Middle East Used Car Market Trends, Analysis & Future Outlook 2025-2033

Middle East Used Car Market Overview

Market Size in 2024: USD 46,717 Million

Market Size in 2033: USD 1,04,933 Million

Market Growth Rate 2025-2033: 9.41%

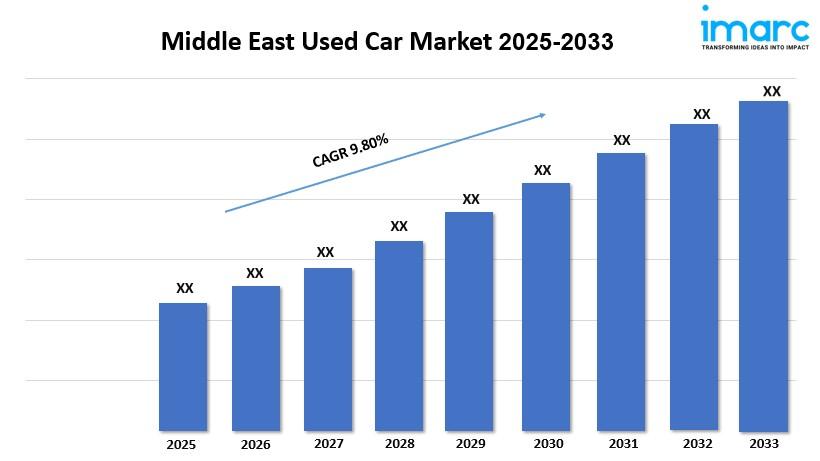

According to IMARC Group's latest research publication, "Middle East Used Car Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Middle East used car market size reached USD 46,717 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,04,933 Million by 2033, exhibiting a growth rate (CAGR) of 9.41% during 2025-2033.

How AI is Reshaping the Future of Middle East Used Car Market

- Revolutionizing Vehicle Valuation and Pricing: AI-powered algorithms are transforming used car pricing mechanisms through advanced data analytics, analyzing millions of data points including vehicle condition, mileage, market demand, and historical trends to provide accurate valuations within seconds, reducing pricing errors by 30-35% and enhancing transparency for both buyers and sellers across regional markets.

- Enhancing Vehicle Inspection and Quality Assessment: Machine learning and computer vision technologies are revolutionizing vehicle inspection processes, enabling automated damage detection, condition assessment, and comprehensive vehicle history analysis, reducing inspection time by 40-50% while improving accuracy and providing detailed reports that build consumer confidence in used car purchases.

- Optimizing Inventory Management and Demand Forecasting: Advanced AI systems are streamlining inventory management for dealerships through predictive analytics, forecasting demand patterns with 85% accuracy and optimizing stock levels to reduce holding costs by 20-25% while ensuring the right mix of vehicles is available to meet evolving consumer preferences across different Middle Eastern markets.

- Transforming Customer Experience with Virtual Showrooms: AI-integrated virtual reality and augmented reality platforms are creating immersive online car shopping experiences, allowing customers to inspect vehicles remotely with 360-degree views and interactive features, increasing online conversions by 45-50% while reducing the need for physical dealership visits in the digital-first Middle Eastern consumer market.

- Streamlining Transaction Processing and Documentation: AI-powered document processing and verification systems are accelerating used car transactions, automating paperwork validation, ownership transfer procedures, and financial approvals, reducing transaction time by 60-70% while minimizing fraud risks and ensuring regulatory compliance across diverse Middle Eastern jurisdictions.

Grab a sample PDF of this report: https://www.imarcgroup.com/middle-east-used-car-market/requestsample

Middle East Used Car Market Trends & Drivers:

The Middle East used car market is experiencing robust growth driven by growing consumer concerns about the steep costs and limited accessibility of new vehicles, with new car prices rising by 15-20% over the past two years due to supply chain disruptions and increased manufacturing costs. This price sensitivity is particularly pronounced among middle-income consumers who seek reliable transportation options without the financial burden of new vehicle ownership, making certified pre-owned vehicles increasingly attractive across the region.

The rapid digitalization of retail processes is revolutionizing the used car market landscape, with the Middle East Automotive AI market valued at USD 136.1 million in 2023 and projected to reach USD 960.4 million by 2030 at a CAGR of 32.2%. Online platforms are providing comprehensive features including extensive photo and video databases, instant financial services, virtual vehicle inspections, and the ability to monitor vehicle documents, performance records, and service histories, significantly enhancing consumer confidence and accelerating the shift toward digital car buying experiences.

Regional market dynamics reveal significant growth opportunities, with the UAE automotive market recording 318,981 vehicle registrations in 2024, representing a 15.7% increase, while Saudi Arabia surpassed the milestone of 1 million vehicle registrations, demonstrating strong market momentum. The growing demand for luxury and premium used vehicles is particularly notable, with Chinese brand inquiries surging by 77% in 2024, while hybrid vehicle listings increased by 44%, reflecting evolving consumer preferences toward fuel-efficient and technologically advanced pre-owned vehicles across Gulf Cooperation Council markets.

The Middle East used car market forecast offers insights into future opportunities and challenges, drawing on historical data and predictive modeling.

Middle East Used Car Industry Segmentation:

The report has segmented the market into the following categories:

Vehicle Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicle

- Others

Sales Channel Insights:

- Online

- Offline

Vendor Type Insights:

- Organized

- Unorganized

Fuel Type Insights:

- Gasoline

- Diesel

- Others

Breakup by Country:

- Saudi Arabia

- Turkey

- Israel

- United Arab Emirates

- Iran

- Iraq

- Qatar

- Kuwait

- Oman

- Jordan

- Bahrain

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Middle East Used Car Market

- September 2025: AutoData Middle East released its H1 2025 Used Car Market Report revealing UAE used car sales rose 18.6% in H1 2025, with EVs accounting for 7% of new registrations within approximately 157,000 new vehicles, marking an 11% year-on-year increase in the first half of 2025.

- March 2025: AutoData Middle East's 2024 Used Car Market Report highlighted 15.7% growth in the UAE automotive market with 318,981 vehicle registrations, while used car listings for Chinese models increased by 56% in 2024, demonstrating growing consumer preference for diverse brands.

- March 2025: The UAE used car market report showed hybrid vehicle listings rising 44% in 2024, with Toyota and Nissan emerging as the most popular brands accounting for 32.8% and 19.2% of market share respectively, reflecting consumer preferences for reliable and fuel-efficient vehicles.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302