Global Virtual Desktop Infrastructure Market Research Report & Insights | 2030

In the dynamic and strategically critical Virtual Desktop Infrastructure (VDI) market, a continuous and deeply analytical approach to competitive intelligence is an absolute necessity for any vendor seeking to achieve and maintain a leadership position. The market is a complex ecosystem dominated by a few major platform providers, and a superficial understanding of their capabilities and strategies is insufficient for effective decision-making. A robust Virtual Desktop Infrastructure Market Competitive Analysis must systematically deconstruct the landscape across multiple dimensions to provide actionable insights that can inform product strategy, marketing positioning, and partnership priorities. This rigorous process involves moving beyond simple feature comparisons to evaluate competitors' underlying platform architecture, their display protocol performance, their cloud strategy, their partner ecosystems, and their vision for the future of end-user computing. This ongoing intelligence gathering is the essential compass for navigating the market's complexities and charting a course to a sustainable competitive advantage.

A practical framework for this competitive analysis should be structured around several key pillars. The first is a comprehensive product and platform analysis. This involves a granular, side-by-side evaluation of the core VDI and DaaS platforms from the major vendors. Key areas of comparison include the performance and feature set of their display protocols (e.g., Citrix HDX vs. VMware Blast vs. Microsoft RDP), the breadth and depth of their management and administration capabilities, their support for different hypervisors and clouds, and their capabilities for graphics-intensive workloads (vGPU support). The second pillar is a deconstruction of their go-to-market and commercial strategy. This means analyzing their complex pricing and licensing models (e.g., perpetual vs. subscription, user vs. concurrent licensing), their target customer segments, their sales channels (direct vs. partner-led), and their core marketing messages. The third pillar is an analysis of their ecosystem, evaluating the size and quality of their third-party hardware and software partner networks, which is a key indicator of a platform's maturity and flexibility.

The ultimate purpose of this rigorous analysis is to synthesize the collected data into actionable strategic intelligence that drives a real competitive advantage. By identifying a weakness in a competitor's platform, such as a lack of strong support for a particular public cloud or a complex management interface, a company can tailor its marketing and sales efforts to highlight its own corresponding strengths. By recognizing an emerging customer need that competitors are slow to address, such as the need for better solutions for Linux virtual desktops, a company can adjust its product roadmap to seize the opportunity. This competitive intelligence should be a direct and continuous input into the product development lifecycle. The Virtual Desktop Infrastructure (VDI) Market size is projected to grow USD 57.8 Billion by 2030, exhibiting a CAGR of 18.20% during the forecast period 2024 - 2030. Most importantly, these insights must be operationalized for the front lines, typically through the creation of sales "battle cards" and training modules that equip the sales team with the specific, evidence-backed arguments they need to consistently win in head-to-head competitive situations with IT architects and CIOs.

Top Trending Reports -

India Communications Interface Market

Categorie

Leggi tutto

Trapstar caps have become an important part of modern streetwear culture worldwide. These caps are known for their clean look and strong urban identity. Many fashion lovers choose Trapstar caps because they never feel outdated or boring. The brand focuses on simple designs that work well across changing fashion trends. Trapstar caps are worn by people of all ages and styles. They fit...

ExpressVPN is initiating a significant upgrade across all its applications, aiming to enhance user experience and security. The new updates bring notable improvements, including optimized performance and cutting-edge post-quantum encryption, ensuring users stay ahead in digital protection. A critical deadline has been announced: all older versions of the app will cease functioning after March...

Introduction Le marché des plateformes de développement low-code a connu l'une des évolutions les plus rapides du secteur des logiciels d'entreprise ces dernières années. Les plateformes low-code permettent aux utilisateurs, des développeurs professionnels aux développeurs amateurs, de créer des applications métier grâce...

What is Critical Damage Boost in Aion 2? The Critical Damage Boost node is a stat node that increases the damage of your critical hits. In Aion 2, critical hits occur when your attack lands as a “critical strike,” dealing higher damage than normal. This node does not affect your chance to land a critical; it only increases the damage once a critical happens. Node Type: Stat...

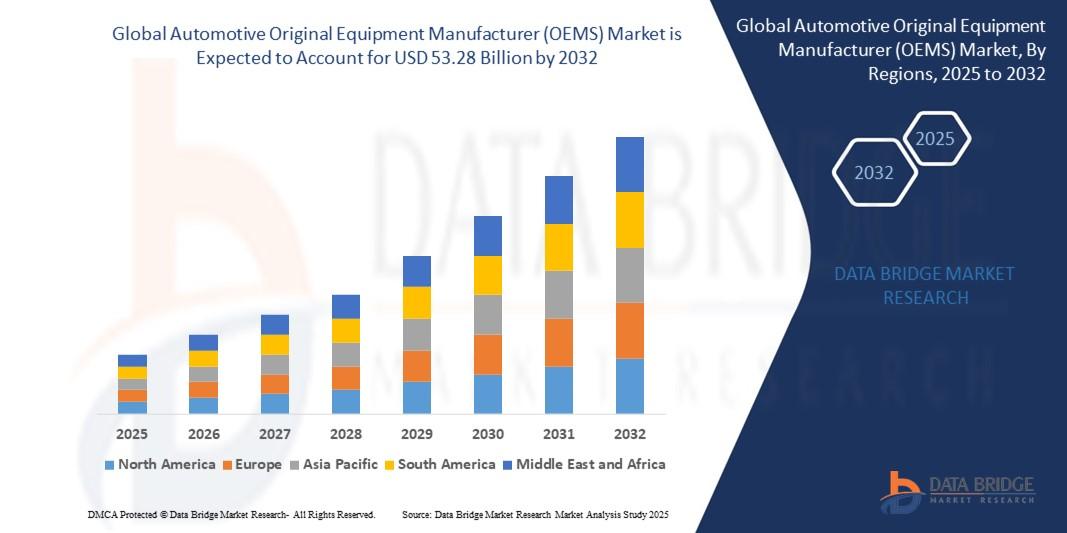

"Global Executive Summary Automotive Original Equipment Manufacturer (OEMS) Market: Size, Share, and Forecast The global automotive original equipment manufacturer (OEMS) market size was valued at USD 36.98 billion in 2024 and is expected to reach USD 53.28 billion by 2032, at a CAGR of 4.67% during the forecast period This Automotive Original Equipment...