How Smart VAT Planning Is Powering Profitable Businesses in Dubai

VAT is not just a compliance requirement in Dubai it is a strategic financial element that directly affects profitability, cash flow, and long-term business growth. Companies that treat VAT only as a reporting obligation often miss opportunities to improve efficiency and protect their bottom line. On the other hand, businesses that adopt smart VAT planning are able to manage tax exposure, maximize recovery, and stay compliant without unnecessary financial strain. As regulations become more detailed and enforcement more active, professional VAT planning has become a key factor in building financially strong businesses.

Understanding VAT as a Financial Strategy

Many businesses view VAT as a simple pass-through tax, but in reality, it has a major impact on daily operations. Every sale, purchase, and contract can affect VAT obligations. Poor planning leads to overpayment, missed input VAT, and unexpected liabilities.

Smart VAT planning looks at the full business model, including pricing, supply chains, and invoicing practices. By aligning these areas with VAT rules, companies can reduce risks and improve financial performance.

How VAT Planning Improves Cash Flow

Cash flow is one of the most critical elements of business success. VAT directly affects cash flow because businesses collect VAT from customers and pay VAT to suppliers before settling with the tax authority.

With proper planning, companies can time their VAT payments and recoveries more effectively. For example, structuring transactions correctly and ensuring valid documentation allows businesses to recover VAT quickly and avoid unnecessary cash outflows.

Avoiding Overpayment Through Correct VAT Treatment

Not all supplies are subject to the same VAT rate. Some transactions are zero-rated, some are exempt, and others fall outside the scope of VAT.

Without proper planning, businesses may charge VAT when it is not required or fail to apply zero-rating correctly. This results in overpayment or lost competitive advantage. Smart VAT planning ensures that every transaction is treated correctly under the law.

Strengthening Invoicing and Recordkeeping

VAT regulations require specific details on tax invoices and proper recordkeeping. Errors in invoicing can invalidate VAT claims and create compliance risks.

Smart VAT planning includes setting up systems and processes that produce compliant invoices and maintain accurate records. This makes VAT returns easier to prepare and reduces audit risks.

Supporting Business Expansion and New Ventures

When businesses expand into new markets or launch new products, VAT implications change. Without proper planning, new activities may create unexpected tax liabilities.

VAT planning ensures that new ventures are structured in a tax-efficient and compliant way from the beginning.

Reducing Audit and Penalty Risk

The Federal Tax Authority actively monitors VAT compliance. Businesses with weak planning are more likely to face audits and penalties.

With proper VAT planning and professional support, companies maintain accurate records and clear transaction trails, reducing the likelihood of penalties.

The Role of Professional VAT Support

Effective VAT planning requires technical expertise and up-to-date regulatory knowledge. Professional support through vat consultancy in Dubai helps businesses implement compliant and efficient VAT strategies that align with their operations.

Long-Term Profitability Through VAT Efficiency

When VAT is managed correctly, businesses keep more of their revenue and avoid unnecessary costs. Over time, this leads to stronger financial performance and greater stability.

Conclusion

Smart VAT planning is not just about compliance it is about building a more profitable and resilient business. By structuring transactions, managing cash flow, and ensuring accurate VAT treatment, companies in Dubai can turn VAT into a strategic advantage rather than a burden.

With professional guidance and proper planning, businesses can grow confidently while remaining fully compliant with VAT regulations.

Категории

Больше

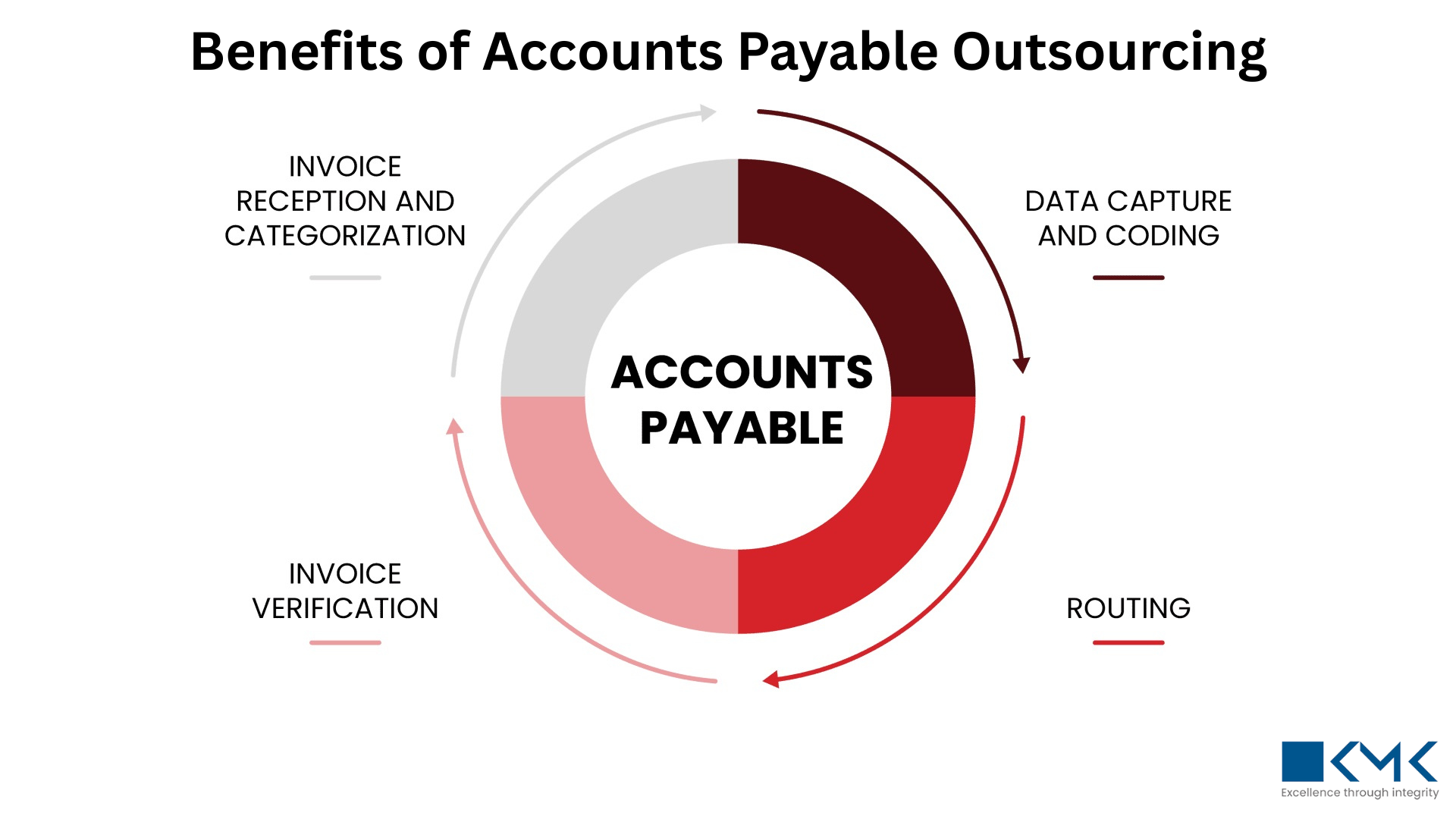

Accounts payable outsourcing helps businesses cut labor costs, speed up invoice processing, and enhance cash flow management. See how AP outsourcing drives efficiency in 2025 For many organizations, the accounts payable (AP) process is one of the most time-consuming and resource-heavy functions. With increasing invoice volumes, vendor payment schedules, and strict compliance...

Proper lighting enhances comfort, safety, and the overall appearance of any property. Light Fixture Installation San Marcos CA provides professional installation services for residential and commercial spaces, ensuring lighting fixtures are installed safely and correctly. Whether upgrading existing lights or installing new fixtures, expert electricians deliver reliable and long-lasting...

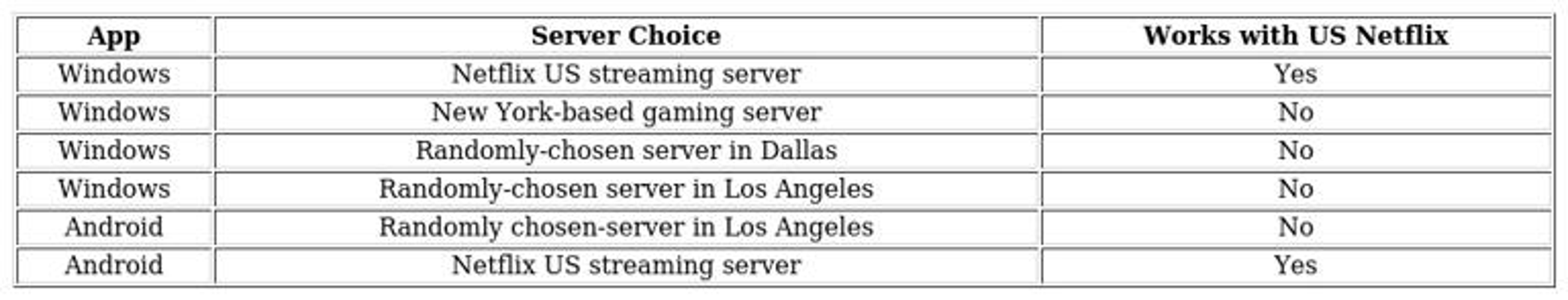

VPN for Netflix Access When traveling internationally, many people turn to Virtual Private Networks (VPNs) to maintain access to their favorite streaming content. This is particularly important for Netflix subscribers, as the platform's library varies significantly between countries. A quality VPN serves two essential functions for travelers. First, it conceals your actual location by...

In the ever-evolving world of digital entertainment, web series have carved a niche for delivering high-quality, binge-worthy content. Among the plethora of offerings, the hotshots web series has emerged as a standout for viewers seeking a blend of intense storytelling, intricate characters, and cinematic excellence. At Series Maza, we aim to bring you closer to such compelling content, helping...

On the third day of Summer Game Fest, George and Eric delved into their gaming experiences, sharing insights on titles like Marvel Rivals, DeathSprint 66, and Battle Aces. They discussed gameplay mechanics, visuals, and their overall impressions of each game, giving viewers a deeper look into the upcoming releases. Their conversation highlighted the diversity of genres showcased during the...