplifies the internal electronics architecture for manufacturers while allowing for deep personalization and complex 3D graphics.

- Integration of Artificial Intelligence (AI) and Natural Language Processing

The incorporation of AI is transforming the user-vehicle interaction by enabling highly intuitive and personalized experiences. Advanced AI-powered voice assistants, built into the infotainment system, allow drivers to perform complex tasks, such as setting navigation, adjusting cabin climate, or searching for media, using natural conversational language. This trend is demonstrated by company activities, such as Mercedes-Benz integrating generative AI like ChatGPT into its MBUX system for US customers, enhancing the system's ability to answer general knowledge questions and manage complex commands. The goal is to minimize driver distraction by reducing the need for manual screen interaction, which directly addresses safety concerns and improves overall usability.

- Over-the-Air (OTA) Updates for Software-Defined Vehicles

The ability to update vehicle software remotely, similar to a smartphone, is becoming a standard feature and a crucial trend in the automotive infotainment market. OTA updates allow manufacturers to deploy new features, performance enhancements, and security patches to vehicles already on the road, bypassing the need for dealership visits. This capability is projected to see connectivity technologies, such as 5G-enabled platforms, grow at a nearly 20% annual rate. For example, major automotive players utilize OTA updates to introduce new infotainment applications, enhance navigation functionality, or even activate premium subscription features after the vehicle has been purchased, turning software into a recurring revenue stream and extending the vehicle's lifespan and feature set.

Leading Companies Operating in the Global Automotive Infotainment Industry:

- Aisin Seiki Co. Ltd.

- Continental AG

- Clarion Co. Ltd.

- Denso Corporation

- Garmin Ltd.

- Harman International Industries, Inc. (Samsung Electronics)

- Magneti Marelli S.p.A.

- Panasonic Corporation

- Pioneer Corporation

- Robert Bosch GmbH

- Aptiv

Automotive Infotainment Market Report Segmentation:

By Product Type:

- Navigation Unit

- Display Audio

- Audio

- Others

Audio is the leading segment in automotive infotainment, driven by advancements in audio quality, integration with streaming services, and personalized experiences.

By Vehicle Type:

- Passenger Cars

- Commercial Vehicles

Passenger cars dominate with 79.5% market share, fueled by increasing demand for connectivity, entertainment options, and the rise of electric and autonomous vehicles.

By Operating System:

- QNX

- LINUX

- Microsoft

- Others

LINUX leads with 60.0% market share, favored for its flexibility, open-source nature, robust security, and compatibility across various hardware platforms.

By Installation Type:

- In-Dash Infotainment

- Rear Seat Infotainment

In-Dash Infotainment holds 65.4% market share, serving as the central interface for vehicle controls and integrating advanced technologies for user interaction and safety.

By Sales Channel:

- OEM

- Aftermarket

OEM leads with 72.8% market share due to seamless integration during manufacturing, offering tailored, high-quality infotainment systems with proprietary technology.

By Technology:

- Integrated

- Embedded

- Tethered

Tethered solutions are popular for connecting smartphones to vehicle systems, providing accessible infotainment features via USB or Bluetooth at a lower cost.

By Connectivity:

- Bluetooth

- Wi-Fi

- 3G

- 4G

- 5G

Bluetooth leads with 35.9% market share, enhancing safety and convenience with hands-free functionality and universal compatibility across devices.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific accounts for over 40.7% market share, driven by rising consumer preference for connected technologies and significant growth in vehicle production and sales.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302