How Smart VAT Planning Is Powering Profitable Businesses in Dubai

VAT is not just a compliance requirement in Dubai it is a strategic financial element that directly affects profitability, cash flow, and long-term business growth. Companies that treat VAT only as a reporting obligation often miss opportunities to improve efficiency and protect their bottom line. On the other hand, businesses that adopt smart VAT planning are able to manage tax exposure, maximize recovery, and stay compliant without unnecessary financial strain. As regulations become more detailed and enforcement more active, professional VAT planning has become a key factor in building financially strong businesses.

Understanding VAT as a Financial Strategy

Many businesses view VAT as a simple pass-through tax, but in reality, it has a major impact on daily operations. Every sale, purchase, and contract can affect VAT obligations. Poor planning leads to overpayment, missed input VAT, and unexpected liabilities.

Smart VAT planning looks at the full business model, including pricing, supply chains, and invoicing practices. By aligning these areas with VAT rules, companies can reduce risks and improve financial performance.

How VAT Planning Improves Cash Flow

Cash flow is one of the most critical elements of business success. VAT directly affects cash flow because businesses collect VAT from customers and pay VAT to suppliers before settling with the tax authority.

With proper planning, companies can time their VAT payments and recoveries more effectively. For example, structuring transactions correctly and ensuring valid documentation allows businesses to recover VAT quickly and avoid unnecessary cash outflows.

Avoiding Overpayment Through Correct VAT Treatment

Not all supplies are subject to the same VAT rate. Some transactions are zero-rated, some are exempt, and others fall outside the scope of VAT.

Without proper planning, businesses may charge VAT when it is not required or fail to apply zero-rating correctly. This results in overpayment or lost competitive advantage. Smart VAT planning ensures that every transaction is treated correctly under the law.

Strengthening Invoicing and Recordkeeping

VAT regulations require specific details on tax invoices and proper recordkeeping. Errors in invoicing can invalidate VAT claims and create compliance risks.

Smart VAT planning includes setting up systems and processes that produce compliant invoices and maintain accurate records. This makes VAT returns easier to prepare and reduces audit risks.

Supporting Business Expansion and New Ventures

When businesses expand into new markets or launch new products, VAT implications change. Without proper planning, new activities may create unexpected tax liabilities.

VAT planning ensures that new ventures are structured in a tax-efficient and compliant way from the beginning.

Reducing Audit and Penalty Risk

The Federal Tax Authority actively monitors VAT compliance. Businesses with weak planning are more likely to face audits and penalties.

With proper VAT planning and professional support, companies maintain accurate records and clear transaction trails, reducing the likelihood of penalties.

The Role of Professional VAT Support

Effective VAT planning requires technical expertise and up-to-date regulatory knowledge. Professional support through vat consultancy in Dubai helps businesses implement compliant and efficient VAT strategies that align with their operations.

Long-Term Profitability Through VAT Efficiency

When VAT is managed correctly, businesses keep more of their revenue and avoid unnecessary costs. Over time, this leads to stronger financial performance and greater stability.

Conclusion

Smart VAT planning is not just about compliance it is about building a more profitable and resilient business. By structuring transactions, managing cash flow, and ensuring accurate VAT treatment, companies in Dubai can turn VAT into a strategic advantage rather than a burden.

With professional guidance and proper planning, businesses can grow confidently while remaining fully compliant with VAT regulations.

Κατηγορίες

Διαβάζω περισσότερα

Benefits of Using Certification Exam Preparation Material Certification exams help people grow in their careers. They help you get better jobs. They also help you earn more money. Many students want to pass the 4A0-107 exam on the first attempt. This exam is offered by Nokia. However, exam preparation can feel difficult. There are many books to read and many topics to cover. This is why using...

A new growth forecast report titled Machine Condition Monitoring Market Share, Size, Trends, Industry Analysis Report : By Monitoring Technique, Component, Deployment (Cloud and On-Premises), End-Use, and Region – Market Forecast, 2026–2034 introduced by Polaris Market Research represents conclusive data on the overall market. It majorly targets to provide a detailed...

USA Network Secures Warner Bros. Movie Package in Strategic Deal In a significant acquisition, USA Network has outbid Turner networks TBS and TNT to secure the rights for seven Warner Bros. theatrical releases, including the critically acclaimed "Training Day" and family hit "Cats & Dogs." The deal represents approximately $49 million for the first network window of these films. The...

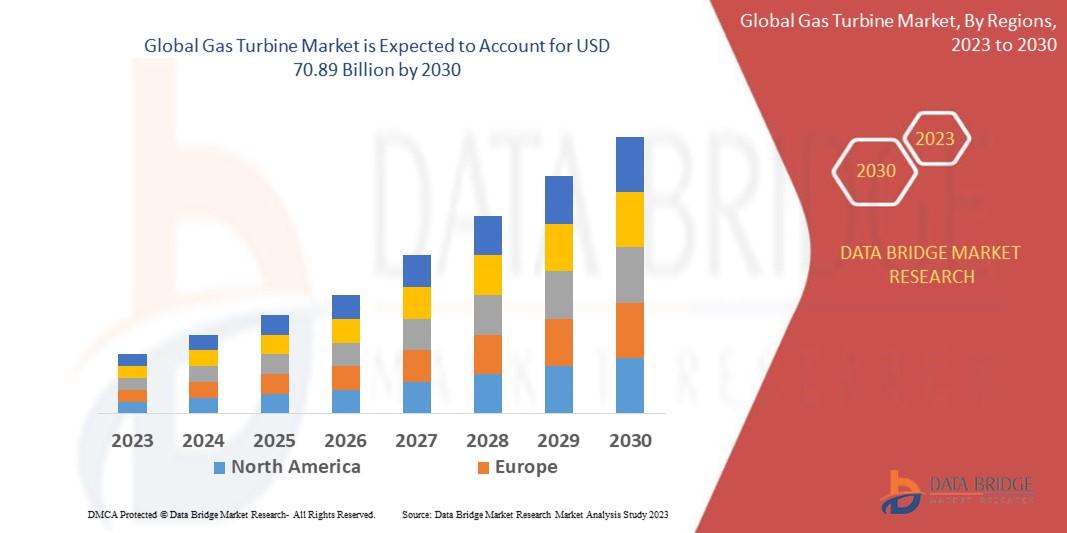

"Executive Summary Gas Turbine Market Trends: Share, Size, and Future Forecast Data Bridge Market Research analyses that the global gas turbine market, which was USD 17.50 billion in 2022, is expected to reach USD 70.89 billion by 2030, growing at a CAGR of 19.11% from 2023 to 2030Keeping into consideration the customer requirement, Gas Turbine Market research report has been...

A greenhouse gives you control during planting season: you can manage temperature, light, airflow, and watering. As the space gets bigger, that control becomes more complicated to manage. A large greenhouse offers more growing potential, but it also creates more decisions every day. What gets planted where, when crops rotate, and how space gets reused can quickly feel overwhelming. This is...